What's On Dimon's Mind?

Ten takeaways from the JP Morgan 2022 shareholder letter

Hey, you are reading Investment Talk. If you’d like to join the 20.5k other readers learning about life, the stock market, and the companies within it, subscribe below. You can check out my other articles and follow me on Twitter too. If you enjoy today’s article, feel free to share it, it helps a lot. Now let’s begin.

What’s on Dimon’s Mind?

Taken a few days ago, does this look like a banker stressed about the collapse of the US economy?

The letters from the CEOs of the companies that make up the world’s financial infrastructure make for interesting reading. Banks, payment rails and credit card companies may be complicated to understand, but the commentary dispersed throughout their shareholder letters and earnings calls provide exquisite insight into the economy, the market, and the health of the nation’s financial plumbing. These rare individuals have a front-row seat on the SS.USA (and other nation-bearing vessels). Who better than Jamie Dimon, the CEO of America’s largest bank, to extract perspective from?

Here are ten takeaways from his most recent1 annual letter.

1. From a virtuous cycle to a vicious one

From a savings glut to scarce capital; Dimon expressed concerns we may be enduring a once-in-a-generation sea change from the virtuous cycle we have enjoyed since the GFC to the vicious cycle that looms ahead. He notes this is further complicated by the tensions of war; which are leading to “the rethinking of many economic alliances, as well as trade and national security”.

2. Preparing for economic extremes

The current environment is removed from the typical economic oscillation that JP Morgan tends to ignore. The economic extremes we have faced of late may not be over. While the economy has proven to be resilient, “managing risks is far more than simply meeting the Fed’s annual stress test”.

3. This time may be different

He actually said those four magic words. Well, he actually expressed it in seven; “it may not be true this time”. By ‘it’ he is referring to the inverted yield curve, an eight for eight2 recession indicator, telling us we are due a recession. He claims it's possible this inversion is driven by prior quantitative easing.

He continues to express that the Fed may be forced to increase rates higher than people expect, despite the banking crisis, if inflation persists. “Also, QT may have ongoing impacts that might, over time, be another force, pushing longer-term rates higher than currently envisioned. This may occur even if we have a mild, or not-so-mild, recession, as we saw in the 1970s and 1980s”.

4. Borrowing to consume

Here Dimon explains how borrowing to consume is, by nature, inflationary. The gradual erosion of excess savings may be a source of reprieve, in terms of inflationary spending, but the other edge of this sword is that it will enhance any recessionary pressures that may be ahead.

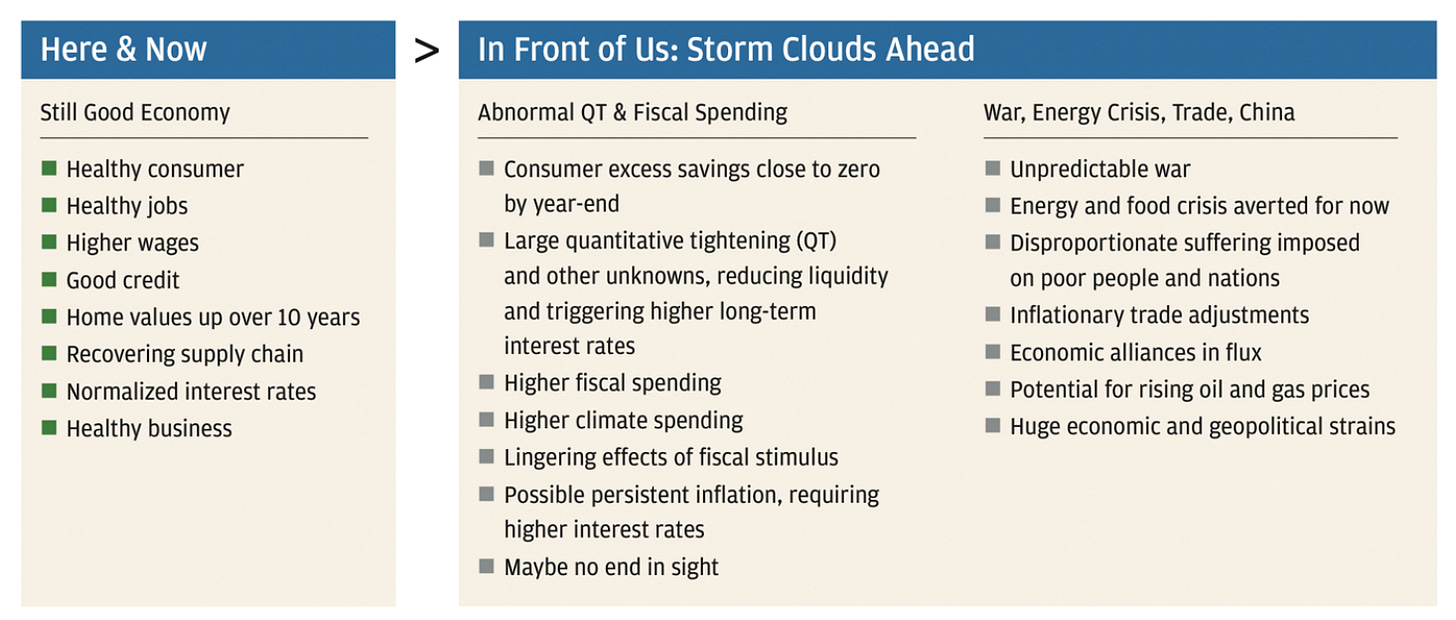

5. This is not 2008

The collapse of SVB and Credit Suisse significantly altered the market’s expectations. Prior to this, the market was performing “adequately”. As consumer balance sheets appear robust, and unemployment (which recently fell 10bps to 3.5%) remains low, the consumer is in a better place to weather a crisis than they were in 2008.

While the current crisis exposed weaknesses in the system, “it should not be considered, as I pointed out, anything like what we experienced in 2008”. The “unique and complication issues” that the US faces today, as Dimon believes, can be found in the below table.