GroupStink

One thread that perfectly captures investor sentiment from the summer of 2021

Take yourself back to the summer of 2021. After the fastest retracement of a bear market in modern history, the S&P 500 was sitting ~85% above its 2020 low. The bull market was firmly back. Anything you bought made you feel like a genius. NFTs were taking over. Bitcoin was $40,000. Teenagers were selling courses to adults on how to trade options. The blind were leading the blind. It was a wonderful time. It was the best of times.

Then someone1 asked Twitter; “What company is worth less than $10 billion today but you think could be worth $500+ billion in a few decades?”. The thread originally had more than 710 responses, and the author highlighted the top 20 common responses that have “50x potential”. I noticed this thread doing the rounds recently after someone resurfaced it and wanted to add some context. In what has now become a legendary snapshot of investor sentiment during the summer of 2021, the results are telling. With the exclusion of Ozon, which was delisted from the Nasdaq in 2022 after the Russian war, here are the 19 responses. You might notice the majority of these stocks had gone public within the last couple of years. The following year, 16 of these 202 stocks would go on to fall between 50% and 95%.

These were the stocks that fintwit collectively put forward. If you bought an equally weighted basket of these stocks on July 20th, 2021 (the day of the thread) you would be sitting on a ~75% loss compared to the S&P 500’s modest 11% return.

That works out to a ~44% annualised loss over the period, while the S&P compounded at 4.1%. The “50x" Portfolio” would have suffered a maximum drawdown of 82% vs the S&P’s 25%. It’s not all black and white. I am sure maybe one or two of the names on the list will go on to retrace their losses. There might be a couple of good companies in here. As much as people like to dunk on stocks in a drawdown, it’s still far too early to tell for some of these stocks. That said, it’s obvious why these stocks were chosen when they were chosen.

Idea generation is a pernickety process. Some investors screen, others rely on networks, channel checks, and external research, and some adopt a mosaic of all of the above. I have personally discovered stocks via conversations online, that I would have never otherwise found. I pass on most of them. When wading into the treacherous waters that are the collective groupthink of fintwit, you have to be cautious. What is popular today, is quickly forgotten tomorrow. To avoid getting embroiled in the latest fintwit fancy, here are a few pertinent reminders to help avoid getting sucked into groupthink.

They are as much a reminder to myself as they might be to you.

Avoid threads like these: It goes without saying, but if the majority of fintwit (or whatever group) is touting a stock as the “best” for X, Y, or Z, it is likely riding on the back of prevailing price sentiment. By the time the masses have reached a consensus, it’s usually too late.

Quite often, the opposite is true. When collective sentiment is at all-time lows for a stock, it’s not implicitly a good time to buy, but it might be a more valuable time to study.

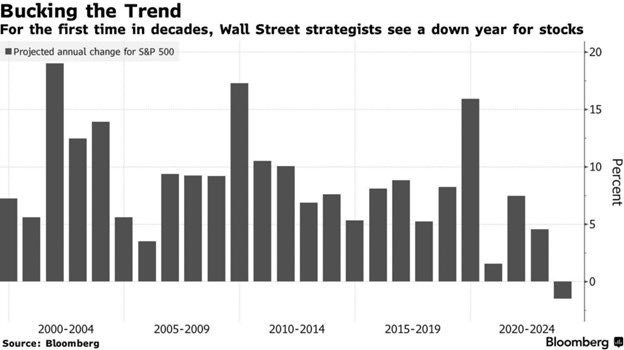

Even the professionals are guilty of this. The below chart is from the beginning of this year; where “For the first time in decades, Wall Street strategists see a down year for stocks”.

A great business trading like a terrible business is preferable to a great business trading like a great business.

Consider who the information is coming from: The thread was largely anonymised, based on popularity, and contained no justifications, analysis, or thoughtful input. If you are going to take ideas from other investors, reserve your time for the opinions of people who understand the stocks they research. Then seek contrary opinions.

During the tail end of bull markets, the blind lead the blind. In what amounts to a flywheel of self-reinforcing sentiment and price action, most investors, retail and professional, get sucked into hysteria. They say you are the average of the people you spend the most time with. Try to avoid hanging around with sheep, becoming a sucker, and think for yourself.

Look around, and take stock of the environment: People like to tell themselves they are rational, unbiased, beings with a long-term time horizon. Even long-term investors need to consider entry price and downside mitigation. As much as outliers like Monster Beverage, Apple, or Amazon might suggest that stocks eventually pay for themselves, the vast majority of stocks will not be so fortunate.

Do things feel crazy? Most people disregard their intuition when things get wet and wild. They are having too much fun. They are sucked into the narrative. They are profiting too much to care. A person could think to themself “This is a bit crazy” while the market gets progressively more crazy. After a while, you might accept the fact that the market is just crazy now and forget about your previous premonitions.

Nobody is saying rotate to 100% cash and sit out of the market for years, but focus your buying activity on times when it no longer feels good to buy.

How much is story vs strength: Every stock has a narrative. To varying degrees, a stock’s performance is reliant on the progression and alignment with that prevailing narrative. But narratives are sometimes wrong and can change at a moment’s notice.

How much of what you need to get paid is based on sensible and realistic assumptions of fundamental performance vs the allure of a compelling story?

Stories are like eyesight. They allow people to envision the past and future. “Virgin Galactic is going to democratise space travel for the everyday consumer by 2050”. It sounds amazing but without substance, it’s just fiction.

Would you ordinarily look at this stock: At times this can be a good thing; other investors can sometimes turn over a rock you might never have got to. Venturing outside of your wheelhouse is not a bad thing either. But if you find yourself feeling compelled to get involved with a new-fangled buzzword company in the insurance space, yet you have no understanding of the insurance industry, ask yourself, why now?

The further you leap from your circle of competency, the more likely you are to be a small fish in a big pond; the more likely you are to ride to the top of Dunning Kruger’s curve and tumble down the other end. At least in the areas you are knowledgeable about, you have a greater sense of what you don’t know.

Do your research, and reach your conclusions: Everyone on this planet talks their book. If you take the advice of another investor without doing the work, when you lose money it’s not their fault, it’s yours. If you lose money after having conducted your own research and making your own conclusions, it’s still your fault, but you hopefully learned something and can improve. Relying on the flitting conviction of others is a recipe for disaster.

I believe most investors are mostly rational, most of the time. The irony is that these same rational investors are prone to becoming irrational at the most inconvenient times. No greater example exists than the brain cell decay of groupthink. This phenomenon isn’t exclusive to bull markets. The same effect that influences people into thinking the music never stops on the way up will have people contemplating the end of the world on the way down. It’s never quite as euphoric or depressing as one imagines.

Investor networks are great. Leveraging the knowledge of others can make you a stronger investor and human being. Just be cautious when wading into open waters.

Stay safe out there.

Thanks for reading,

Conor

The author of the thread was Brian Feroldi, a popular educator and influencer on Twitter and other social channels. I want to make it clear that I am not mocking Brian here. I have had the pleasure of meeting him a few times and he is a great guy. He simply asked a question, aggregated the answers, and provided context. I don’t believe he was implying that his followers should buy these stocks. If anything, this thread demonstrates the sentiment at the time.

Including Ozon, which was later delisted.

being part of the herd all the time certainly doesnt work. but then being a contrarian all the time also doesnt work, which is why this game is so hard. and this quote always stuck with me

“The CROWD is always wrong at market turning points but often times right once a trend sets in. The reason many market fighters go broke is they believe the CROWD is always wrong. There is nothing further from the truth. Unless volatility is extremely low or very high one should think twice before betting against the CROWD. - Shawn Andrew”

Great piece of work Conor - Love the back-testing of the list of stocks from Brian's thread back in 2021 showing how bullish the sentiment was vs what actually occurred. I was personally invested in 2 of the stocks on the list and have exited with losses , thankfully didn't place any big bets and had allocated some 10% of my portfolio to some of these 50x prospects in a bid to silence the FOMO feeling in my stomach without blowing myself up. Still a lot of lessons learned from these small bets.