What if God was a hedge fund manager?

Why investors would still lose money in a perfect portfolio: A lesson in myopic loss aversion

Hey, you are reading Investment Talk. If you enjoy today’s article, feel free to share it, or become a supporter, it helps a lot. Now let’s begin.

The Perfect Portfolio

Bill Miller1 once asked himself; “What if God himself was an investor?”. Whether you believe in a higher power or not, the idea is that God is blessed with divine omniscience; he knows everything that is and everything that will be. With precision foresight and a long-term outlook, it reasons that he would be a pretty solid stock picker. Of course, Miller was referring to an earlier paper2 authored by Alpha Architect; where they put this idea to the test. They wanted to know if God would be so good; that he avoided being fired or losing faith with investors because of sour performance. Seeing as how God would know which stocks were going to perform the best, he would simply buy only those which would become top-decile performers over the next five years; rebalancing at the end of each period3.

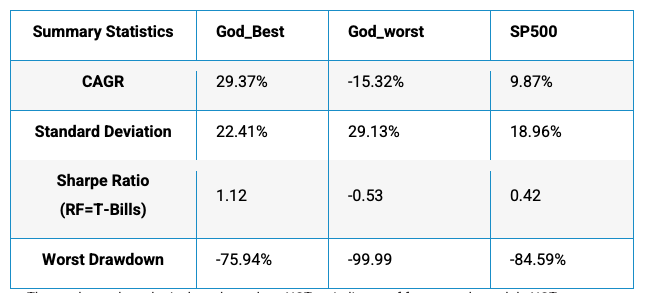

Unsurprisingly, he crushed it. Between 1926 and 2016, the God portfolio would have returned an annualised 29.4% vs the S&P 500’s 9.9%. But there was something surprising in the data; God struggled to eliminate large drawdowns. In most years, the drawdowns would be just as large as those in the S&P 500, and in some cases considerably worse. For instance, in 2000/01, his strategy would return -34% vs the market's -21.5%, for a hefty 13.5% of underperformance.

This prompted the study to take an alternate direction. What if God was blessed with the ability to use instruments to manage volatility? If God was a hedge fund manager, he could pick the winners but also short the losers. The study was repeated; this time allowing God to buy the top-decile performers and short the bottom-decline performers. His performance got an upgrade; now generating annualised returns of 46.2% (vs 28.9%) against the S&P 500’s 9.9%. But despite the lessened severity in drawdowns, they were still present.

While a max drawdown of 47% is more palatable than 76% (his max drawdown before being allowed to hedge), it’s significant enough to reason that God would have faced backlash from his investors. Although being a hedge fund manager isn’t quite the same as working a desk job; in keeping with the author’s mythical theme, it’s reasonable to assert that God could have ended up being “fired"' at some point. At the very least, investors would have pulled their money.

“Clearly, a substantial portion of his investors would have declared him senile and fired him at the end of that stretch, which would have resulted in realized losses and a huge amount of foregone outperformance”.

Bill Miller

Looking at the 1Y relative CAGR over time between the God portfolio and the S&P 500, he may well have been fired several times over. This is despite God’s long/short portfolio being the perfect portfolio.

Investors who pulled their money from God’s fund and reinvested it with a mortal money manager would have missed out on spectacular gains. But why? The lack of foresight is one thing; naturally. But the more likely explanation is myopic loss aversion.

Why investors would still lose money in a perfect portfolio

Myopic loss aversion is when investors 'feel' or 'fear' losses twice as much as the high they get from gains, or react too negatively to recent losses, which may be at the expense of long-term benefits.

“Loss is painful, on average twice as painful as gain is pleasurable in matters financial. That is, people on average need about a 2 to 1 payoff on an even-odds bet gains over time, which is why casinos make so much money. People get more bullish as prices go up, and more bearish as they go down. They overweight recent trends relative to their long-term significance, and their emotions give greater weight to events the more dramatic they are, often out of all proportion to the probability of their occurrence. All of these features of how our beliefs affect our behavior are actionable if they are systematically incorporated into an investment process”.

Bill Miller

This is why investors feel compelled to sell on the way down instead of on the way up. It’s why dreams are given up after a short setback and why struggling students drop out instead of seeking help. The view of the forest is obscured by that of the tree. At this tipping point, giving in to loss aversion is like pushing against an open door. We are hardwired to think this way; something which Daniel Kahneman, et al, studied4 back in the 1990s. Kahneman and his associates asked two groups of faculty members at UCLA how they wanted to invest their 401(k) retirement funds; framing the study differently to each group. The investors would choose between a riskier, more volatile fund with higher expected returns and a safer, less volatile fund with lower expected returns. The more volatile higher-return fund used a return distribution based on an index of large US stocks, while the lower-return fund used a return distribution based on a portfolio of five-year government bonds. The investors would not be aware of this, however, so as to remove any prone bias.

One group would be shown a chart of the distribution of 1Y returns for each fund, while the other group were shown a chart of average annualised return rates over 30 years. Unsurprisingly, investors who were provided with data illustrating the distribution of individual-year performance perceived the high-risk, high-return, portfolio (consisting of large US stocks) as more risky. With the worst returning years presented alongside the best performing years, the possibility of losing money in the short term was visceral. The bond fund had lower drawdowns and seemed like the best shot at not losing money. Only 40% of the investors in this group chose this fund for their retirement.

In contrast, investors who were shown the average annual returns over the same period allocated 90% of their retirements to the high-risk, high-return, portfolio. While they may not have been ignorant of the fact losses were incurred over the timeframe, they were not reminded of the fact in the way the data was presented. The way it was framed to this group was that in the long run, the performance averaged out to be vastly superior to that of the low-risk, low-return, portfolio. This reminds me of something Clifford Asness shared5 about running money for the long term. He explains that one must embrace risk; as being truly long-term is “an advantage for investors because it allows you to bear more near-term risk than those with shorter horizons”. He continues to assert that “setting up your portfolio to withstand substantial volatility without changing course is the leading determinant of long-term success". Of course, the caveat is that in order to embrace risk, one must be mentally prepared to brace for the short term; a feat easier said than done. Clifford’s assertion is in direct contrast with our inclination to sweat the near term at the expense of the long term.

The substance of both of these tales; the God portfolio and the myopic loss aversion study, is that when presented with granularity on near term performance, investors are more likely to make decisions that detract from the benefits of having a long-term orientation. As Miller puts it: “Investors should put a much stronger emphasis on long-term performance and process than on recent returns when making decisions”.

Thanks for reading,

Conor

Miller Value Partners (2016), No Pain No Gain, Underperformance as a Prerequisite for Outperforming Over the Long Term (here).

From the paper: “To summarize, we are creating portfolios that are explicitly engaging in look-ahead bias. Clearly, these portfolios do not reflect anything even remotely possible in practice. The concept of this research is to capture results associated with a long-term investor (we assume a 5-year holding period) that has incredible stock-picking skill”.

Interesting idea for an article! :D

I've been saying for a while now but drawdown control is important and it pays to think about how to reduce drawdowns to maximise your risk-adjusted returns.

Great article, but probably isn't so much applicable to a middle age young retiree with a modest portfolio where short term tends to more of a factor than long term goals.