Is Chipotle Squeezing too Hard?

Driving growth via traffic vs menu price

The following passage is an excerpt from my sister newsletter called Notes to Self; where I write concise notes…to myself… about companies I own or track.

Driving growth via pricing vs traffic

Chipotle has notoriously been somewhat of a perpetually “expensive” stock if you take an optical approach. Today it trades at ~49x forward earnings; on par with the 10Y mean. On a price-to-free cash flow basis, the 58x multiple is slightly below to 10Y mean of 62x, but still relatively expensive. We can get into the nuances of relying on multiples as a means of relative valuation assessment, but something Chipotle has not been known for throughout its history is being an expensive consumer offering. Menu price increases (averaging 8.6% per year between 2021 and 2023) in recent years have caused some to fear the erosion of that value proposition. With margins and average restaurant sales at all-time highs and Niccol suggesting they can go further still, is Chipotle squeezing the consumer a little too much?

It was a good year for Chipotle; which recently announced its Q4 FY23 earnings. Revenues have surpassed a $10 billion run rate. Net income ($1.23 billion) and the corresponding margin (12.4%) have never been higher. Operating cash flow1 ($1.78 billion), free cash flow ($1.22 billion), and average restaurant sales ($3 million) are at all-time highs. Operating margins (both GAAP and restaurant level) are now back to where they were before the E. coli scandal. The balance sheet is healthy and there is a clear vision for what the company wants to achieve over the next decade. Chipotle were one of many quick-serve restaurants to offset inflation with menu price increases in recent years. Yet their persistence, post-inflation, has drummed up an interesting discourse. In the three years preceding the pandemic, the company raised prices by 1.2%, 2.4%, and 0.2%; averaging 1.3% per year between 2017 and 2019. In these years, much of Chipotle’s comparable sales growth was fueled by transactions (additional traffic per store). In the three years following the pandemic, prices were raised by 8.5%, 12%, and 5.2%; averaging 8.6% per year between 2020 and 2023.

In 2022, when Chipotle raised prices by 12%, transaction growth slumped to 0.9% (down from 10.3% in 2020). Around this time, you started to see headlines questioning if Chipotle had increased prices too much. This year was a more balanced dynamic with menu prices increasing by 5.2% with 5% in transaction growth. For now, Chipotle has shown that it can increase prices, expand margins, and not decimate traffic. But the question of whether this is sustainable is an important one; worthy of taking the focus in today’s note. Chipotle’s appeal as an investment is attractive box-to-box unit economics, an appealing value proposition, and customer loyalty. You could make the case that their conscious decision to increase prices beyond necessity is an effort to push margins beyond necessity. In the short to medium term, this would hurt customer loyalty.

Average restaurant sales (AUVs) are now sitting at more than $3 million per store. Using the same playbook2 that took them to $3 million, management wants to take AUVs to $4 million over the medium term. There is an inherent level of inflation baked into AUVs; as inflation persists at any positive level throughout the economy, AUVs will naturally climb as Chipotle pass inflation onto the consumer, ceteris paribus. The argument really boils down to margins. If you are simply passing inflation along to the consumer, then you are offsetting those costs and wouldn’t ordinarily see margin expansion. Yet, Chipotle’s margins have been expanding and John Hartung (CFO) believes they will continue to do so as they strive for $4 million in AUVs:

And as we get up to $4 million, I would expect we'd be in the high 20%, maybe even in the 30% range. Again, you're talking about predicting something over a very long period of time. But our margins will definitely get stronger over time, which means our returns will get stronger as well as we move from $3 million to $4 million.

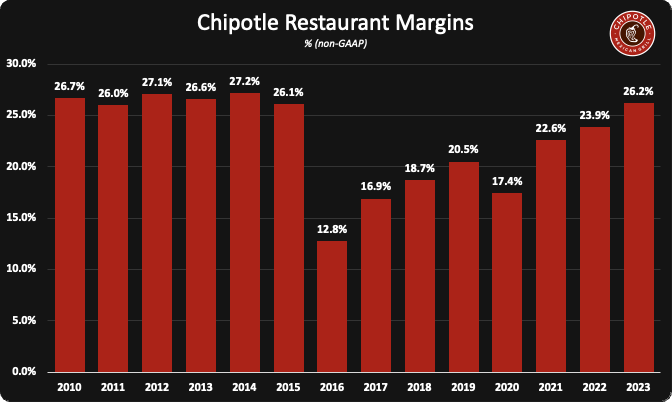

Chipotle’s margins have indeed improved significantly in recent years. This is evidenced by the restaurant-level margin; which represents total revenue less direct restaurant operating costs, expressed as a percent of total revenue.

Restaurant margins are +570bps from 2019. There are a few ways to interpret this data. On the one hand, margin expansion has been aggressive. Yet, look at the base rate. While it appears significant, this has been part of a lengthy recovery from the E. coli scandal in 2016. Margins are now, after seven years, back to where they were in 2015. While 30% is higher than anything we’ve seen before, they have been higher historically. Let’s not forget there have been other things, besides price, that have and will maintain a positive influence on margins. Save the natural benefits of economies shared and sales leverage, the Chipotlane, introduced in 2018, is one newer facet of Chipotle’s business that Hartung claims to boast “hundreds of basis points of higher margin” when compared to a non-Chipotlane store.

Since 2018, Chipotle has opened more than 800 Chipotlanes, which are now attached to almost a quarter of the store count. Each year a considerable portion of new stores contain one of these Chipotlanes, and this is a trend that will continue. Around 80% of the 300 or so stores that are expected to open in 2024 will have a Chipotlane.

Digital3, another facet of Chipotle’s business, which today accounts for ~37% of sales, is another area rife with margin opportunity. The benefits of customer loyalty programs are well-known. Rewards members, of which Chipotle has ~40 million, tend to purchase more frequently and with greater basket sizes. During the call, Niccol remarked that the company is on a “multiyear path to commercializing customer data and insights into more targeted marketing campaigns” with the goal of “improving the overall digital experience that will drive increased frequency and spend over time”. Upselling loyalty customers is pure sales leverage. Then you must also consider the variety of labour-related initiatives the management team are experimenting with to improve efficiency. While seemingly longer-term undertakings, the implementation of automation projects like Autocado or the Hyphen digital make-line may afford Chipotle cost savings down the line. These are important factors to consider going forward, especially given that Chipotle look set to continue raising prices in 2024.

In the coming quarter, Hartung cites that Chipotle will raise prices between 2.5% and 3%. Following that, the FAST Act is set to come into effect this summer. As California wages increase 20% across the industry, this will impact ~15% of Chipotle’s store count. Hartung remarked this could result in a further 80bps to 100bps of price taking:

“We haven't made a final decision in terms of pricing with FAST Act. We know we have to take something at a significant increase when you talk about a 20%-ish increase in wages. And I think we talked in the past that there's one approach where you would cover the profitability so you would break even from a profitability standpoint but not protect margins - or you take a higher price increase and you protect margins as well. We haven't decided within that range. We'll wait and see just what the landscape looks like, what the consumer sentiment is, what other companies are going to do. So depending on where we end up, there'll probably be an extra 80-ish, 90-ish basis points to maybe something over 100 basis points in terms of additional menu price across all of our 3,400 restaurants, just to give you kind of an order of magnitude”.

The “positive” in all this is that Chipotle’s competitors will be facing the same dilemma. Depending on where the menu pricing settles, Chipotle is likely to retain its current relative value proposition. Given that Chipotle has shown growth can be achieved by traffic once again, I believe fears of premiumisation are overblown. I’ve yet to see any emphatic evidence, besides a few anecdotes4 on Twitter, that the value proposition of Chipotle has declined significantly. Customers vote with their wallets, and they’ve opted for another term for Chipotle. For all the supposed uproar on price, the traffic tells another tale. This is something to consider over the medium to longer term, but for now, it appears to be noise.

By this, I mean that Chipotle is not planning on adding any significantly new levers to fuel this expansion outside of existing operations, marketing, loyalty programs, menu innovations, Chipotlanes, etc. In contrast, a business like Greggs PLC is relying on a myriad of relatively new levers to expand its business such as focusing on new dayparts (evening trade), delivery, digital loyalty, and enhanced supply chain enhancement.

Digital sales represent food and beverage revenue generated through the Chipotle website, Chipotle app or third-party delivery aggregators. Digital sales include revenue deferrals associated with Chipotle Rewards.

Anecdotes are all well and good but I tend to be particularly skeptical of them in the quick-serve restaurant business. Often, people project an opinion based on their own perception of what is and what isn’t great food; failing to consider the bigger picture. The market, on the whole, doesn’t think like them. I can attest, as a shareholder of Starbucks that the coffee is extremely mid and overpriced. As a shareholder of Greggs, I’d not find myself consuming any of their goods more than once or twice per year, at most. I’ve eaten at Chipotle once in my entire life. I’ve never eaten at Kura Sushi. It doesn’t matter what you think, it’s more important to focus on what the broader market thinks.

Chipotle is still a terrific value proposition because restaurant prices have inflated so dramatically over the past few years. The ability to purchase a very filling meal for $10-12 that has quality ingredients and can be customized while the customer watches is a terrific deal in 2024 compared to other options. I eat out rarely, usually only in unplanned situations, and when I do, I always am on the lookout for a Chipotle as the "least bad" option in terms of health and financial impact.

(Incidentally, I do like small mom & pop Mexican places, but I hesitate to go into a new one that I'm not familiar with. Despite the e coli scandal, or perhaps because of it, I have more trust in Chipotle in terms of avoiding illness, especially when I'm traveling and the cost of getting an intestinal illness would be ... very high).

Actually, it does matter what anecdotal feedback has to say about Chipotle. $10 for a vegetarian burrito is outrageous given the inexpensive ingredients, even in the inflated price world we live in. I can find something acceptable as a replacement for far less at any number of other QSR chains. I have talked to others who feel the same way and will not buy from Chipotle. If Chipotle continues with the unreasonable price increases, they can expect business to fall off considerably despite what the charts, statistics and Wall Street soothsayers say today.