Crowdsourced Portfolio

Let's create a crowdsourced portfolio that doesn't suck

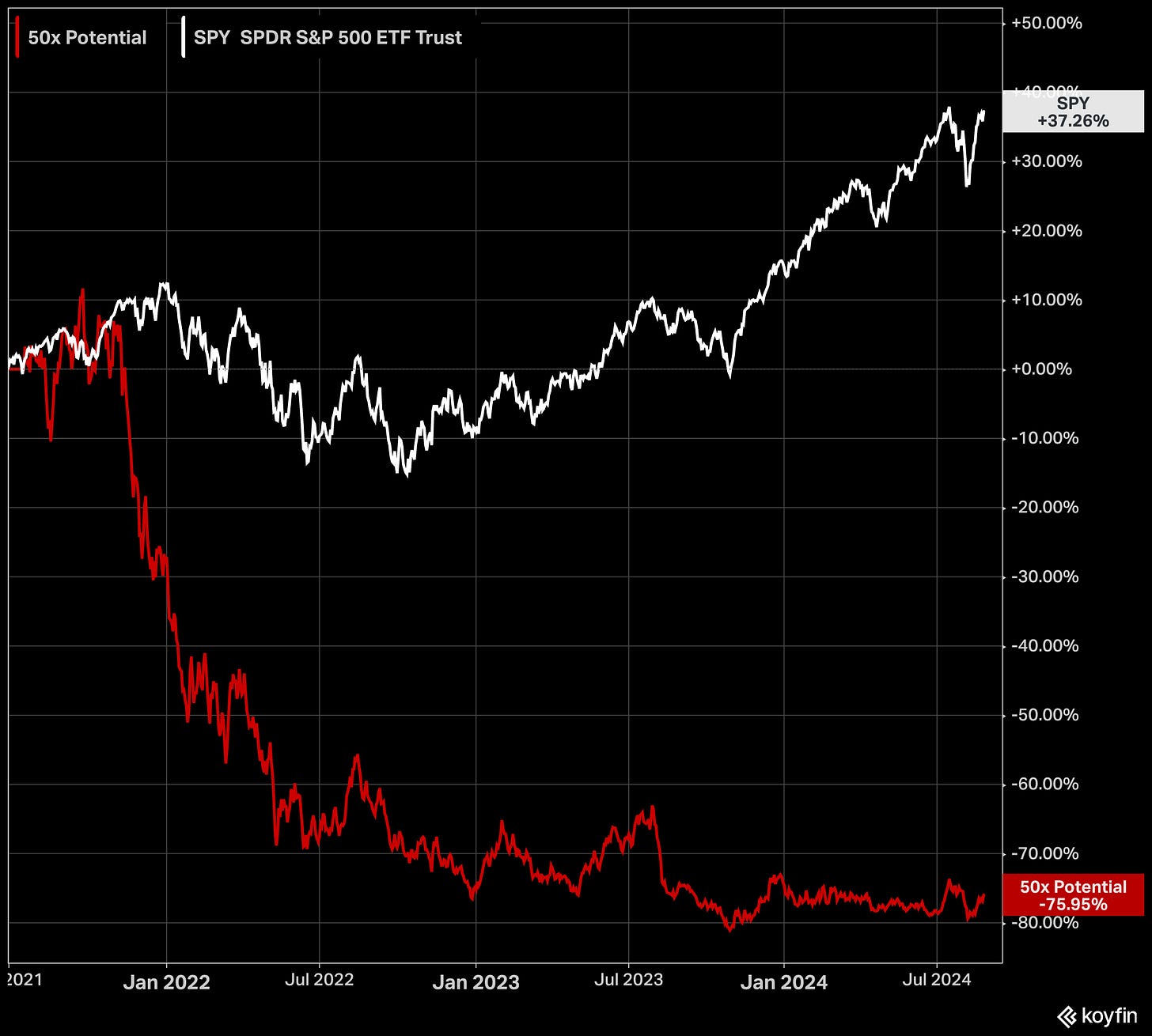

Now and then, a Twitter thread will be dusted off from the warehouse of some exuberant period in financial markets. The thread usually contains a bunch of stocks that have performed terribly since that date. People point, laugh, say “What a sign of the times” and move on. One of the most visceral examples is the time Brian Feroldi asked Twitter, at the peak of 2021 mania; “What company is worth less than $10 billion today but you think could be worth $500+ billion in a few decades?”. He aggregated the top 20 responses and it is fair to say those picks were dreadful.

Recently another of these lists has circulated, called “Fintwit Darlings”. Comprised primarily of small caps, the author shared the list to voice his contempt for ‘popular’ stocks. The performance of the Fintwit Darlings, however, has been quite strong. While trailing the S&P 500 on a 1Y basis (by 11.6%), the basket would have trumped the S&P 500 by 57% over the last three years.

Inspired by these crowdsourced portfolios of ideas, I want to put the investing acumen of Investment Talk readers to the test. This is going to be a bit like the marshmallow test. We won’t get any benefit from it right now, but I imagine this will be fun to track and comment on over the next few years.

I want you to try your hardest and avoid submitting ideas that are based solely on upside with little consideration for downside risk. Image someone asked you to put your entire net worth into a single stock for five years. You’d be more likely to base this opinion on stocks that will perform well but also have a low chance of taking you out of the game entirely.

To Participate:

Comment below ONE equity you think has the greatest chance of beating the market, or performing amicably, over the next five years.

Please include TICKER and NAME to avoid confusion.

T&C’s

I am going to leave this open for the next week. Once closed, I will aggregate the names and then create a model portfolio to track the performance over time.

The portfolio will be limited to 25 individual names.

Funds or non-equity submissions will not be counted.

Each mention of a ticker will count as 1 vote. Duplicate entries will earn more votes, thus increasing the likelihood they are selected for the top 25.

The portfolio will have an inception date of August 26th, 2024.

The portfolio will be equally weighted at the inception date, with no rebalancing or allocation changes thereafter.

One entry per person, the first entry will be counted.

The portfolio will use USD as the base currency.

Thanks for reading,

Conor

ASML Holding NV

AMS: ASML

Constellation Software (CSU) is a stock to hold and leave for the next generation