The Last Bastion of British Luxury

Burberry (BRBY:LON): “Turnarounds seldom turn”

Aspirational Luxury

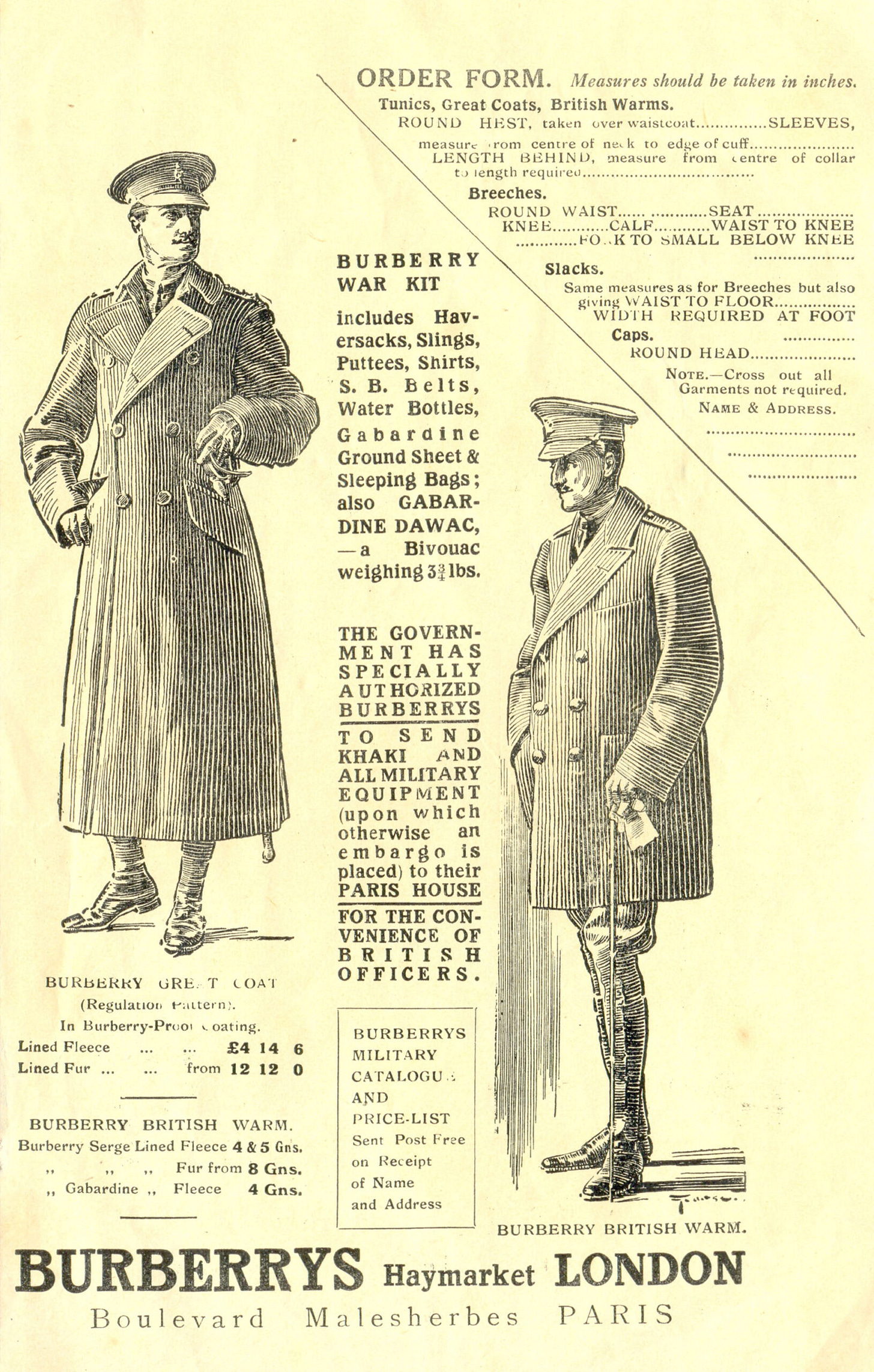

Growing up in the UK, my earliest memory of Burberry was the iconic chequer-clad baseball caps, donned by chavs. I later realised those caps were likely fake and that Burberry was rather luxurious. The company has been around since 1856; fructified by Thomas Burberry’s desire to manufacture clothing to protect people from harsh British weather. It has since woven itself into the fabric of the country1 and is one of the few heritage luxury fashion brands to hail from the United Kingdom. Known for its iconic Burberry check, trenchcoats, and scarves; Burberry’s strengths lie in the sale of outerwear, accessories, and bags.

Key Revenue Streams Burberry's revenue streams are multifaceted, including:

Retail sales from Burberry-owned stores and online platforms.

£2.5 billion (81%) of 2023 sales.

Wholesale distribution to high-end department stores.

£543 million (17%) of 2023 sales.

Licensing agreements, allowing other companies to use the Burberry brand.

£50 million (2%) of 2023 sales.

Key Product Divisions Burberry's product categories include:

Accessories: £1.13 billion of 2023 retail/wholesale.

Women: £867 million of 2023 retail/wholesale.

Men: £868 million of 2023 retail/wholesale.

Children & Other: £184 million of 2023 retail/wholesale.

Key Geographics Burberry's geographic segments include:

Asia Pacific: £1.3 billion (43%) of 2023 retail/wholesale.

EMEIA: £1 billion (33%) of 2023 retail/wholesale.

Americas: £743 million (24%) of 2023 retail/wholesale.

On the luxury spectrum2, Burberry sits above premium retailers (Lululemon) and affordable luxuries (Coach), and below true luxury brands like Rolex and Hermes. As a means of illustration3, a woman’s Coach bag can be acquired for as little as £150 with an upper range of ~£1,000. The cheapest Burberry bag you will find starts at ~£800 with an upper range of ~£3,800. At Hermes, you will struggle to find a bag that retails under £3,000 (if it’s even in stock). In fact, a 35mm bag strap can fetch as much as £1,800 at Hermes4.

Similar to true luxury companies, Burberry is renowned for its high-quality craftsmanship. It holds heritage status and the brand is instantly recognisable. However, while Burberry exhibits some of the traits of a true luxury brand, their range in pricing and relative lack of scarcity relegates them to the status of an aspirational luxury; dreaming of one day making it into a prestigious club where few brands sit. Burberry’s new CEO, Jonathan Akeroyd understands the mission. During his first earnings call as CEO, he opened his remarks by stating “The ambition to be true luxury remains absolutely right”; reaffirming an intent that had been set in motion years earlier.

Aspirational luxuries don’t become true luxury brands overnight; if at all. While the intent is clear, this story is really about revitalising the brand and repositioning it to a more exclusive audience.

“The ability to set a high price is a consequence of being a luxury brand, but it's not an enabler. Just because you're charging a high price, you're not going to become a luxury brand. But if you're a luxury brand - there's much more than price. There's heritage, there's the intangibles. You cannot simply attain all of those characteristics by setting a high price”.

Leandro, Best Anchor Stocks

For those looking for an excellent breakdown of the nuances of the luxury spectrum and the economics of the luxury business, I highly recommend this recent transcript between Leandro from BAS and Sleepwell Capital.

Revolving Door

Despite its global presence, Burberry has struggled to hold relevance over the last few decades. Just as soon as the headlines read; “Is Burberry Back?” they fade away again; mired by botched rebrands5 and a rotating door at the chief executive’s office. This century has seen five different CEOs walk in the door. Between the mid-90s and 2006, Rose Marie Bravo was credited with revitalising the brand and expanding globally. In 2006 Angela Ahrendts took over, serving until 2014 when she joined Apple, and was heralded for integrating digital technology into the business and tripling revenue. Between 2014 and 2018, Christopher Bailey, then creative director since 2001, took on the CEO role. Stepping down in 2018, he was replaced with Marco Gobetti. Marco’s focus was repositioning Burberry into the luxury market. The torch was passed to the current CEO, Jonathan Akeroyd, in 2022 who came from Versace.

A role that has been somewhat more stable is that of the creative director. The creative director plays an integral role in a business like Burberry. Responsible for shaping and establishing a brand’s identity, these individuals often work hands-on with marketing, partnerships, and the design process. In short, they are tasked with ensuring commercial success. Christopher Bailey served in the role from 2004 until 2018. Riccardo Tisci took over in 2018 when his attempt at blending modernity with Burberry’s heritage “Britishness” was received with a lukewarm reception. In late 2022, Akeroyd made a key hire in Daniel Lee; who was praised for the revival of Bottega Veneta, an Italian luxury brand. In the hopes that Lee would bring the same reinvigoration to Burberry, Lee was hired as the creative director.

The duo would inherit the preceding management’s strategic plan and lay out the plan for the next five years in November 2022. Eliminating the word salad from this slide, I get the sense that Burberry wants to slowly price out the aspirational consumer and focus more on the top end of the market. The problem with this strategy, however, is seats at the table of true luxury are not often self-prescribed.

Gone Nowhere

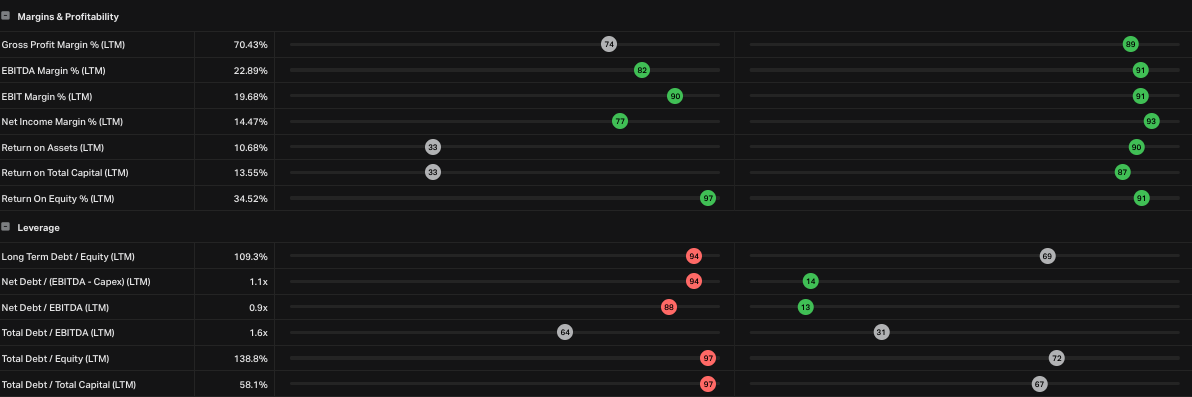

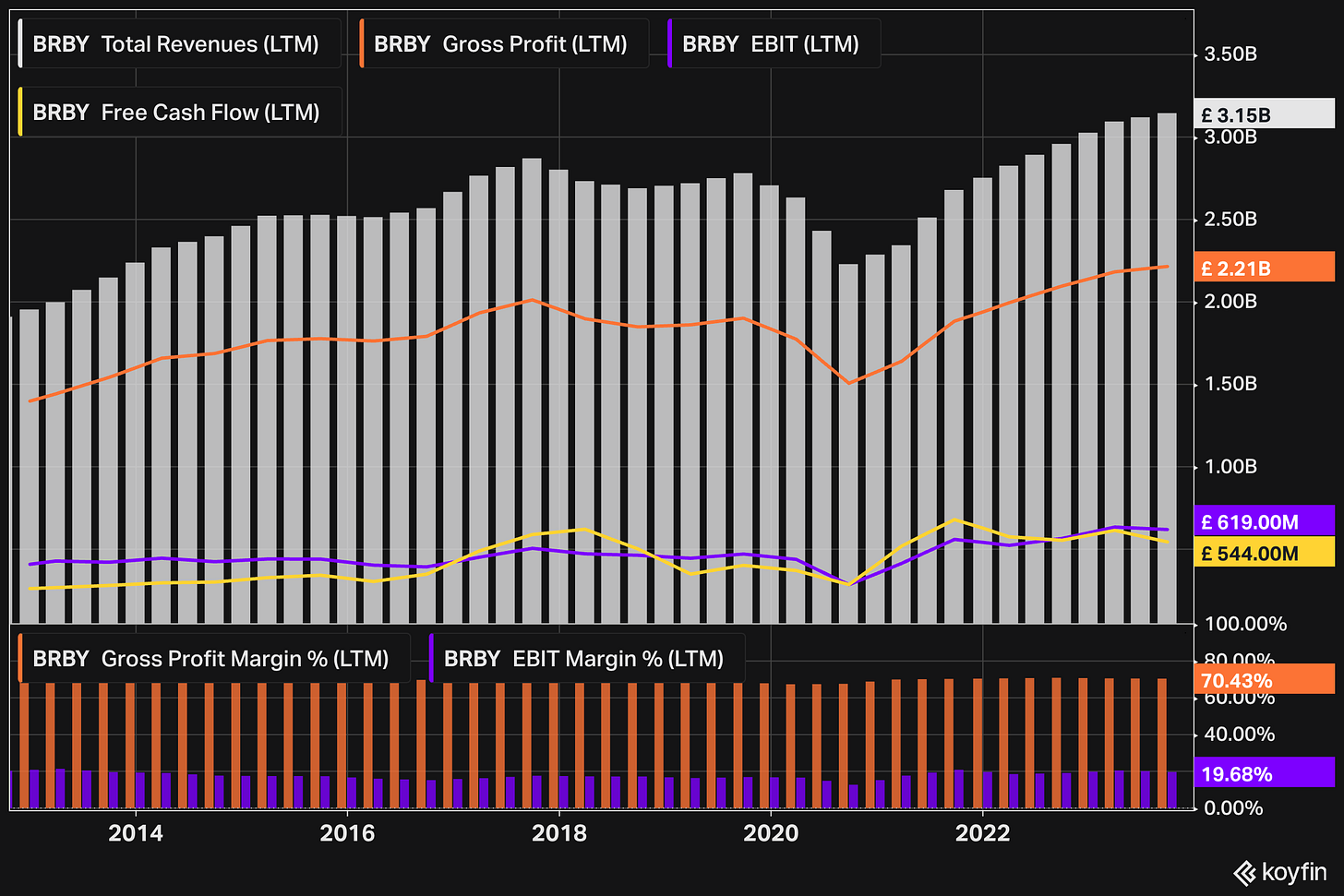

Nick Train, of Lindsell Train, is one of Burberry’s most notable and longest-serving investors. Over the past 18 months, he has routinely been present in the media suggesting that Burberry stock is cheap. Meanwhile, Burberry is a stock that has gone nowhere for the last decade, having reported just 38% in returns6 over the period and bouncing between £4 billion and £10 billion in market cap. Today it trades at ~£5.6 billion, with £3.15 billion in trailing revenues7, a 70% gross margin, a high teens to low twenties operating margin, and net income margins that are usually in the mid-teens. In a good year, Burberry will kick out ~£500 million to £600 million in free cash flow before tax.

The company shells out ~£230 million yearly in dividends (currently ~4% yield) and has repurchased £410 million in stock over the last twelve months. In the last five years, the company has repurchased ~13% of its outstanding share count. Trading at 14.3x forward earnings and 1.7x forward revenues, Burberry scores in the lowest percentiles across most valuation markers relative to its 10-year history. Indicating that the company has seldom been “cheaper” over that period.

Meanwhile, the valuation yields, margins, and profitability markers are all positioned in the upper percentiles relative to their 10-year history. Without any other context, this might be considered an attractive proposition; a cheap company, a strong brand, and relatively strong fundamentals. But Burberry has endured its fair share of knocks in recent years. Starting close to home, where the UK government opted to withdraw the UK VAT refund scheme. This scheme, which was a significant aspect of the shopping experience for many tourists in the UK, underwent a major change in 2021. Previously, non-EU tourists were eligible to claim VAT refunds on the goods (20% for most goods) they purchased during their stay. The UK government's decision to abolish the scheme made travel spending on luxury goods like Burberry considerably more expensive. If anything, it was an enabler for UK tourism8. While Burberry’s revenues are largely comprised outside of the UK, it’s not ideal for a business looking to recapture its “Britishness”.

The market sentiment for Burberry is abysmal. The market votes with its fingers; and the fact the stock flat over the last 5 years might tell you all you need to know.

Damp Sentiment

But there are some legitimate reasons for the damp sentiment. More recently, the company issued a profit warning during their interim report in November. Citing a global slowdown in luxury demand, Akeroyd remarked “If the weaker demand continues, we are unlikely to achieve our previously stated revenue guidance for FY24”. Shortly after, the £3.2 billion consensus estimate for 2024 revenue was revised down to £3.13 billion (which would represent 1% YoY growth). The consensus for 2024 EBIT was also revised down by 8% to £566.8 million. While the expected currency headwinds for 2023 were softened during the interim filing, the company still expect a £110 million hit to revenue and a £60 million profit impact.

For the first 26 weeks of 2023, Burberry reported a 4% jump in revenue, totalling £1.4 billion, (7% at CER) with the company’s largest revenue channel, retail, growing by 6% (10% at CER). Wholesale declined by 8% and licensing grew 45%, albeit from a tiny base. EBIT and net income declined by 15% and 18% respectively. While the business mustered up a 10% comparable store sales comp, the sequential degration in trends seen in the second quarter spooked investors.

The Asia Pacific, Burberry’s largest revenue generator, slumped to a 2% comp in the second quarter, and within that category, China was down 8%. The Americas, an area Burberry has been struggling in as of late, witnessed two-quarters of negative comparable sales decline. Sophie Yates, head equity analyst at Hargreaves Lansdown, claims “The shine is dimming on the luxury sector as even higher-end consumers tighten their belts”. Director of Investment at AJ Bell, Russ Mould, adds further context:

“Traditionally the wealthy clientele which shop for expensive clothes and accessories are seen as being insulated from the impact of higher borrowing costs and rising prices but apparently they are feeling some of the pain. This is particularly disappointing for Burberry given it has worked hard to position itself firmly at the luxury end of the market in recent years”.

While it’s no secret that the slowdown is impacting Burberry’s peers too, these same companies have proven to be more resilient than Burberry. The pandemic and the disjointed recovery from the Chinese consumer impacted every high-profile luxury business. In Burberry’s case, the trough was deeper, and the recovery was weaker than the likes of Hermes, Kering, or LVMH.

Pull back the calendar a little further, and it’s evident Burberry has been falling behind. Over the last decade, Burberry’s revenues have compounded at ~4.5% per year compared to Hermes (12.8%) and LVMH (11.0%). The reason Burberry doesn’t command the luxury multiple is that it doesn’t deserve the luxury multiple.

While it might feel natural to compare an iso-brand business like Burberry to the likes of Hermes, also a single luxury brand, and play bridge the gap; “If Burberry trades at 25x like …. then…”, it would be a mistake to do so. These companies play in different leagues, serving different clientele. Part of the very extremes of Burberry’s bull case involves the company climbing the luxury ladder to become more of a competitor to Hermes, but I would caution against basing an investment case on that most unlikely of outcomes.

Burberry is a Turnaround Stock

The luxury sector, as a whole, is under fire. Coming out the other end of a whirlwind of shifting consumer demand and inflation, luxury companies became overstocked and overvalued. The pricing actions they took to catch up with inflation also require some time to breathe. In a recent report, which includes downgrades for several luxury companies, analysts at JP Morgan stated:

“While we remain positive on luxury fundamentals in the medium/long term, with likely an opportunity to turn more constructive in H2 next year, we see little scope to chase the sector in the short term. The sector has partly correct since the summer, but with no earnings upgrades and EV/Sales multiples still at 25% premiums vs history given peak margins, we think it might be too early to chase the sector”.

While that may true, something which separates Burberry from the rest and is, in my opinion, the prize contributor to Burberry’s damper sentiment, is the fact this is a turnaround stock. The company currently has a medium-range guidance of achieving £4 billion in revenues within the next 3 to 5 years (the current analysts consensus suggests 2029). The company also expressed a longer-term target of hitting £5 billion. Burberry has failed to exhibit consistency in prior years, which leaves investors doubtful.

RBC Capital Markets recently claimed in a report that the £4 billion revenue guidance was “achievable, whilst underlying profit margin guidance of ‘significantly above 20 per cent’ remains fairly ambiguous for now, even though the 20 per cent margin has been reached in 2023”. They continued: “From here, we believe the strategy needs to deliver on sustainable earnings growth which has ultimately proved inconsistent in the past”.

Burberry is a classic turnaround business, and as Warren Buffett succinctly puts it; “Turnarounds seldom turn”. Individual investors are often too optimistic about the prospects of a turnover, and while these bottomed-out stocks may look appealing, they often possess several risks that otherwise can be wisely avoided. As an illustration of this lack of confidence, of the 21 analysts covering Burberry, just 4 have a buy rating, while 14 suggest holding and 3 recommend a sell.

Acquisition Prospect & Positive Things

With lingering concerns over the luxury market, domestic VAT woes, and rock-bottom sentiment, what is there to like about Burberry?

Valuation & Strong Brand

Burberry is historically cheap, but I would avoid exaggerating its relative cheapness by looking at stronger peers sitting in higher luxury brackets. While there is little use in comparing Burberry with true luxury brands, the company does exhibit the economics of a luxury business; gross margin in the low 70% range, EBIT margins in the mid to high 10s, and a consistently profitable business that kicks back £0.11 to £0.15 of every £1 earned into net income. Margins have been relatively stable over the last decade.

The growth has been uninspiring, but looking back at the stewardship of prior executives can only tell you so much. Those who are optimistic about Burberry would be inclined to believe Lee and Akeroyd can have an impact going forward. Prior inconsistencies aside, the business has a good chassis to work with. The business is in no danger of being made extinct anytime soon. The brand may be somewhat underappreciated today, but it’s still a globally recognisable one. Fiscally, the business has some staying power too. Burberry’s balance sheet is well-stocked with £1 billion in cash, equivalents, and receivables and relatively little outstanding debt; £299 million in 2025 notes bearing 1.125% interest that the company raised in 2020.

Operating cash flows (£912 million in 2022, £750 million net of interest and tax) have historically been strong enough to support the company’s various capital allocation needs. The company recently completed a £400 million buyback authorisation and CapEx is expected to reach £200 million by year-end as they continue the refurbishment of their 409 stores. With the buyback authorisation extinguished and the refurbishment project edging closer to completion, the intensity of outflows should reduce in the coming years.

Growth Vectors & New Management

There are two sides to every argument and while Burberry’s lack of stability in the executive suite and the uncertainty of new management can be painted in a negative light, it can also suggest the prospect of revitalization. Daniel Lee’s time at Bottega Venetta was inordinately successful. Before joining in 2018, Bottega had seen revenues decline 8.5% between 2015 and 2017. Between 2018 and 2021, revenues would grow 35% (to €1.5 billion) under Lee’s tenure as creative director. This included a positive comp in 2020; one of the most difficult years for luxury since the financial crisis of 2008. Financials aside, Lee reshaped the image of Bottega and his term was seen as a renowned success by fashion editors, buyers, and customers alike. So much so, that it was a shock when he announced his sudden departure.

It’s early days, and Lee’s product is gradually working its way into the product mix9, but Burberry is hoping that lightning strikes twice for this young creative director. As far as I can tell10, his collections have impressed buyers and consumers thus far. Akeroyd is no slouch either. Having spent 12 years at Alexander McQueen following the death of its eponymous founder, he is no stranger to operating under turbulence. He would later take the top position at Versace in 2016, where he oversaw the $2.1 billion sale of the brand to Michael Kors; now called Capri Holdings.

Digital & Physical Overhaul

The duo’s strategy is multi-faceted. Already we have seen a major overhaul of Burberry’s digital and e-commerce platforms, as well as the introduction of new collections that come with higher tickets than their predecessors. This is evident throughout leather goods, clothing, and accessories, but particularly apparent in bags; where new ranges like Knight, Shield, Chess, and Rose were introduced with price tags for Medium size bags starting at $3,500, about $1,000 to $1,500 higher than the previous collection. In the physical world, Akeroyd intends to refurbish the brand’s global fleet of stores, focussing on full-price sales and rationalising wholesale. Over the medium term wholesale penetration is expected to decline.

Currently standing at 409 stores, they expect to have completed more than 50% of the work by year-end and will complete the project by 2026. Akeroyd aims to boost store sales densities by more than 50% to £25,000 per square meter under this refurbishment project; remarking during the recent interim call that they are “on track towards to achieve that productivity goal”.

Accessories, Accessories, Accessories

In 2022, Akeroyd outlined a plan to double sales in leather goods, shoes and women’s ready-to-wear and grow outerwear sales by around 50% in the medium term. For accessories, the company’s largest segment, he expressed that he wanted to broadly double that business by 2027 and eventually have accessories become more than 50% of group revenue (currently ~35%). This compliments Lee’s success in monetising accessories at Bottega.

Outside of strengthening categories Burberry is known for the business has worked on underrepresented categories such as shoes, quilts, and dresses.

Acquisition Prospect

There is promise in the fundamental story of Burberry, but as a single-brand entity, operating within a country that appears to be getting ravished by overseas M&A activity of late, trading at a historically low valuation, in an industry that loves consolidation… there is a prospect that Burberry is the target of acquisition. Luxury retail is an active market. In the last three years, we have witnessed LVMH acquire Tiffany for $15.8 billion and Emilio Pucci for an undisclosed fee, Exor acquire a controlling stake in Louboutin for $640 million, Tapestry acquire Capri Holdings for $8.5 billion and Richemon acquire Gianvito Rossi in July, to name a few.

While the prospect certainly adds optionality if you are buying at current levels, I am not sure it’s something I take all too seriously. The window to acquire a business like Burberry is limited in so far as they continue to trade at such low multiples. However, it’s not something that should be dismissed. For further reading on the matter, I will direct you11 to a couple of articles by Undervalued Shares who can add to the conversation better than I have scope to in this article.

Closing Thoughts

They say should buy outstanding businesses trading like they are horrible businesses. In Burberry’s case, I believe the current opportunity is more akin to a good business trading like a bad business; it’s not quite trading like a death row inmate yet. Because of the margin for error in deciphering whether Burberry is a good or average business, I think the delta between the appropriate valuation and the market's perception of what an appropriate valuation is might be too narrow. Bear in mind, too, that a great deal of the optimistic perspective is based on narrative right now. There is a new management duo, they have a progressive plan in place, but we are yet to see the fruits of that labour. Turnarounds are notoriously difficult, and most would be better off avoiding them.

Are there higher-quality businesses in this sector? Yes. Do they trade at considerable premiums? Certainly. Do they deserve those premiums? If the premium alludes to a comparison with Burberry, yes. Some investors instinctively want to own the highest quality companies and are happy to pay up for the privilege. Others are hardwired to look for value. I am in no doubt that Burberry is probably an attractive prospect for someone. For most, I think there needs to be more evidence of a successful turnaround first.

Turnarounds aside, Burberry does have an iconic brand that is diversified across the world. While French luxury is world-renowned, few genuine brands from the UK can come close. Burberry is one of them. It has the skeleton of a high-margin luxury business, and I appreciate management’s willingness to cannibalise the sharecount when appropriate. While there is a long road ahead, I struggle to see the Burberry brand, which has survived over 160 years, dying anytime soon. When you are hunting for bargains, you should feel a little sickly; it’s not supposed to “feel good” buying.

Thanks for reading,

Conor

Great article by Sleepwell Capital on this subject (here).

“Luxury is a spectrum. According to Brunello Cuccinelli, there are three types of luxury brands. If we imagine a pyramid, at the top is true or absolute luxury, in the middle is aspirational luxury, and the bottom accessible luxury. The top is where only the very best of breed sit and there are only a handful of them for any given category. Those that sit below can only dream of one day becoming part of that prestigious club. In the words of RH’s Gary Friedman, climbing the luxury mountain is incredibly hard, and has rarely been done. What separates the top from the bottom is having traced their own path for a very long period of time”.

This is a very simplified perspective of the luxury spectrum; it’s not solely a matter of price.

In 2018, creative director, Riccardo Tisci, altered the company’s branding and adopted the generic black, all caps, lettering that many other luxury houses converted to in the 2010s. When Daniel Lee took over in 2022, he wanted to bring Burberry back to its roots and celebrate the DNA of the company.

There continues to be a considerable amount of lobbying for this to be repealed. Kwasi Kwarteng reintroduced the tax-free shopping scheme as part of his mini-budget, but Jeremy Hunt reversed the decision when he became chancellor, claiming it was unaffordable. At the time, retail bosses described Hunt's decision as a “hammer blow to UK tourism and the British high street”. It’s not improbable that we see VAT-free shopping in the UK again in the future, which would be a boon for Burberry.

Lee’s product is expected to account for 75 per cent of Burberry’s assortment by March 2024.

Various sources are confirming this, but this piece from Vogue Business is a good one.

A comment not about Burberry but about brands...

A few decades ago, my then-wife and I received a housewarming gift of two butt-ugly placemats from Hermes. That one gift begat my education.

01. Hermes is not pronounced Her-meez, but Air-may. Okay.

02. With no receipt of any kind, I went to the local Hermes store in Beverly Hills, California to return the placemats. No problem.

03. The salesperson said that, with no receipt, she would have to search for the price. She suggested I look around the store for an item I might exchange for so I did. A woman's scarf: US$1800. A purse: $4000. A cashmere sweater: I had to pull my hand away as though it had been scorched the price was so ludicrously high. Okay keep looking, bound to find something. A cash clip: $100. A dog collar: $195. For a dog collar! I found the placemats I was returning: $195...for one. $400 for 2 ugly placemats! My values and Hermes's prices diverged wildly. I would take a credit slip.

The salesperson returned. The store would issue a credit of $100. A conversation ensued that went something like this...

"$100 for one placemat?" I asked.

"No," she replied. "$100 credit for the two of them."

"But you have them right there (I pointed) for $195/placemat, $390 for the two of them."

"I understand. But you do not have a receipt so I can only issue a credit for the sale price."

"Have these placemats ever been on sale?," I asked.

"No. So we had to create a sale price. $50/placemat."

"But you have nothing in this store for under $100..."

"Your choice: Accept $100. Keep the placemats. Gift the placemats. Trash the placemats."

I took the $100 credit. She returned with a credit slip for $100. "Wait," I said. "What about crediting back the sales tax?"

"Without a receipt, we do not credit back sales tax."

I was floored into silence. I meekly accepted the credit slip and sulked my way out of the store. This whole Hermes thing is a giant scam, I thought. I would never shop there. But what do I do with the $100 credit?

I gifted it to friend a few weeks later. A Brit from London who had moved years prior to Los Angeles. He seemed familiar with the product; he was quite profuse with his thanks. He said he and his wife would visit the Hermes store that weekend. When I saw him agin the next Monday, I was excited to learn how their shopping had gone. He was not so cheerful. "Your gift has to be the most expensive $100 gift I ever received!"

"Huh? I don't understand..."

"The $100 credit cost me $1500 just to use."

Oh. In retrospect, I should have just gifted the $5/)-%# placemats, just like Christmas fruitcake that circles the globe from one recipient to the next gift recipient.

The power of luxury brands and all that. :-)

Thank you for another excellent article, Conor.

Very interesting article!