Hey, you are reading Investment Talk. If you’d like to join the 20.9k other readers learning about life, the stock market, and the companies within it, subscribe below. You can check out my other articles and follow me on Twitter too. If you enjoy today’s article, feel free to share it, it helps a lot. Now let’s begin.

On October 3rd, Tortilla’s market cap collapsed by 32% following an interim report that illustrated how persistent inflation and the loss of government subsidies from the pandemic era, showed up in the company’s margins. My contention was that this was predictable and viewed the price action as an opportunity and acquired shares for as low as £0.88 through December (see footnotes1 for previous essays).

“This business trades for £39m - spends ~£0.23 to generate £1 in sales and last year showed a gross profit of £38.3m. I don’t anticipate profitability in the near term, but I do believe Tortilla’s operating cash flow is enough to mostly self-fund their expansion, even if that means later withdrawing guidance”.

Myself, October 2022

I hadn’t planned on writing anything following the release of audited full-year statements, but the investor call2 answered a few of my lingering questions as the CEO & CFO responded to a couple of the ones that I had submitted ahead of time. Tortilla’s full-year report illustrated an amicable performance given the operating environment. There was a noticeable shift in verbiage around franchising too.

Under duress

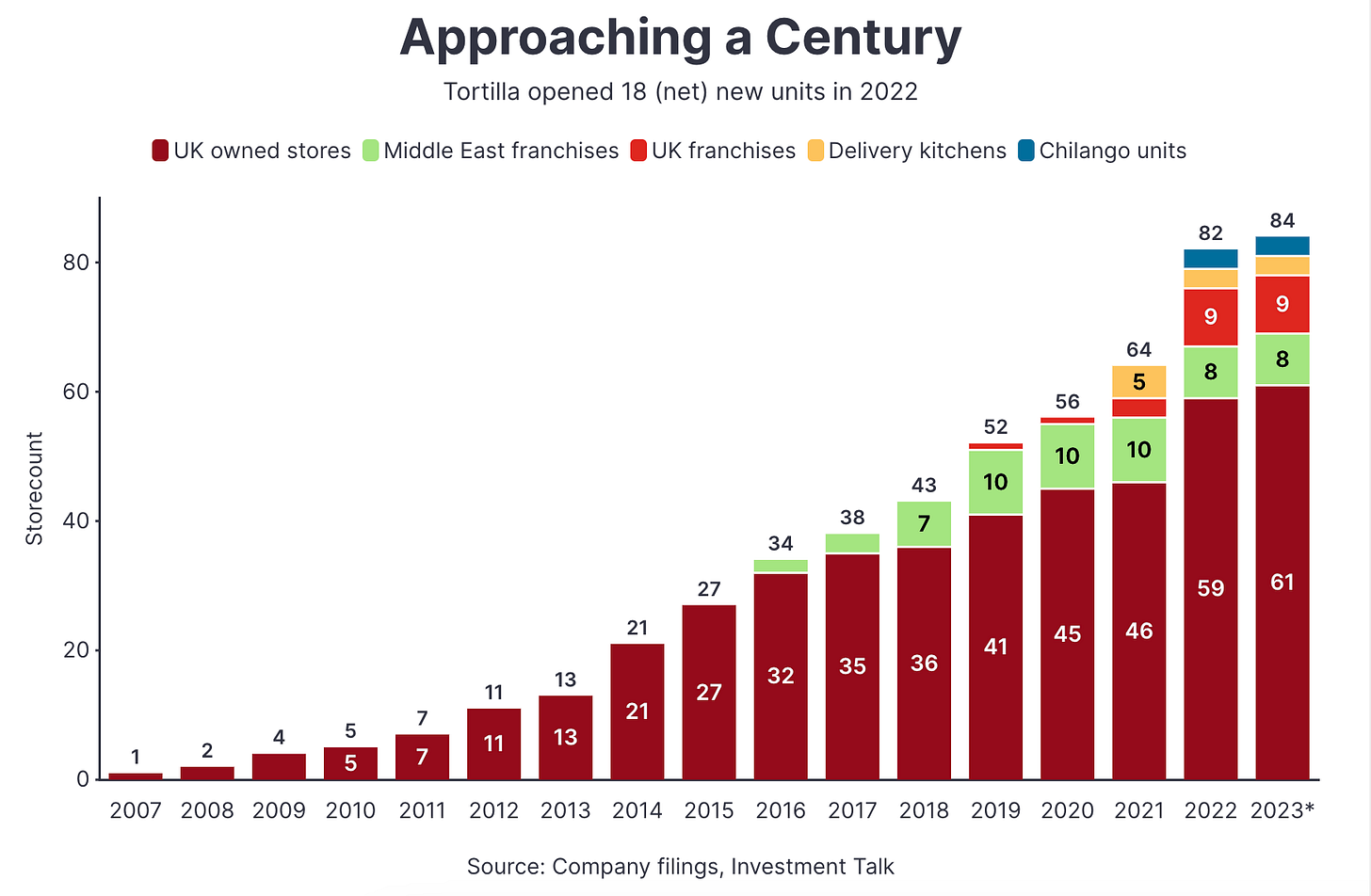

Tortilla muddled through 2022 as revenue of £57.7 million grew by 20%; with administrative expenses matching the pace at 19.3%. As the revenue bridge below demonstrates, most of the growth was organic. Excluding the acquisition of Chilango, sales grew by ~13% and the company opened ten new company-operated units. Including the acquisition of Chilango; they opened eighteen. Adjusted for VAT, like-for-like sales (vs 2019) were 14.8%, down slightly from 15.3% where they sat midway through 20223.

Gross profit (£44.1 million) grew by 15.2%, shedding 320bps of margin; led by two factors. One, the days of government benefits are over. Two, channel mix. I talked previously4 about how gross margins benefited from an increasing delivery mix; where items are priced 20-30% higher. Add to that the fact that their exclusivity with Deliveroo5 (abandoned last year) gave them more favourable rates. They made a decision6 to sacrifice margin in favour of sales leverage. In 2019, delivery accounted for 17% of revenues. By 2021 it had grown to 48%. Last year, it averaged 31% and it's expected to remain thereabouts by the end of 2023. Factoring these points in, it's understandable margins fell.

Pricing increases in April are expected to improve the gross profit line, but it’s worth noting this was under the assumption that the “latest market information suggest that food cost inflation has largely plateaued”. Instead, last week’s March CPI reading came in above expectations; surpassing 10% for the seventh consecutive quarter. The UK now has the highest rate of inflation across Western Europe, and food & beverage inflation is one of the leading causes. Until now, Tortilla has been increasing prices below the rate of inflation and shielding the true cost from the consumer.

Further down the income statement, operating income amounted to £536,000 (down from £3.6 million) and the business lost £637,000 for the year (down from net earnings of £1.4 million). Expected.

Liquidity & Expansion

While the deleveraging of a serendipitous few years was expected, there’s no hiding from the ramifications as far as cash flow and liquidity are concerned. In 2021, Tortilla produced more free cash flow than it did operating cash flow throughout the last year. In 2022, Tortilla’s operating cash flow tumbled 35% to £7.6 million and free cash flow fell 89% to £940k. In part, Tortilla over-earned in 2021, but there was a step change in CapEx last year; 170% greater at £6.6 million. The bulk came from additions to fixtures (£3 million), leases (£2 million) and plant (£1.6 million). The company now finds itself in a position with £5 million in current assets (£2.4 million cash) and more than £14 million in obligations due within the year. The balance sheet looks fragile. At present, £3 million of a £10 million revolver has been drawn, and the company wants to build between 10-12 company-operated stores (includes kitchens with considerably lower CapEx requirements) in the current year. The highly cash-generative nature of the business gives management confidence they can continue to self-fund, but my gut says they might need to raise capital. I could be wrong. I had a similar gut feeling with Kura Sushi7 and five days later8 they did. Eloquently, I might add. It's a similar, but not identical, situation whereby the business could report higher free cash flow and lower operating expenditure, but that would come at the cost of reducing CapEx for new builds; consequently lowering administrative overheads.

The portfolio currently consists of 61 Tortilla company-operated stores, 3 delivery kitchens, 3 Chilango stores, 9 UK franchises, and 8 Middle East franchises (more on franchising shortly). Company-operated units cost an average of £350,000 (excluding landlord contribution) depending on the size of the unit, site condition and storefront requirements9. The popularity of Tortilla is not in question. Rewards members (280k) have grown 40% since last summer, and stores opened in 2021 through 2023 (see below) continue to perform well.

Management claims a store breaks even within a few months of opening and matures within 1-2 years. Last I heard, mature London stores average just under £100k in EBITDA, and non-London stores average £115k. The back of the napkin says a payback period of 2.5 to 3.5 years. I like the payback periods and economics of their stores, and the business overall doesn’t bleed earnings. But the liquidity question still remains; more so pertaining to their ability to afford the rollout, as opposed to the business’s ability to remain a going concern. I am not as confident in understanding Tortilla’s management as I was with Kura’s. Thus, am less confident in how they might raise capital; as there is a lack of significant capital allocation decisions (minus the Chilango acquisition) to speak of. I can’t imagine divestment. The additional £7 million in their revolver may be enough to dodge liquidity problems, but there is the option of equity issuance. At present, ~75% of Tortilla’s ownership is not publicly held. There was some exit liquidity during the IPO, but there are still a number of private equity firms holding onto their pre-IPO shares. It’s fathomable that a liquidity event could fructify in some way. I’d reason there would be strong demand for it. If we are talking about scarcity, a variable is that quite important in microcaps, then Tortilla may exhibit some, but not for lack of competitors on public exchanges. There is, of course, Chipotle (NYSE: CMG), but they don’t seem to care much about the UK market; despite years of people saying they eventually will. Then there is Barburrito, which was acquired by the Restaurant Group (LON: RTN) for £7 million last year and is, in my opinion, Tortilla’s greatest adversary. The Restaurant Group has enhanced the financial capabilities of Barburrito, but it represents one of their smallest (yet most exciting) brands. It’s speculated10 that the Restaurant Group may be divesting their pubs & concessions business; which may free up capital to more aggressively reinvest into Tortilla's rival.

Nonetheless, a liquidity event to increase the share count may well be a good thing in the long term. As things stand the company represents the only direct exposure to the UK-Mexican food market. This is all speculation, but as much as I am unsure where the cash comes from, there is not a lack of optionality.

Franchising & European Aspiration

Moving onto something less capital-intensive; franchising. It’s always permeated the literature of Tortilla’s reporting, but only this year did they start calling it a “key opportunity”. It’s a peanut-sized operation at best. Last year, franchise income accounted for just £648k (1.1%) of Tortilla’s sales. The year before that; £306k (0.6%). But it is low-intensity, high-margin, revenue. The rhetoric suggests it will be a larger focus going forward; and so do actions. Last September, Tortilla added a non-executive board member; Francesca Tirtiello who comes with >20 years of European franchising experience, more recently serving as the CFO for the European Franchise Business unit of YUM! Restaurants (Pizza Hut, KFC, Taco Bell, etc) covering 1.1k restaurants in 27 countries. All in aid of seeking “new businesses and partnerships” as they develop their European growth strategy. In the CEO’s words, the “success” of their UK franchising operation has given them confidence about “the opportunity to utilise a similar low-capital approach and establish a greater international presence”. But how successful has the existing franchising operation really been?