Companies That are Fixated on Buying Back Stock

20 of the most prolific share cannibals of the last 20 years

A while ago I wrote a piece about share cannibals and where to find them (see here). Since we introduced the ability to screen for share cannibals at Koyfin (the screener I use, if interested) I have been exploring aggressive share repurchasers more often. Evident to me, is the disparity in attitudes towards share repurchases between US and European stocks. When casting a wide geographical net in the screener and searching for the loftiest reduction in share count (as a %), the US companies proliferate the output.

To give one example, if you were looking for North American and European companies1 that have repurchased more than 30% of their sharecount over the last decade, sorted from largest reduction to lowest, you’d have to scroll down to row 23 to find the first non-North American entrant. That would be the UK transport operator, FirstGroup Plc. North America would then dominate again until the next European entrant, in row 80. There is a myriad of factors at play here— including but not limited to differences in regulation, tax efficiency, culture, market structure, and appetite for leverage. Europe has commonly favoured dividend distributions in recent history.

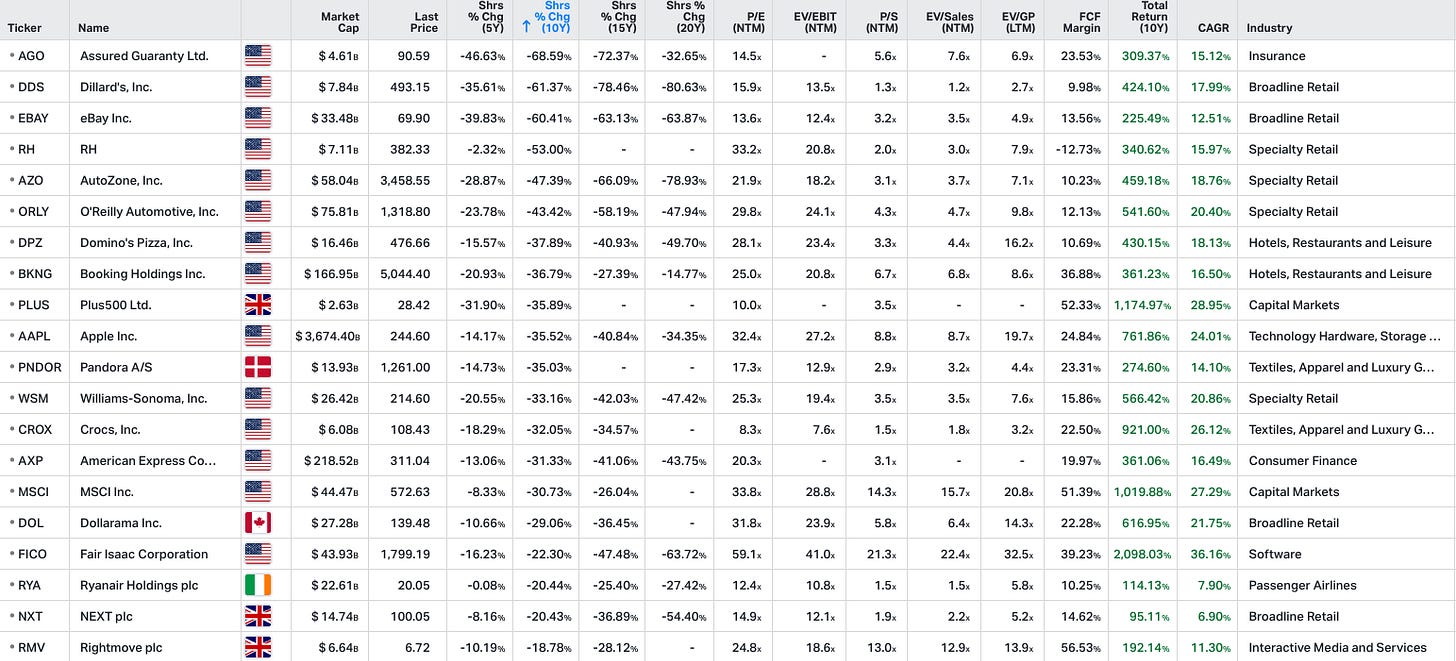

Below is a list of twenty serial share cannibals from the last decade. Most have been consistent buyers over the decade, but I sprinkled in a few alternatives to highlight companies that have more recently picked up their repurchases. Combined, this cherry-picked—confirmation bias cesspit—basket of companies has generated an impressive 23.5% CAGR over the last ten years. Is this useful information? Absolutely not, but it makes for a pretty chart.

There is no science behind the selection. I was primarily interested in exhibiting companies from various industries and countries, to acknowledge that share cannibals can exist in any market.

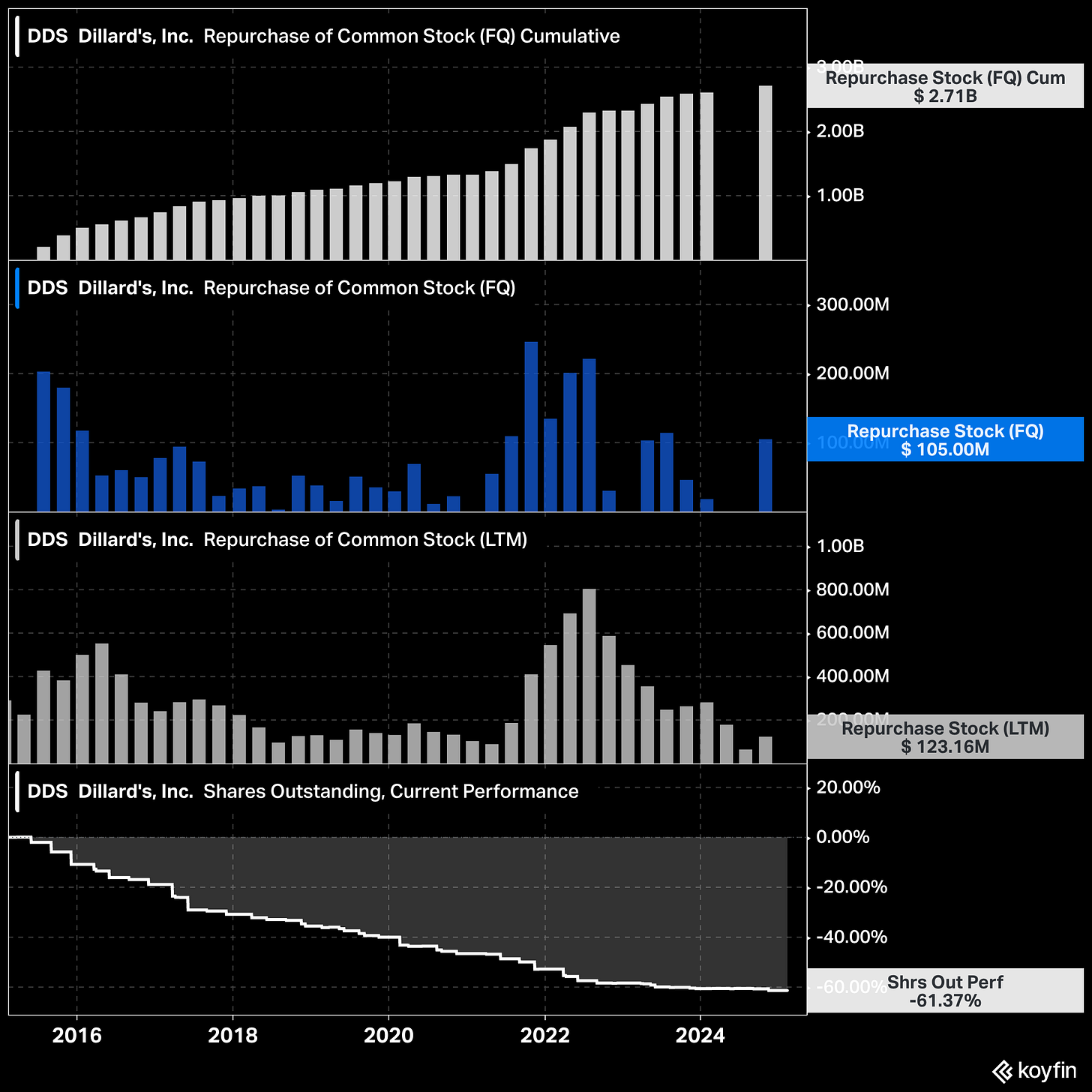

1) Dillard’s (DDS:NYSE)

What it does: A department store chain offering apparel, cosmetics, home furnishings, and accessories through its network of retail locations and e-commerce platform. The company generates revenue through direct sales, private-label credit card partnerships, and real estate investments.

Market cap: $7.8 billion

Distance from ATH: -2.0%

Shares repurchased (%, 10Y): 61.4%

Shares repurchased ($, 10Y): $2.71 billion

Total return (10Y): +424% (18.0% CAGR)

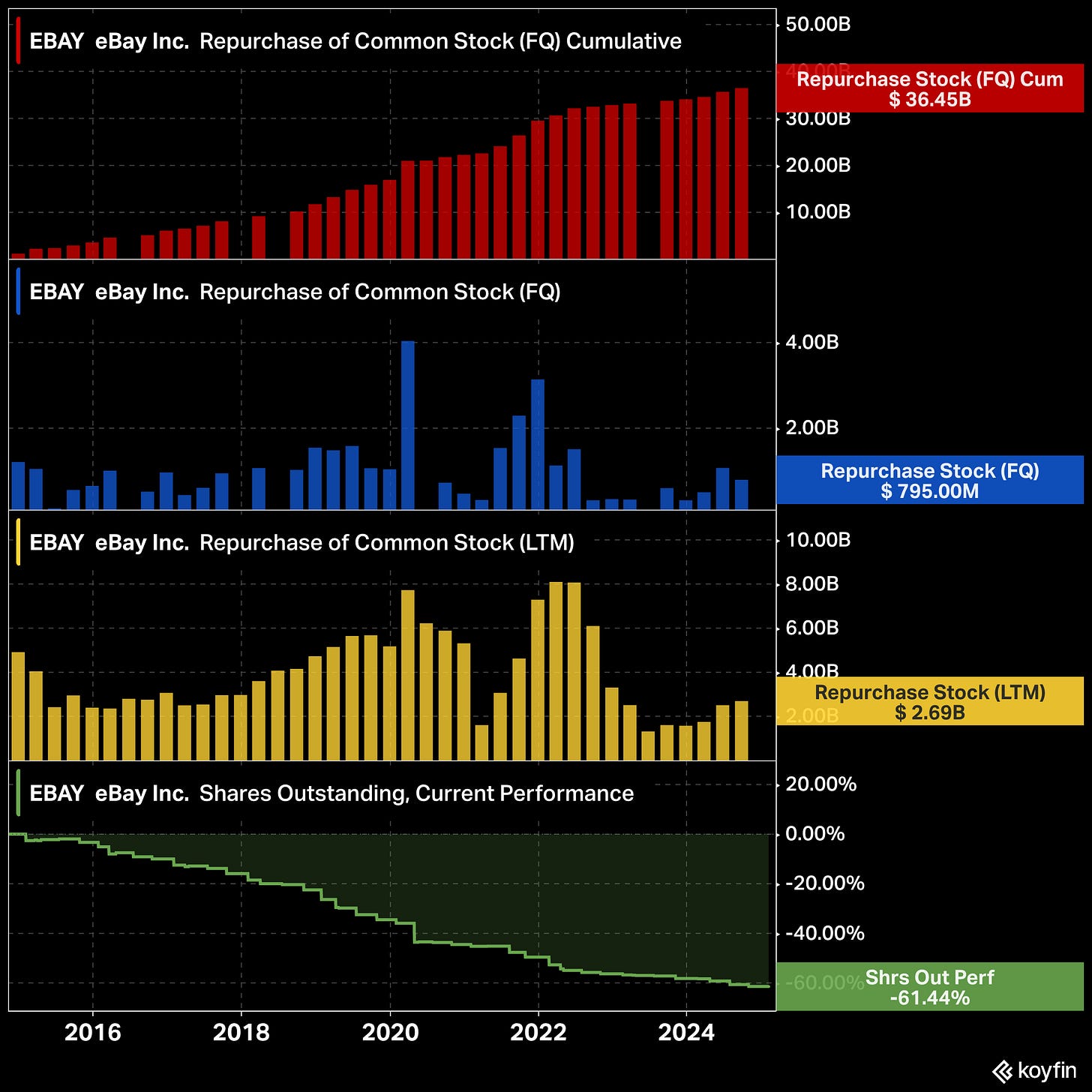

2) eBay (EBAY:NASDAQ)

What it does: An online marketplace that connects buyers and sellers to facilitate the sale of new and used goods across various categories, including electronics, fashion, collectables, and more. The company generates revenue primarily through transaction fees, advertising, and payment processing services.

Market cap: $33.5 billion

Distance from ATH: -13.9%

Shares repurchased (%, 10Y): 61.44%

Shares repurchased ($, 10Y): $36.45 billion

Total return (10Y): +225% (12.5% CAGR)

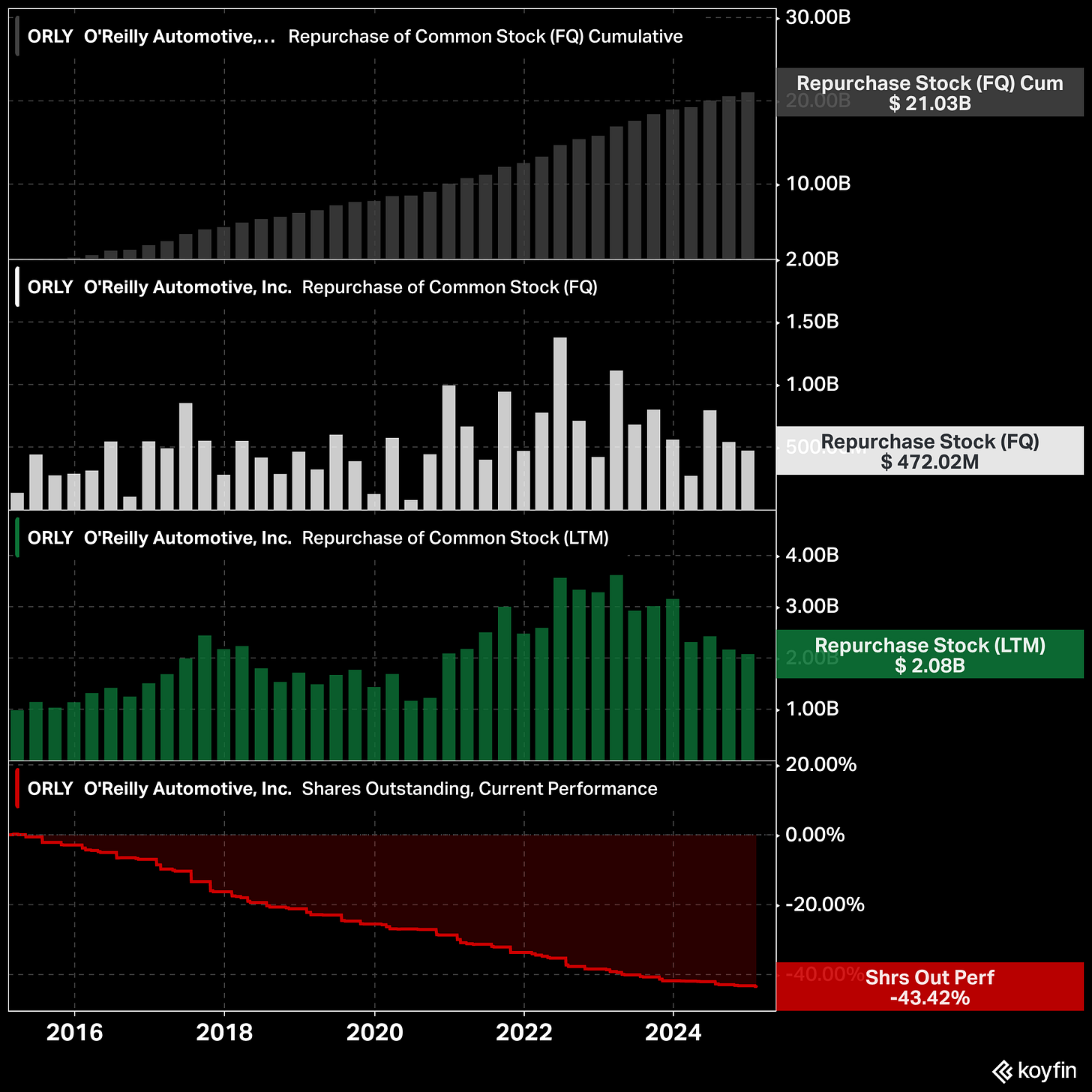

3) O'Reilly Automotive (ORLY:NASDAQ)

What it does: Retailer and distributor of automotive parts, tools, supplies, equipment, and accessories, serving both professional repair shops and do-it-yourself customers. The company generates revenue by selling auto parts and related products through its network of stores and an online platform.

Market cap: $75.8 billion

Distance from ATH: -2.3%

Shares repurchased (%, 10Y): 43.4%

Shares repurchased ($, 10Y): $21.03 billion

Total return (10Y): +542% (20.4% CAGR)

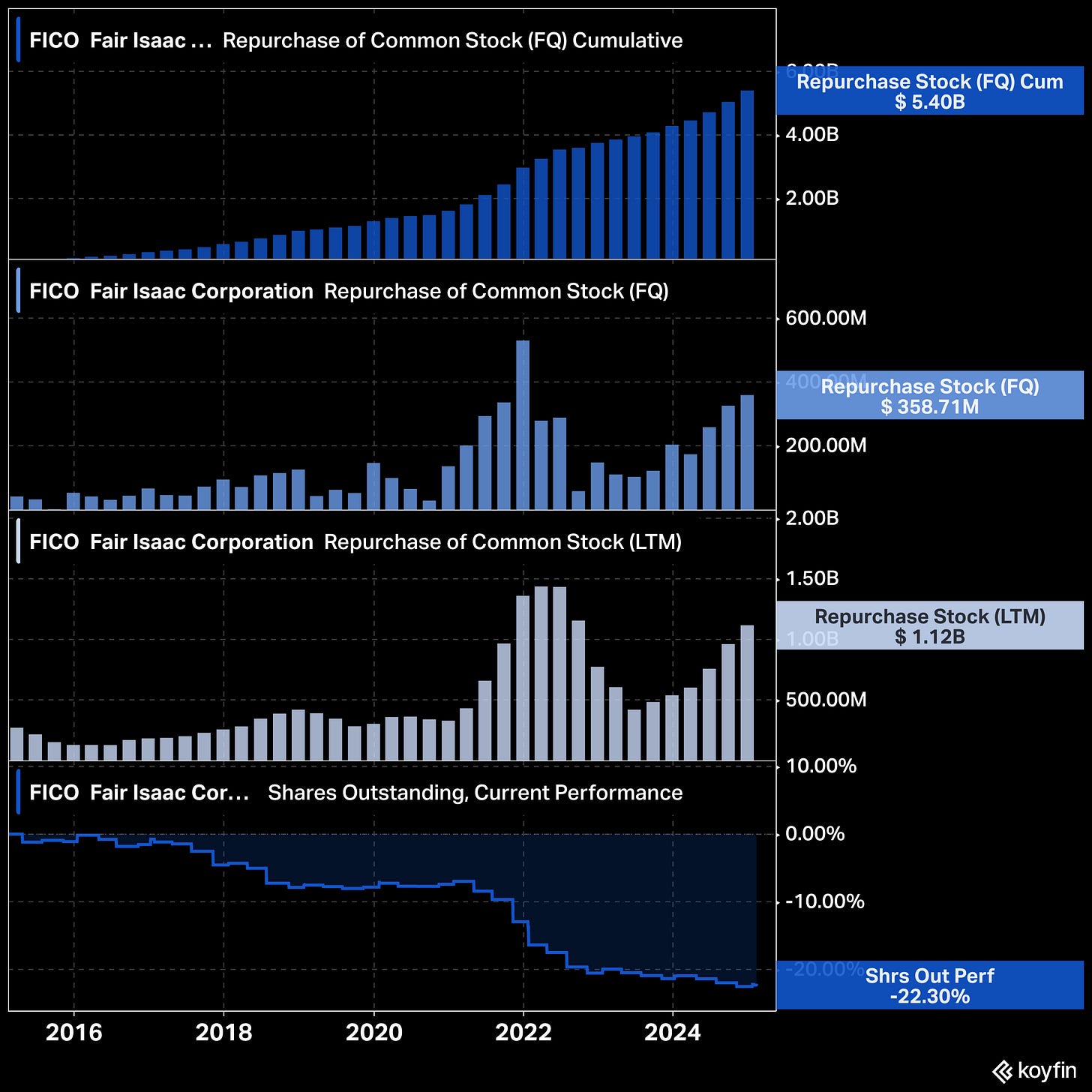

4) Fair Isaac Corporation (FICO:NYSE)

What it does: Commonly known as FICO, provides analytics and decision-making software focused on credit scoring, risk management, and fraud detection for financial institutions, businesses, and governments. The company generates revenue through software sales, cloud-based analytics solutions, and licensing fees for its widely used FICO credit score.

Market cap: $44 billion

Distance from ATH: -25.1%

Shares repurchased (%, 10Y): 22.3%

Shares repurchased ($, 10Y): $5.40 billion

Total return (10Y): +2,098% (36.2% CAGR)

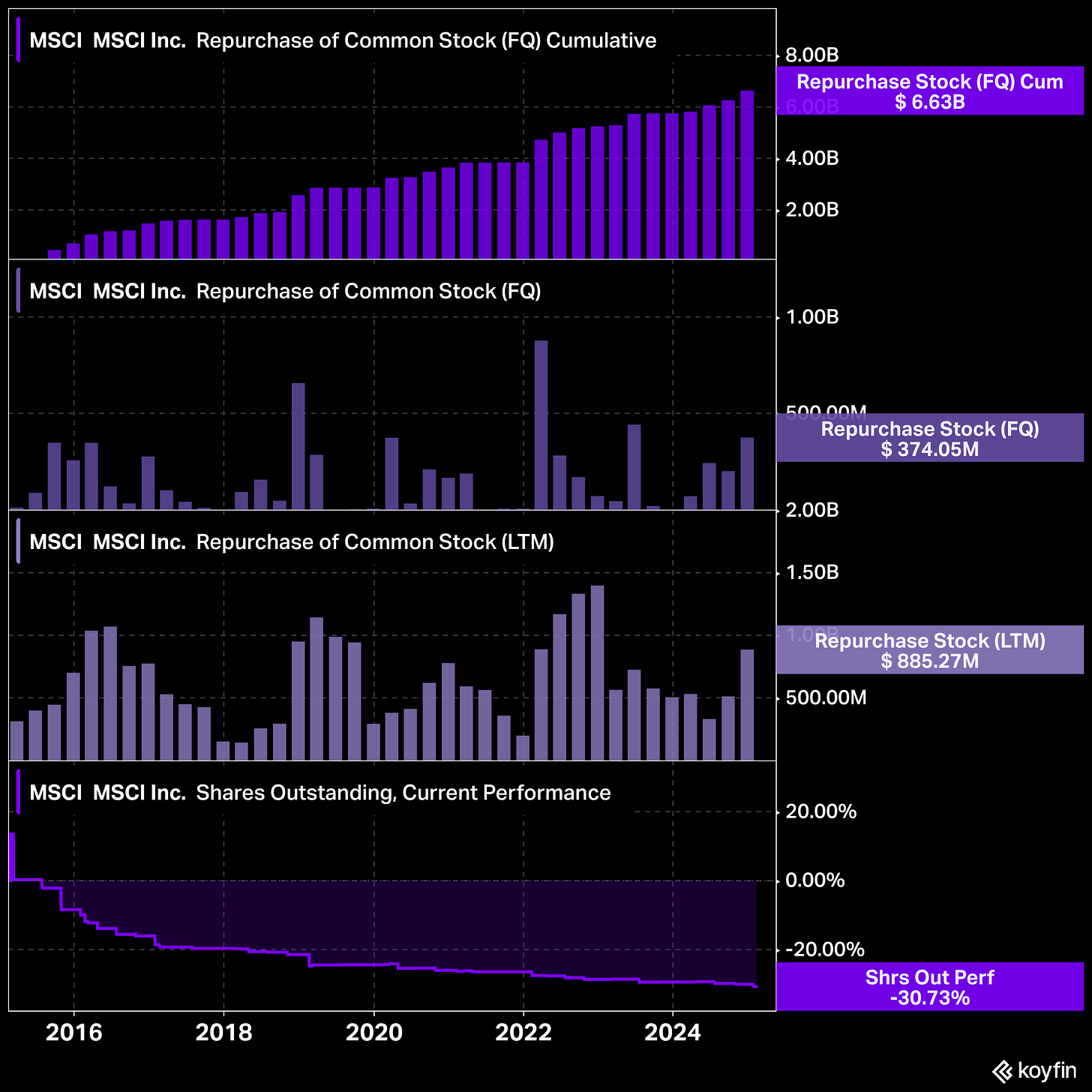

5) MSCI (MSCI:NYSE)

What it does: A global provider of investment decision support tools, including indexes, analytics, and ESG (Environmental, Social, and Governance) research, serving asset managers, banks, and hedge funds. The company generates revenue through index licensing fees, subscription-based analytics services, and ESG and climate data solutions.

Market cap: $44 billion

Distance from ATH: -15.8%

Shares repurchased (%, 10Y): 30.7%

Shares repurchased ($, 10Y): $6.63 billion

Total return (10Y): +1,020% (27.3% CAGR)

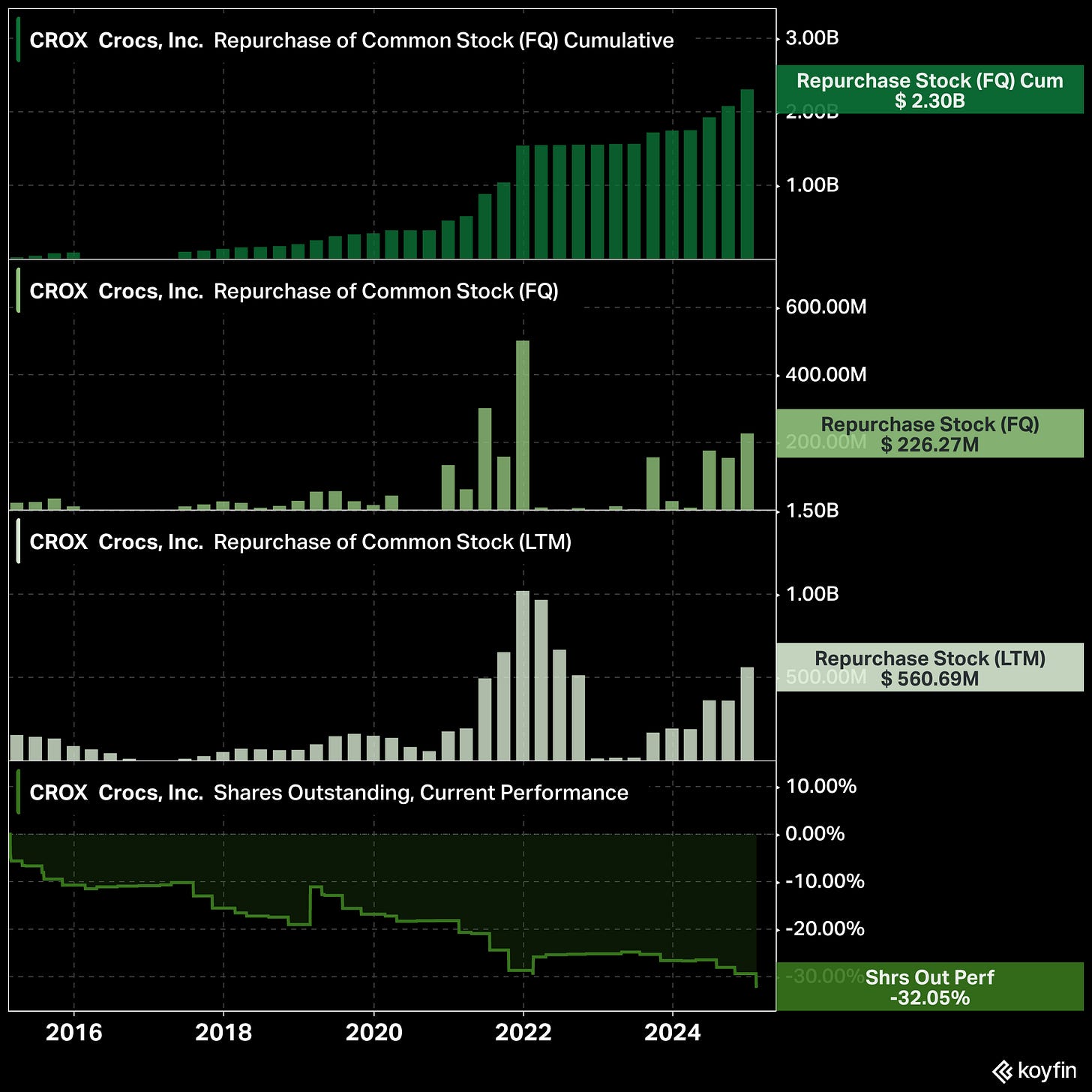

6) Crocs (CROX:NASDAQ)

What it does: A global footwear company known for its casual, comfortable, and foam-based shoes, including its signature clogs. The company generates revenue through direct-to-consumer sales via its website and retail stores, as well as wholesale distribution to third-party retailers worldwide.

Market cap: $6.1 billion

Distance from ATH: -41.0%

Shares repurchased (%, 10Y): 32.1%

Shares repurchased ($, 10Y): $2.30 billion

Total return (10Y): +921% (26.1% CAGR)

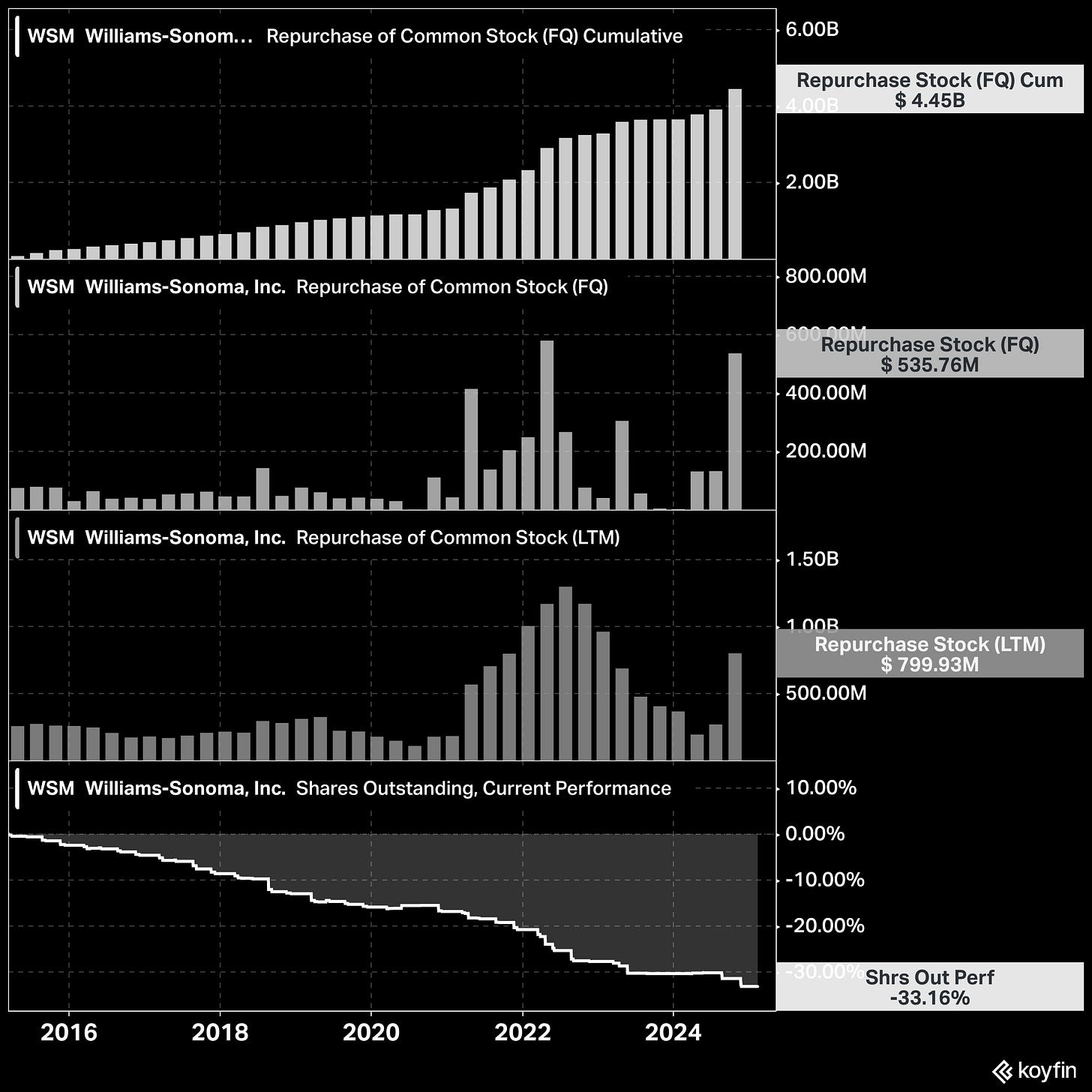

7) Williams-Sonoma (WSM:NYSE)

What it does: A speciality retailer of high-end home goods, including kitchenware, furniture, and décor, operating through brands like Pottery Barn, West Elm, and its namesake Williams-Sonoma. The company generates revenue through direct-to-consumer sales via its e-commerce platform and retail stores, as well as through membership and design consulting services.

Market cap: $26.4 billion

Distance from ATH: -2.4%

Shares repurchased (%, 10Y): 33.2%

Shares repurchased ($, 10Y): $4.45 billion

Total return (10Y): +566% (20.9% CAGR)

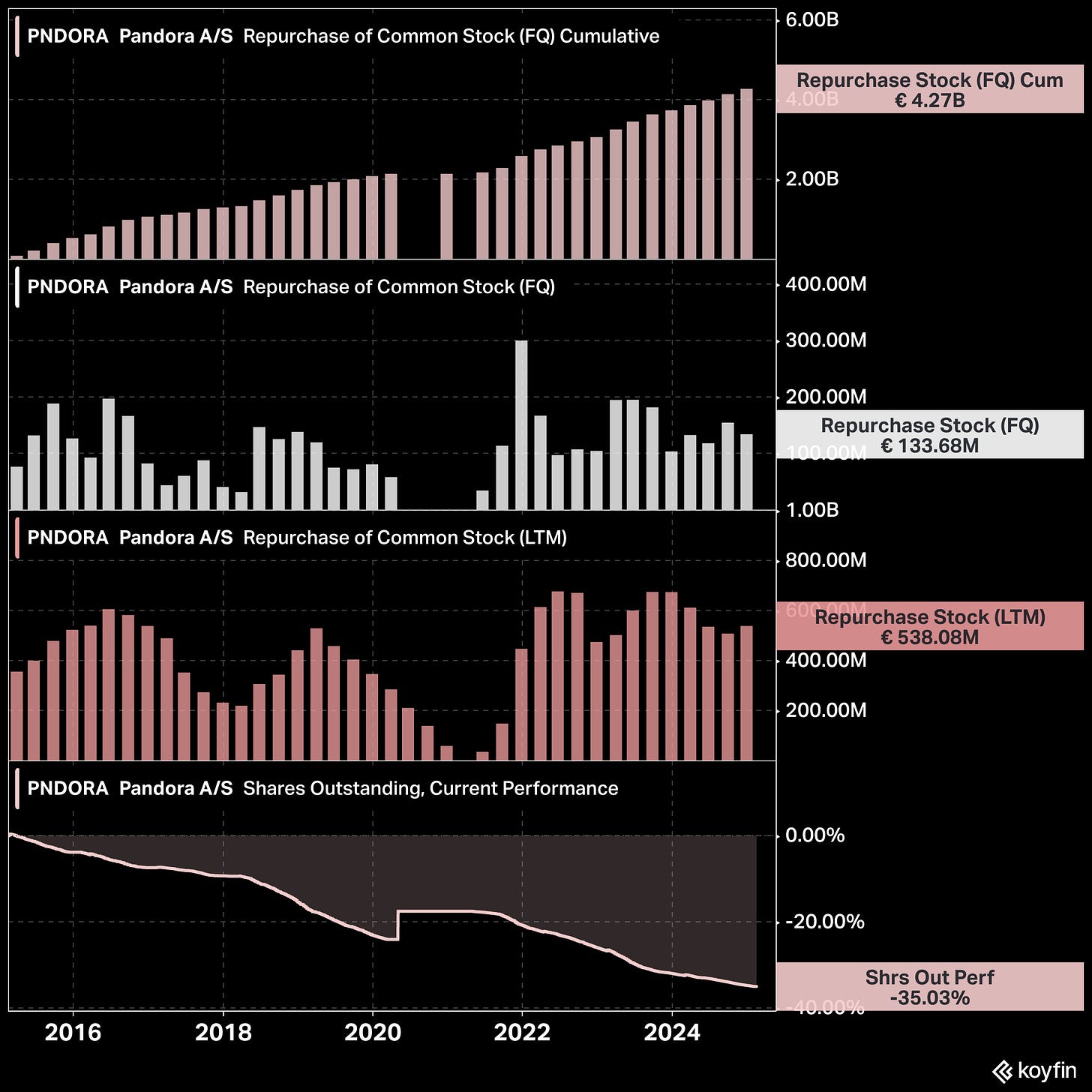

8) Pandora A/S (PNDORA:CPSE)

What it does: A Danish jewellery manufacturer and retailer known for its customizable charm bracelets, rings, necklaces, and earrings. The company generates revenue through direct-to-consumer sales via its global network of branded stores and e-commerce platform, as well as wholesale distribution to third-party retailers.

Market cap: €13.2 billion

Distance from ATH: -2.4%

Shares repurchased (%, 10Y): 10.9%

Shares repurchased ($, 10Y): €4.27 billion

Total return (10Y): +275% (14.1% CAGR)

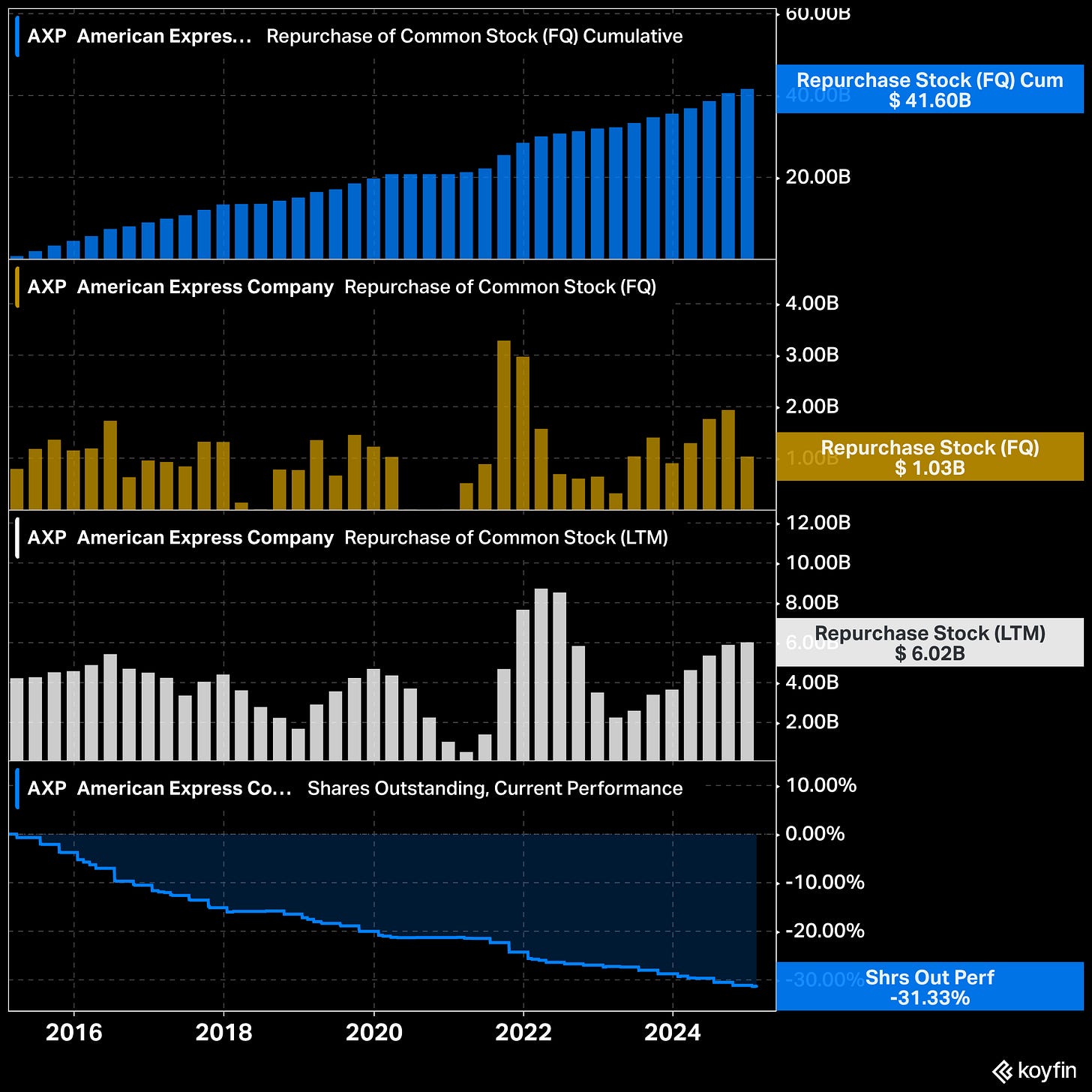

9) American Express (AXP:NYSE)

What it does: A global financial services company specializing in credit cards, payment processing, and travel-related services for consumers and businesses. The company generates revenue through transaction fees charged to merchants, interest on cardholder balances, annual membership fees, and travel and financial services.

Market cap: $219 billion

Distance from ATH: -4.7%

Shares repurchased (%, 10Y): 31.3%

Shares repurchased ($, 10Y): $41.6 billion

Total return (10Y): +361% (16.5% CAGR)

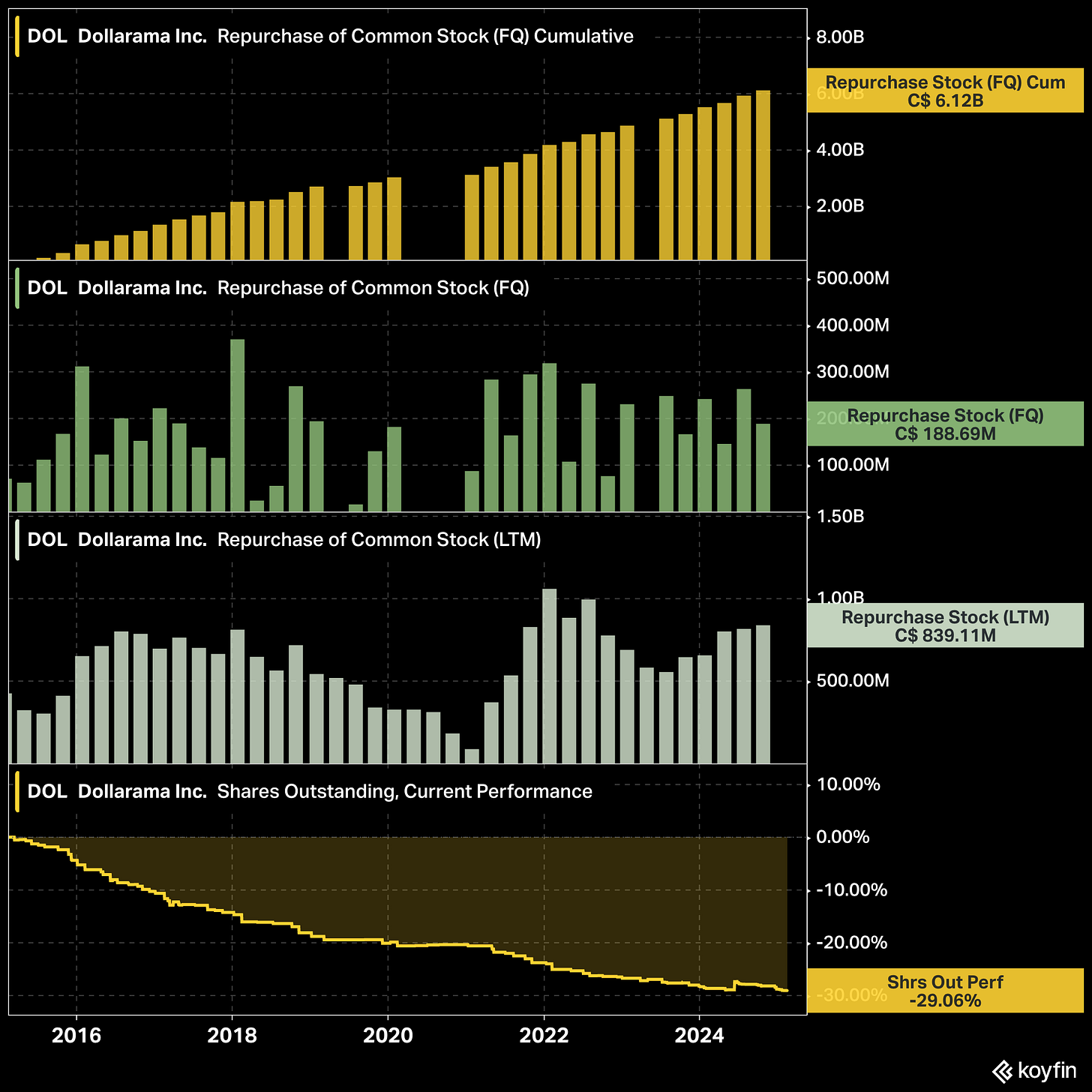

10) Dollarama (DOL:TSX)

What it does: A Canadian discount retailer offering a wide range of low-cost consumer goods, including household essentials, food, and seasonal items. The company generates revenue through direct in-store sales across its extensive retail network and growing e-commerce operations.

Market cap: C$38.7 billion

Distance from ATH: -8.8%

Shares repurchased (%, 10Y): 29.1%

Shares repurchased ($, 10Y): C$6.12 billion

Total return (10Y): +617% (21.8% CAGR)

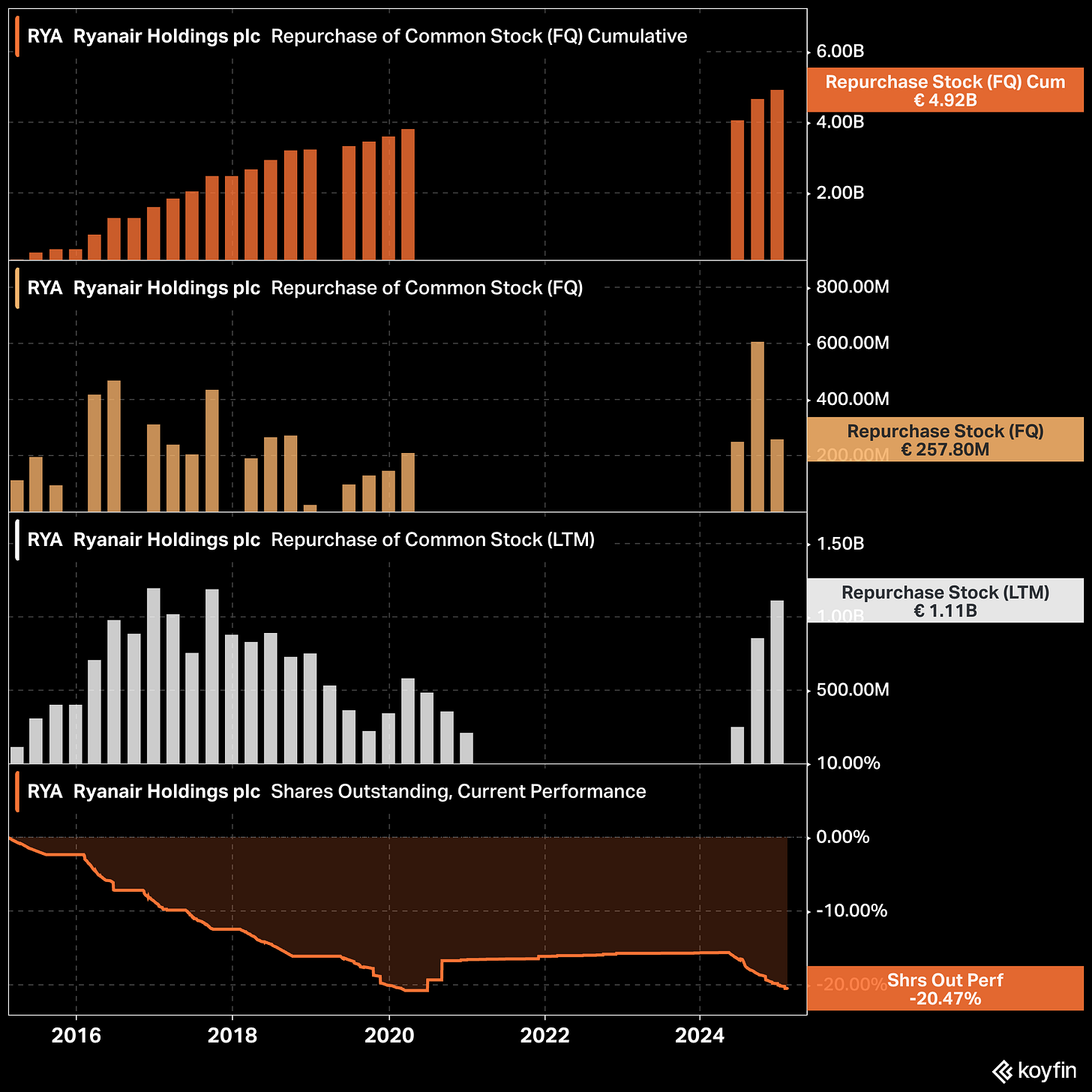

11) Ryanair Holdings (RYA:ISE)

What it does: A low-cost airline operating across Europe, known for its budget-friendly fares and high-flight frequency. The company generates revenue through ticket sales, ancillary services like baggage fees and seat selection, onboard sales, and partnerships with third-party service providers, including hotels and car rentals.

Market cap: €21.6 billion

Distance from ATH: -8.8%

Shares repurchased (%, 10Y): 20.4%

Shares repurchased ($, 10Y): €4.92 billion

Total return (10Y): +114.1% (7.9% CAGR)

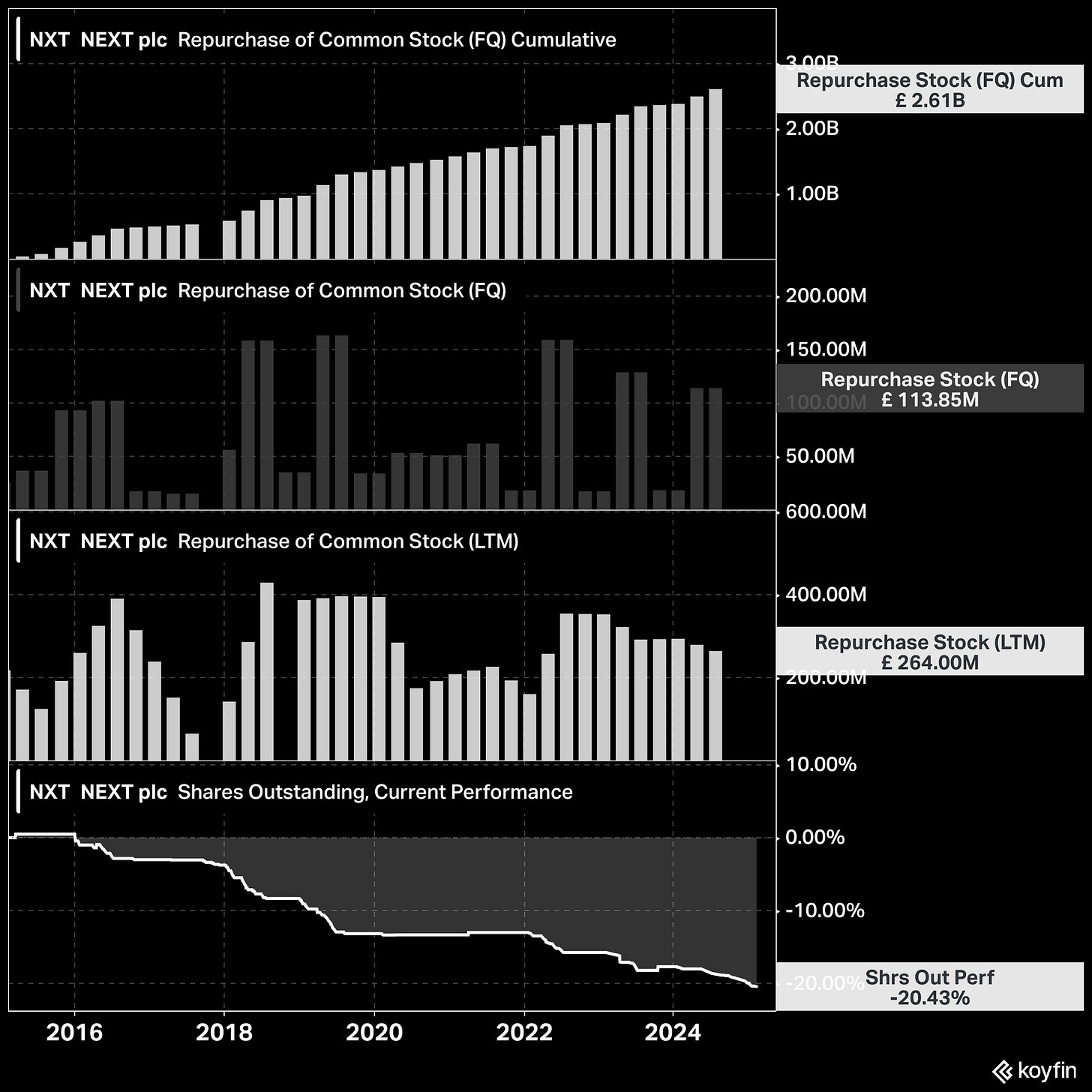

12) Next plc (NXT:LSE)

What it does: UK-based retailer specializing in clothing, footwear, and home products, operating through physical stores, online platforms, and third-party brand partnerships. The company generates revenue from direct sales, online orders, and a consumer credit business that offers financing options to customers.

Market cap: £11.6 billion

Distance from ATH: -9.9%

Shares repurchased (%, 10Y): 20.4%

Shares repurchased ($, 10Y): £2.61 billion

Total return (10Y): +95% (6.9% CAGR)

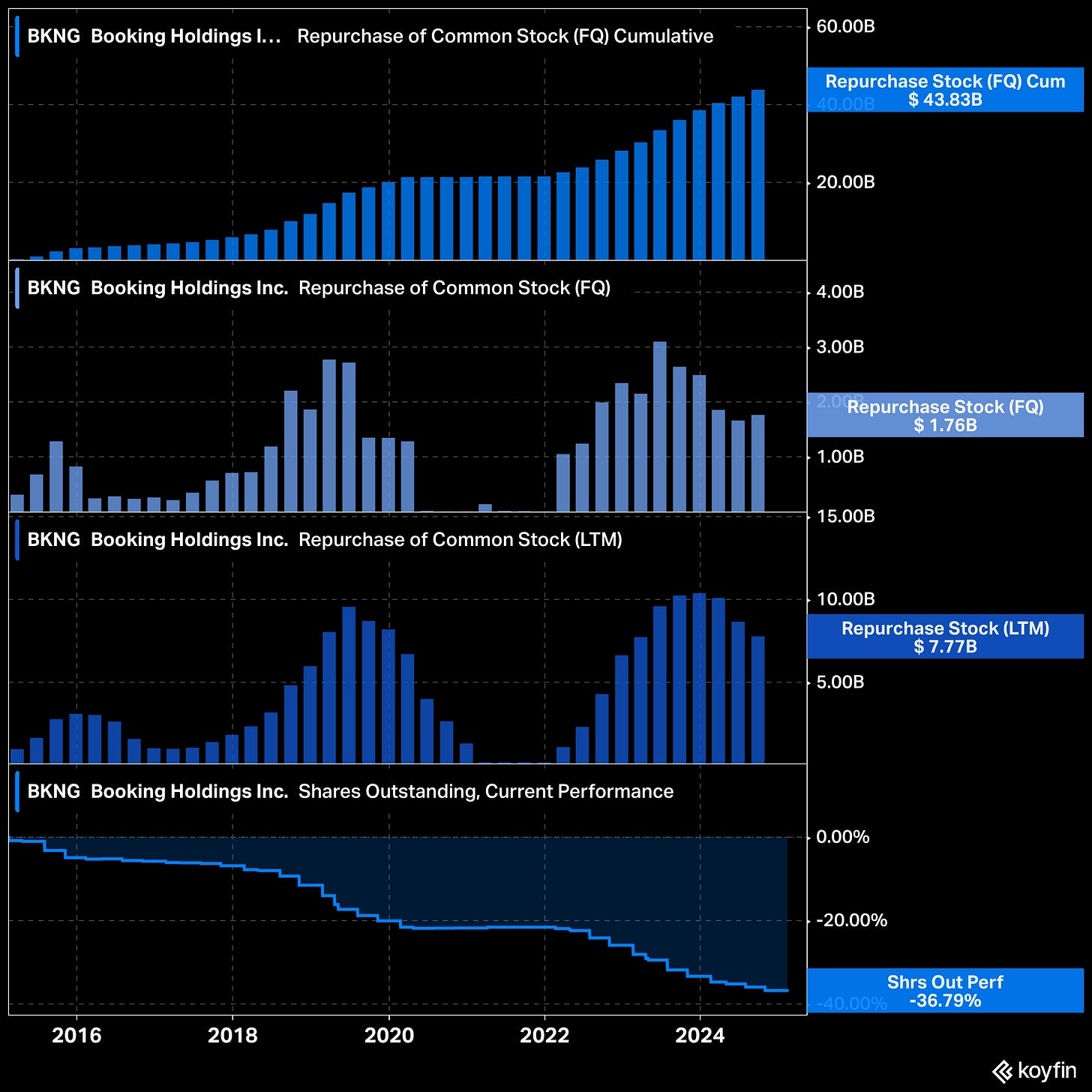

13) Booking Holdings (BKNG:NASDAQ)

What it does: An online travel company that operates platforms like Booking.com, Priceline, Agoda, and Kayak, allowing users to book hotels, flights, rental cars, and vacation packages. The company generates revenue through commission fees on bookings, advertising, and payment processing services.

Market cap: $167 billion

Distance from ATH: -5.5%

Shares repurchased (%, 10Y): 36.8%

Shares repurchased ($, 10Y): $43.83 billion

Total return (10Y): +361% (16.5% CAGR)

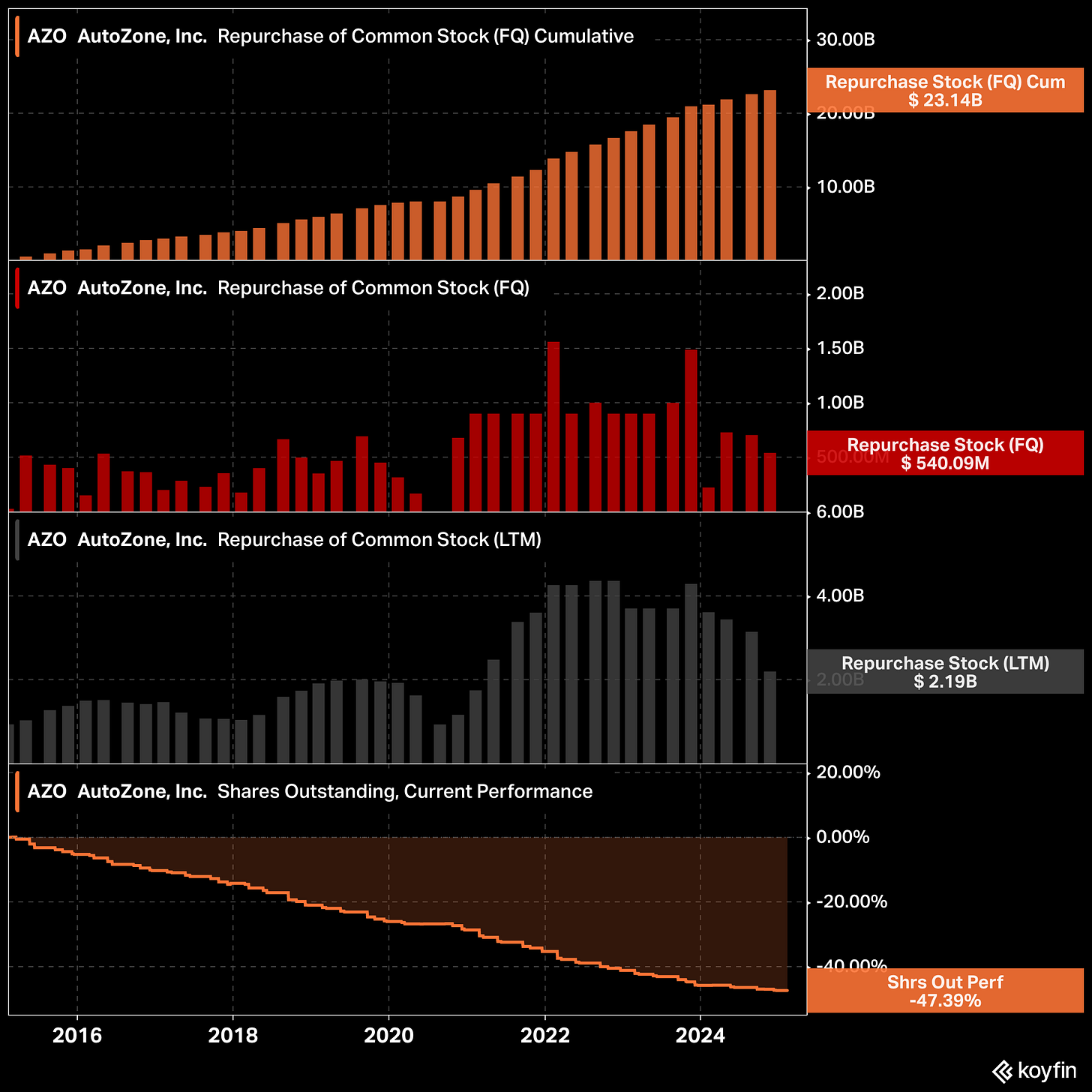

14) Autozone (AZO:NYSE)

What it does: A leading retailer and distributor of automotive replacement parts, accessories, and maintenance products, serving both professional mechanics and do-it-yourself customers. The company generates revenue through direct sales at its retail stores and online platform, as well as from commercial delivery services to repair shops.

Market cap: $58 billion

Distance from ATH: -0.7%

Shares repurchased (%, 10Y): 47.4%

Shares repurchased ($, 10Y): $23.14 billion

Total return (10Y): +459% (18.8% CAGR)

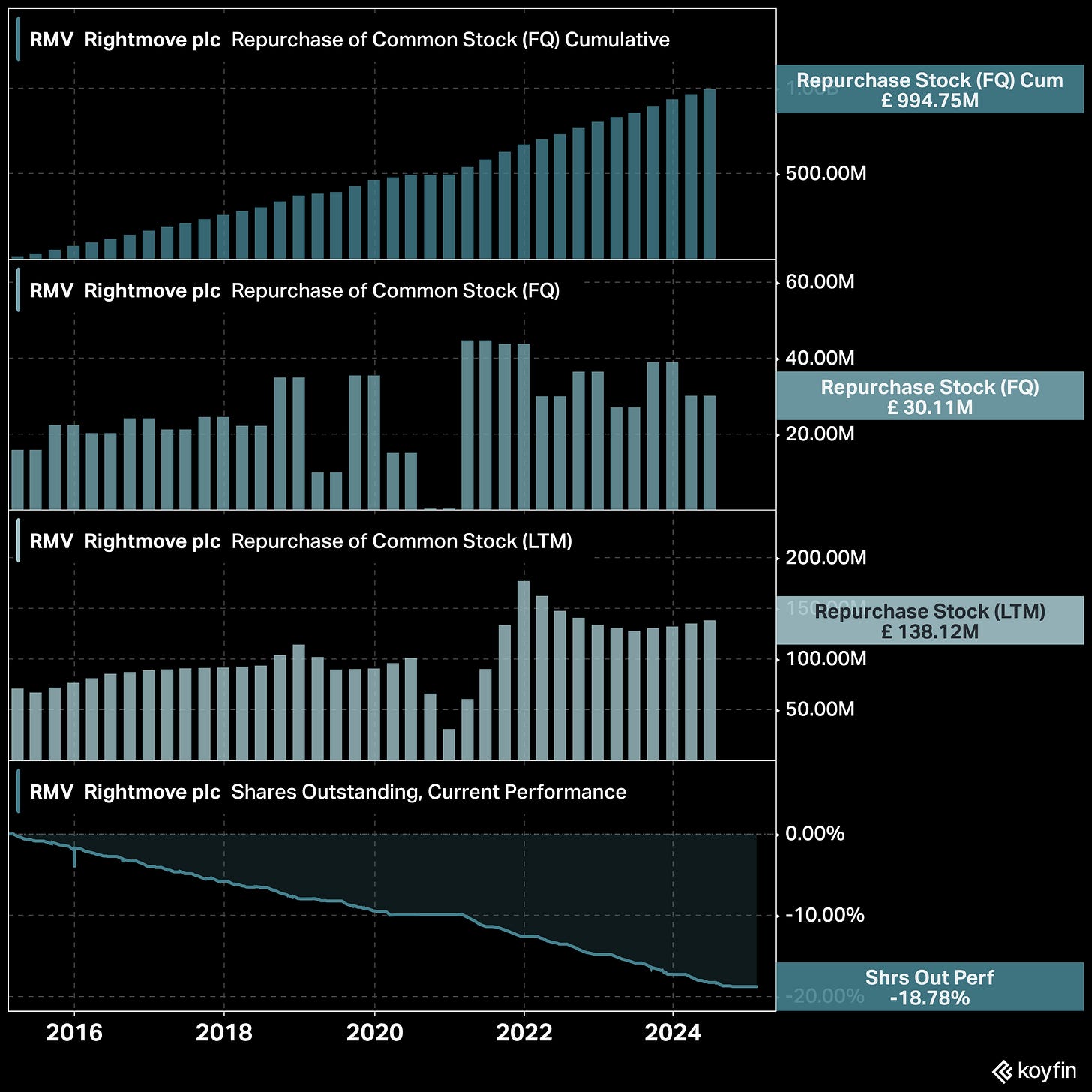

15) Rightmove plc (RMV:LSE)

What it does: The UK’s largest online property portal, connecting homebuyers, renters, and sellers with estate agents, letting agents, and new home developers. The company generates revenue primarily through subscription fees and advertising services paid by property professionals to list properties on its platform.

Market cap: £5.3 billion

Distance from ATH: -17.0%

Shares repurchased (%, 10Y): 18.8%

Shares repurchased ($, 10Y): £995 million

Total return (10Y): +192% (11.3% CAGR)

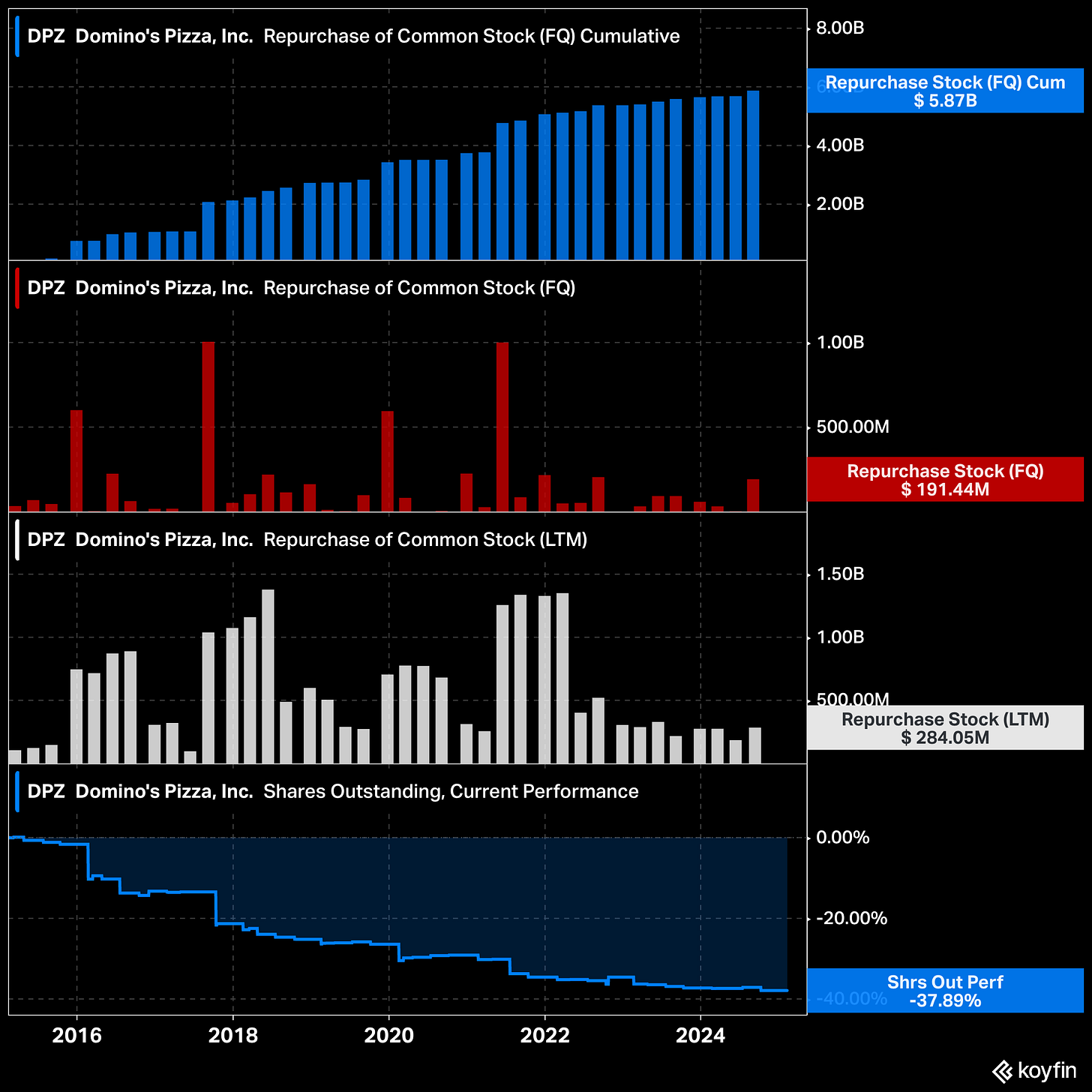

16) Domino’s Pizza (DPZ:NASDAQ)

What it does: A global quick-service restaurant chain specializing in pizza delivery and carryout services, operating through company-owned and franchised locations. The company generates revenue through franchise royalties, sales from company-owned stores, and supply chain operations, including selling ingredients and equipment to franchisees.

Market cap: $16.5 billion

Distance from ATH: -16.0%

Shares repurchased (%, 10Y): 37.9%

Shares repurchased ($, 10Y): $5.87 billion

Total return (10Y): +430% (18.1% CAGR)

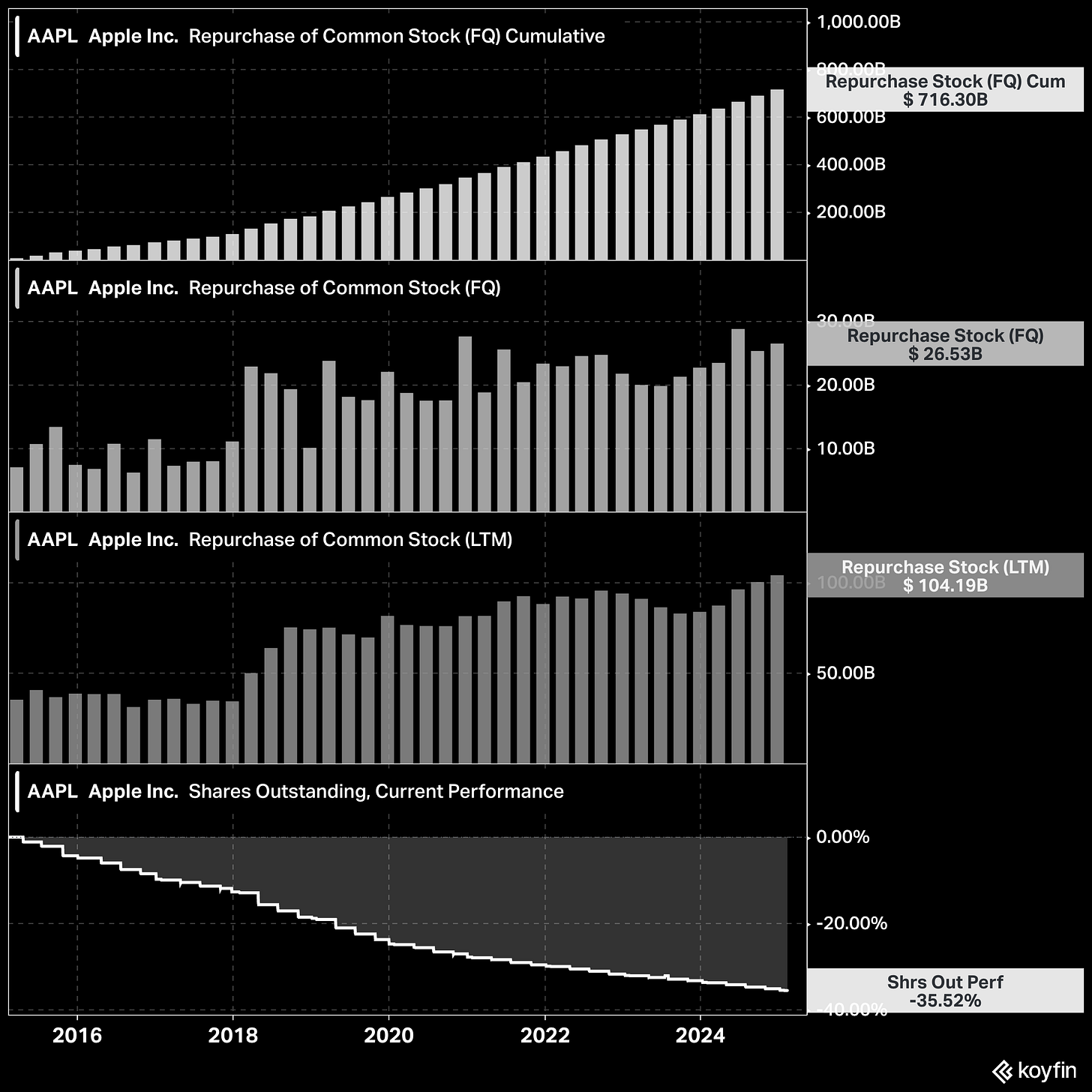

17) Apple (AAPL:NASDAQ)

What it does: A global technology company that designs, manufactures, and sells consumer electronics, software, and digital services, including the iPhone, Mac, iPad, and Apple Watch. The company generates revenue through hardware sales, subscription services like iCloud and Apple Music, App Store commissions, and licensing fees.

Market cap: $3.67 trillion

Distance from ATH: -6.0%

Shares repurchased (%, 10Y): 35.5%

Shares repurchased ($, 10Y): $716.3 billion

Total return (10Y): +762% (24.0% CAGR)

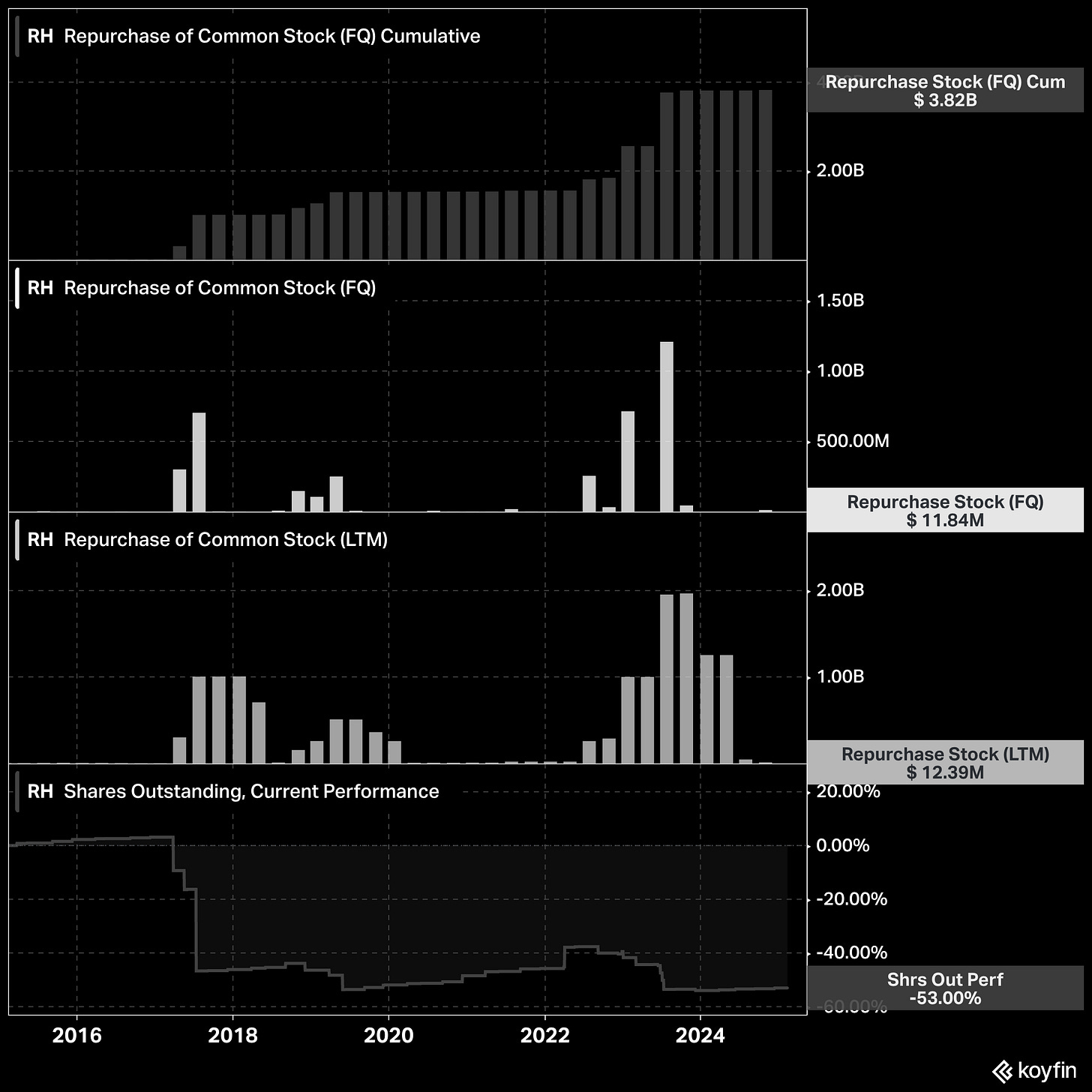

18) Restoration Hardware (RH:NYSE)

What it does: RH, formerly known as Restoration Hardware, is a luxury home furnishings retailer offering high-end furniture, décor, and design services through its showrooms, catalogues, and online platform. The company generates revenue through direct-to-consumer sales, membership subscriptions, and interior design consulting services.

Market cap: $7.1 billion

Distance from ATH: -48.7%

Shares repurchased (%, 10Y): 53.0%

Shares repurchased ($, 10Y): $3.82 billion

Total return (10Y): +341% (16.0% CAGR)

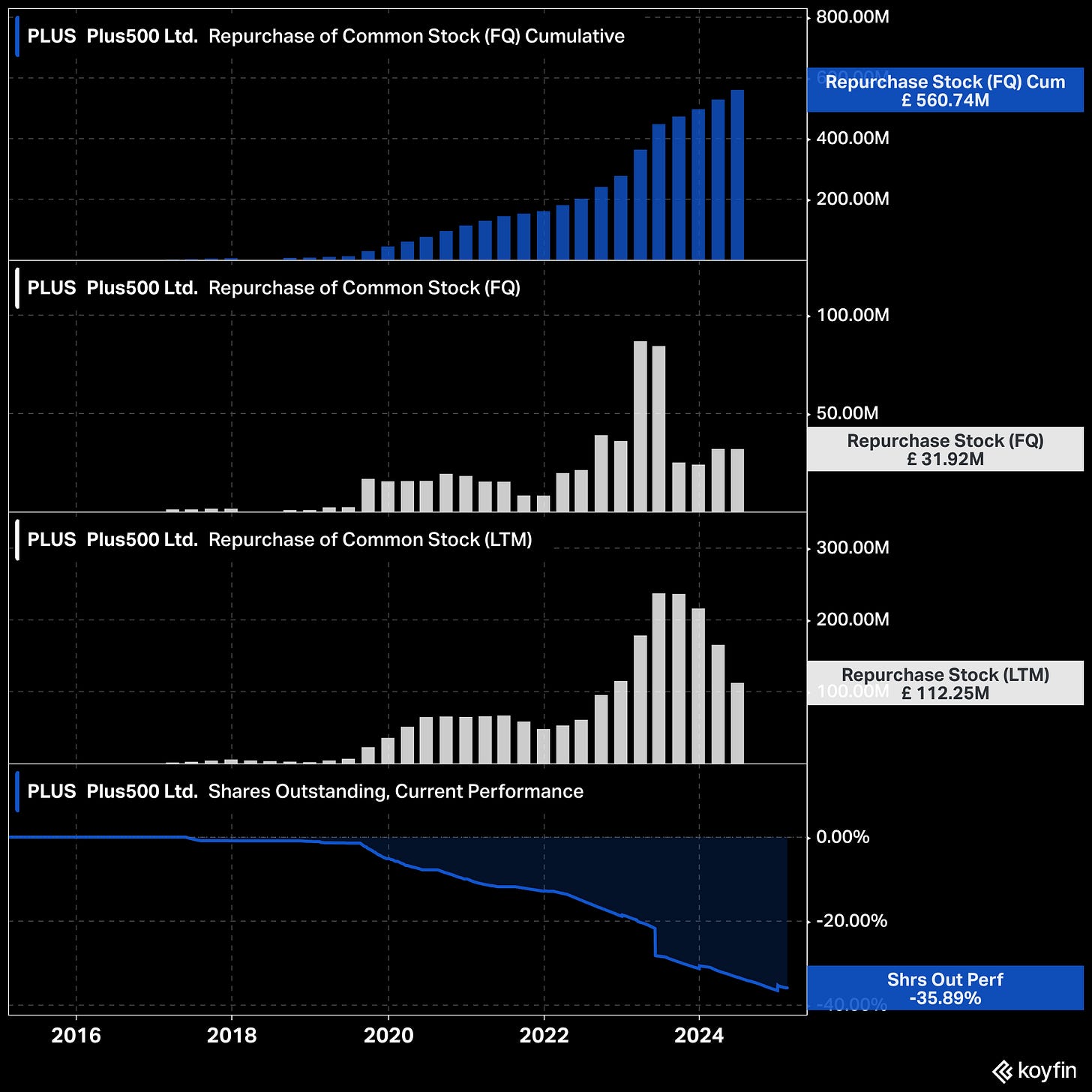

19) Plus500 (PLUS:LSE)

What it does: A fintech company that provides an online trading platform for retail investors to trade contracts for difference (CFDs) on stocks, forex, commodities, and cryptocurrencies. The company generates revenue primarily through trading spreads, overnight fees, and inactivity fees from its users.

Market cap: £2.1 billion

Distance from ATH: -3.1%

Shares repurchased (%, 10Y): 35.9%

Shares repurchased ($, 10Y): £560.74 million

Total return (10Y): +1,175% (29.0% CAGR)

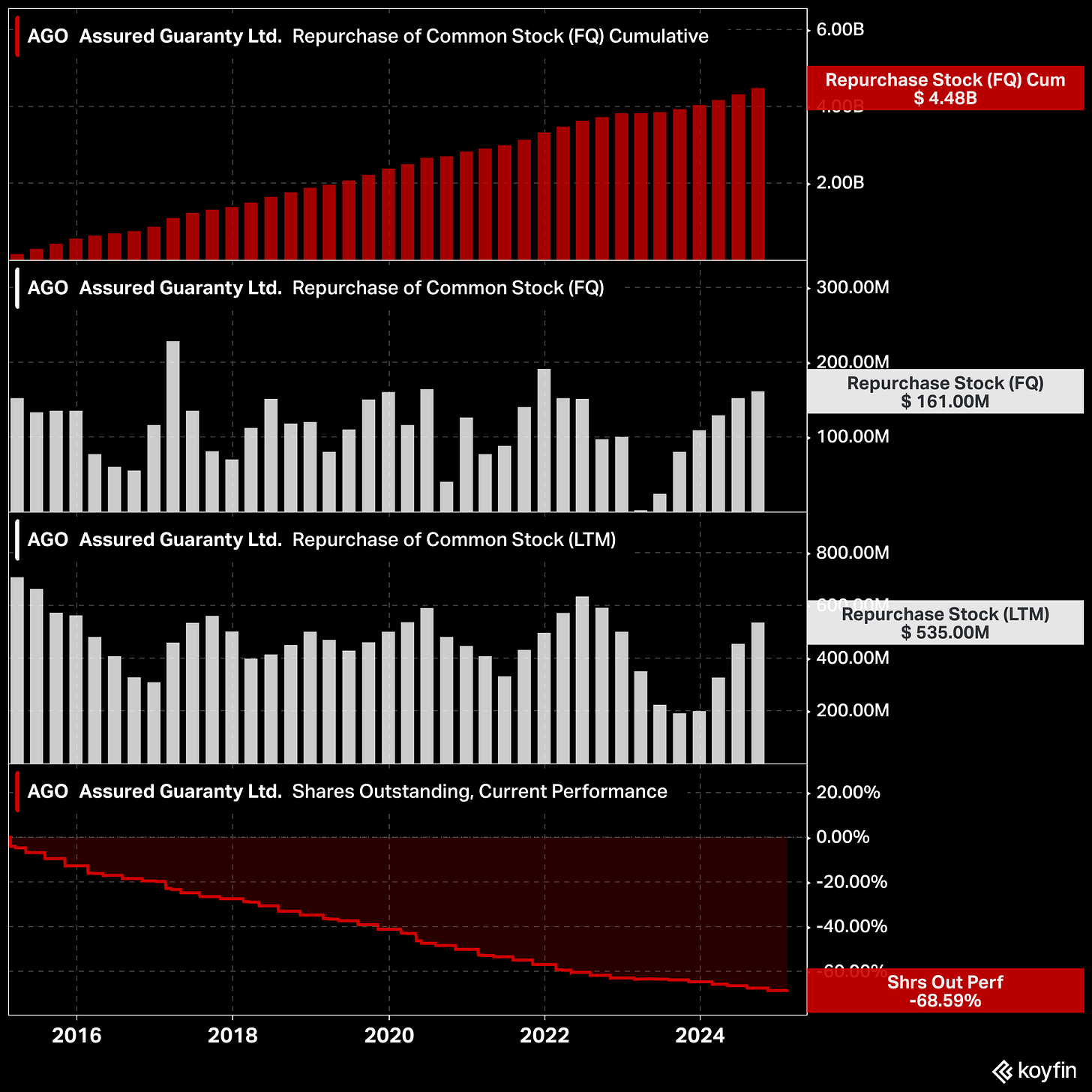

20) Assured Guaranty (AGO:NYSE)

What it does: A financial services company that provides bond insurance and credit enhancement solutions for municipal, infrastructure, and structured finance markets. The company generates revenue through insurance premiums, investment income from its portfolio, and fees for risk management services.

Market cap: $4.6 billion

Distance from ATH: -6.2%

Shares repurchased (%, 10Y): 68.6%

Shares repurchased ($, 10Y): $4.48 billion

Total return (10Y): +309% (15.1% CAGR)

Summary of Stocks Highlighted

Thanks for reading,

Conor

*Companies greater than $1 billion in market cap.

Great list!

thx a lot! looking for some company in this list.