It’s a playbook Kura Sushi has performed numerous times before to shore up the balance sheet. In 2021, the company issued 1.1 million shares of stock at $45 netting proceeds of ~$47 million of which $17 million was used to erase the line of credit extended to them during the pandemic from the parent company. The rest was used for CapEx and operating costs. In 2023, the company issued a further 1.3 million shares at $54 per share, netting ~$65 million in proceeds for CapEx and operating costs.

Following the Q4 earnings in November 2024, an announcement to raise (at $85 per share) a further $64.6 million in proceeds surfaced; once again for CapEx and operating costs. Armed with more than $100 million in cash on the balance sheet (an all-time high) the business is secure for the next few years.

In the fiscal 2024 year, Kura opened 14 new units steering CapEx to $44.3 million, up 65% from the $22.8 million in 2022. A further 14 stores are expected in the fiscal 2025 year, meaning we can expect that figure to approach the $50 million mark with the added maintenance costs of an evergrowing portfolio1 (now 69 stores across 21 States).

Share issuance carries dirty connotations. Kura, whose sharecount has expanded by 43% since 2020, has not shied away from using public markets to acquire growth capital. The cons of doing so are well-known. It’s not sustainable to rely on public favour, it dilutes shareholders, and it can be a wasteful endeavour without capital discipline. It’s my opinion that Kura bucks the trend.

Management has demonstrated savvy capital allocation with respect to share issuance, tapping into the market at times when the share price is scorching hot. They have, at times, favoured this method to avoid or pay down debt appropriately. The signal that Kura has often provided for issuing stock is that of expansion opportunity. Given that growth has outpaced dilution, I believe this has proved to be justified. The added liquidity this affords has resulted in a steady increase in institutional ownership too.

On a per-share basis over the period the sharecount has climbed 43%, revenue (+90%), gross profit (+152%), and book value (+97%) have all more than offset the dilution effect.

A return to pre-pandemic profitability has eluded the business thus far. The last time Kura Sushi reported a positive net income was back in 2019, at a razor-thin margin. Operationally, excluding the insignificant $332,000 in EBIT reported in 2023, they have by all accounts evaded operational profitability since 2019 too. Since then, however, the acceleration in overheads from a considerably more aggressive expansion has been immense. It’s not exactly a moment in the company’s history when they ought to be prioritising profitability over scale. Since 2019, Kura’s revenues have grown 270% at a 30% CAGR, now amounting to $238 million on a trailing basis (up 27% YoY). Management is guiding for revenue growth in the mid-teens for fiscal year 2025.

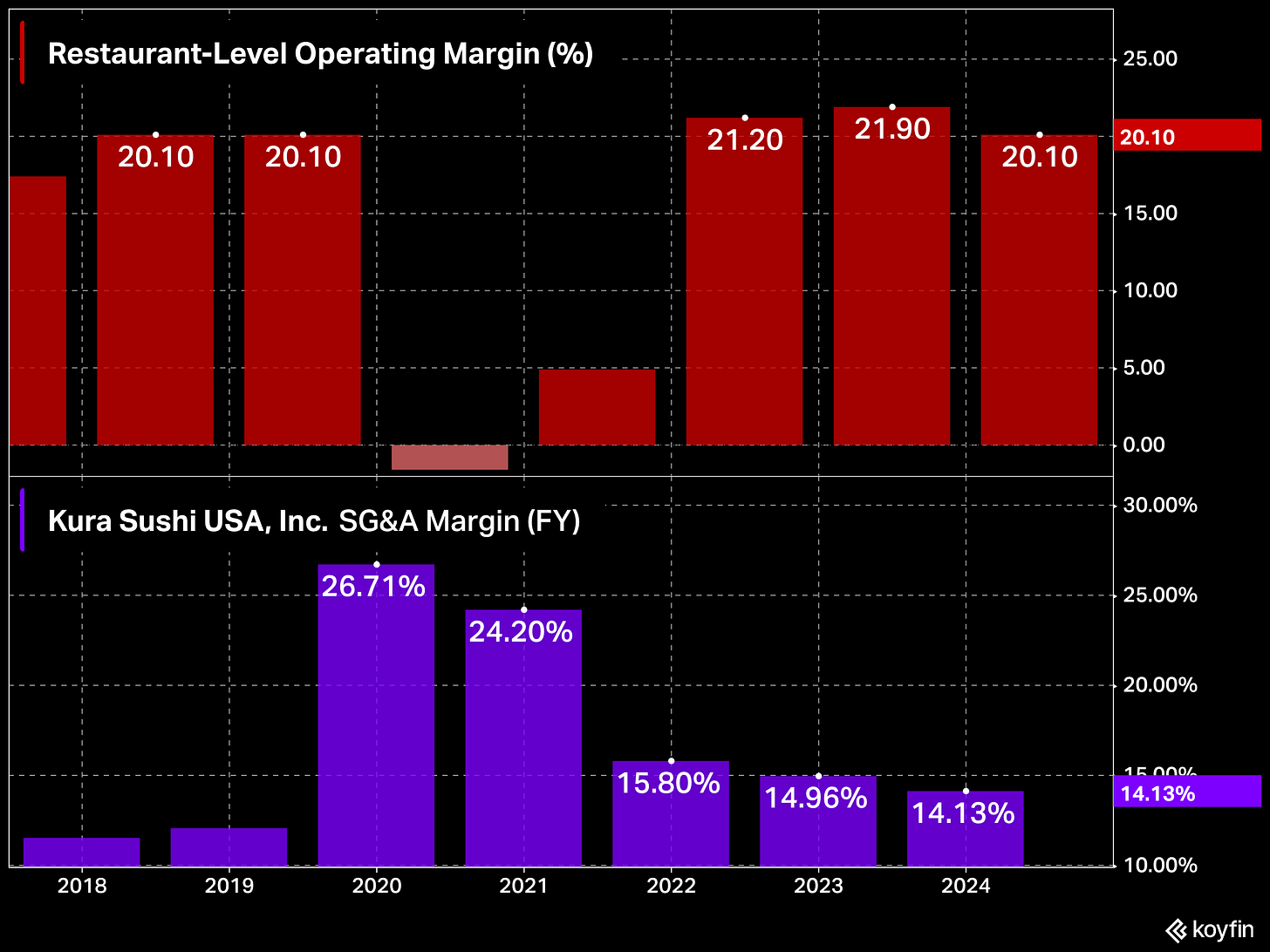

Signs the economic model is growing stronger over time continue to stack up. While food and labour costs climbed slightly year-over-year on the back of inflation, Kura management maintained a restaurant-level operating margin above 20% for the third consecutive year. The SG&A margin, 14.1% in fiscal 2024, has continued to improve in alignment with CFO, Jeff Utz’s, guidance and is expected to fall another 60bps by fiscal 2025. Average Unit Volumes, up 35% since 2019, held steady at $4.23 million in 2024.

Strength in AUV was no doubt aided by pricing, but this was impressive as Kura’s mid-year was troubled with a decline in traffic. In his post-mortem, CEO Hajime Uba claimed that while initially believing the slowdown was a result of the “sticker shock” (higher pricing) after the implementation of the AB 12282 , his thinking changed to a “wider national macro factor, which has been corroborated by the earnings calls of [industry] peers”.

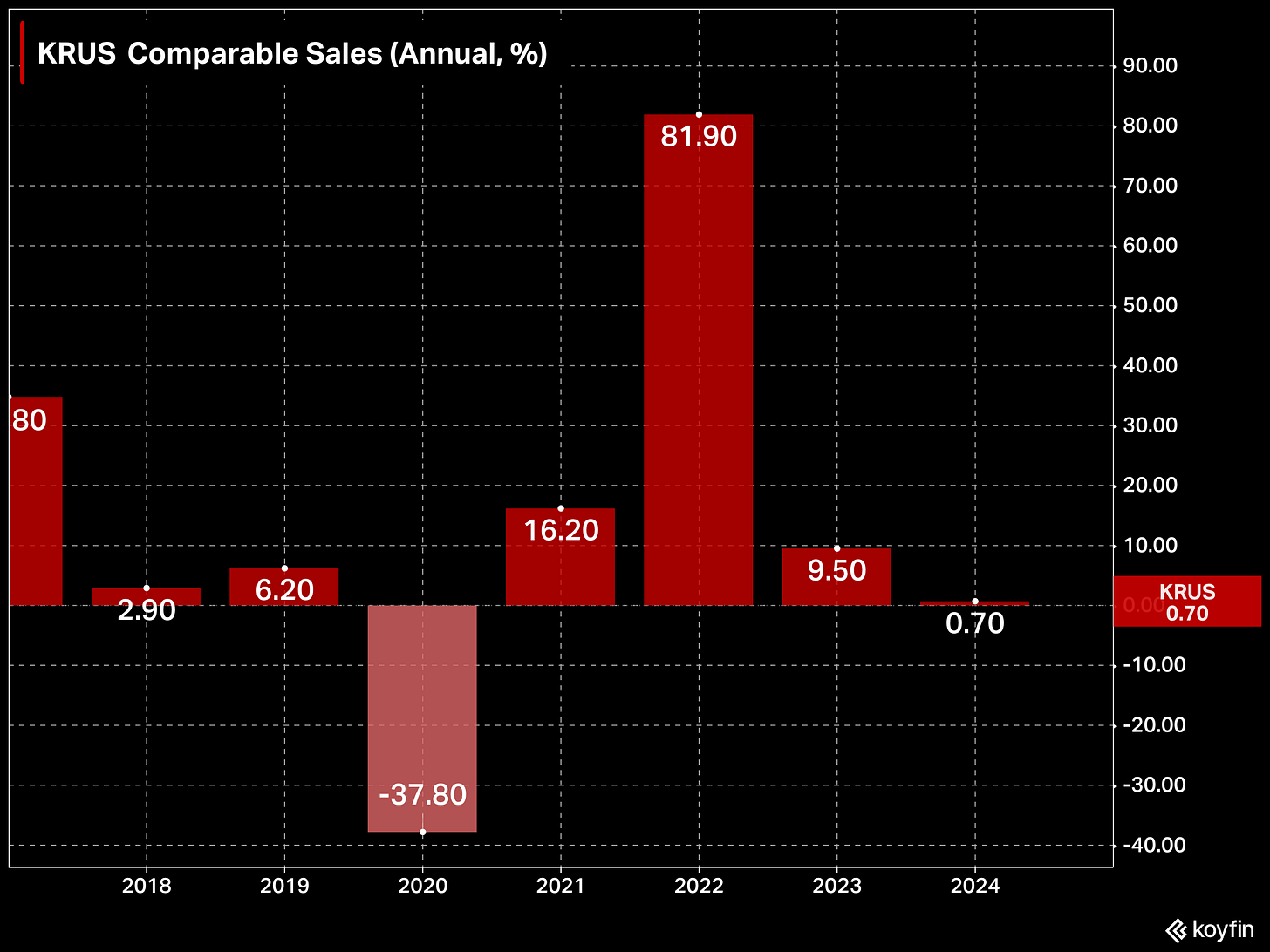

Comparable restaurant sales growth, which has been in free fall since the middle of 2023, has been in sequential decline since mid-2023. After flirting with a negative comp in Q3, comparable sales dipped into the negative (3.1%) in Q4.

The tide may be changing, however. Uba would remark in the Q4 call that “The sales pressures beginning in April improved significantly over the course of the quarter” which assisted in the company avoiding negative comparable sales for the fiscal year, coming in at 0.7%. This was followed by assurances that the team expect positive comparable sales in the coming fiscal 2025 year.

There isn’t much value in getting distracted by short-term traffic trends; particularly when similar headwinds have been felt across multiple industries. Kura’s guidance is modest and around half of the 2Y average revenue growth rate. It was nice to see a more conservative approach to guidance after the faux pas3 in fiscal 2024. When asked about why the guide is so muted, it seems management wanted to avoid being the cat that touched the stove top twice.

“We're very pleased with the performance that we've seen to date as we've entered the fiscal year September and October. Q1 is definitely outperforming Q4, and we're very happy to see that. But -- it's also true that we're still in mid-process in terms of recovery. And so we feel it's prudent not to be overly aggressive with our revenue guidance at the beginning of the year. The last thing we want to do is to have to do a repeat of downward revenue guidance that we did last year. And so we felt that this was the most prudent approach”.

Five stores have been opened so far in fiscal 2025 with another 6 under construction. There could be some upward revision there given that 35% of the guidance has been delivered before Q1 is over. The expected implementation of the self-seating system is not currently included in the guidance, a variable that management suggests could provide up to 50bps of savings on the labour line item and flow directly to the bottom line as “gravy” to the current guidance. Moreover, as we have seen in the past Kura typically likes to lowball annual guides and provide incremental upgrades with improved clarity. Granted this bit them in the ass in 2024, but there remain a lot of positive opportunities for surprises in the coming year, assuming the macro environment remains stable.

The handful of KPIs worth following for this business remains on track as far as I am concerned, leaving me comfortable with holding for the foreseeable future. One concluding remark I will make is that was I slightly jaded in the summer when the stock sunk to ~$50 per share. In my infinite wisdom, I held off buying this drawdown partly because the position size was comfortable and because I had reservations that the drawdown came at a time of weakness compared to the past few times which came after incredible earnings. I did suggest my significant other take a small position around this time and her investment is now up more than 100%, so not all was lost.

Thanks for reading,

Conor

AB 1228 replaced the original FAST Act and introduced a compromise between the fast-food industry and labour advocates. It preserved the creation of the Fast Food Council but limited some of the council's powers compared to AB 257. It also introduced a $20 minimum wage for fast-food workers, effective April 2024, addressing a key demand from labour groups.

An excerpt from my comments in Q3: “At the end of Kura’s fiscal 2023, the company communicated guidance of $241 million (mid-point) in fiscal 2024 revenue. Following successive upgrades in Q1 and Q2, the guide increased to $245 million. The Q3 revision which calls for $236 million is now 2.1% lower than what they guided for in Q4 of last year and implies a 3.7% downgrade from last quarter’s mid-point estimate”.

Buenas noches, echar un vistazo a INMODE ( INMD ) a ver que os parece. Muchas gracias.

Moreover, the good thing is that that industry group has tailwinds behind it