Starbucks

Weighting as of writing: 5%

10th May 2024 - Q2 FY24 Results

On the 30th of April, Starbucks presented results for the second quarter of FY24. While Starbucks shows growth on a 6-month YoY basis, Q2 was a continuation of the troubling trends from last quarter in what the company call a “complex operating environment”. A broad decline in same-store sales comps and transactions across the board, offset only by a +4% comp in North American ticket, has led many to speculate that Starbucks pushed the envelope too far with price inflation in years prior. Voting with their wallets, consumers have lost their appetite for the world’s largest coffee chain. Matters were made worse when Laxman Narasimhan, Starbucks’ CEO, received harsh criticism from Jim Cramer on CNBC. The bumbling, corporate-sounding, and vague rebuttals to Cramer’s legitimate questions did not paint Howard Schultz’s appointed successor in a good light.

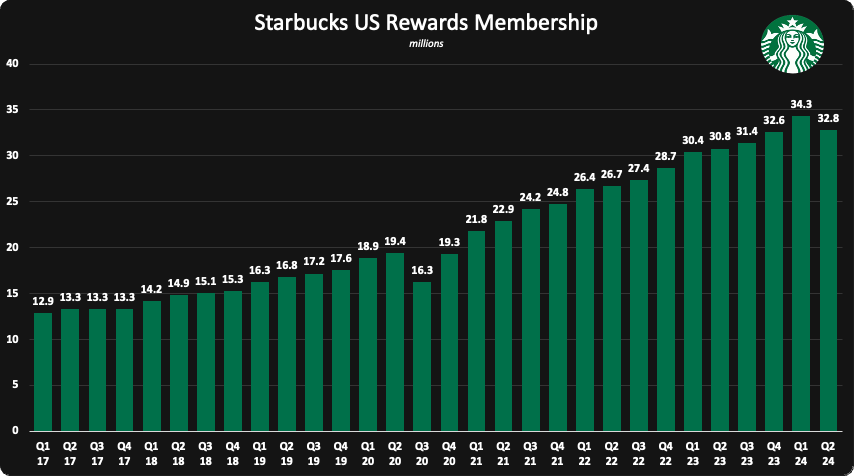

At home, Starbucks Rewards members declined sequentially. In China, where recovery has yet to take off in a meaningful way, aggressive discounting behaviour from competitors is showing up in Starbucks’ anaemic revenue growth in the region despite rapid store growth. Guidance for FY24 EPS took a sizeable haircut. Starbucks is facing immense challenges from every corner, and the share price, now ~$76 per share, is far from its last high of $118 (2021). The company’s forward PE1 of 19.1x is the lowest it has been since the great financial crisis of 2008 and while this is subject to likely downward revisions on estimates, the sentiment surrounding Starbucks as both a business and stock is exceptionally foul.

Key points from the report:

Revenue of $8.6 billion (-2%) with a 4% decline in comparable sales (-6% decline in transactions, +2% in average ticket).

North America same-store sales (-3%) driven by 7% decline in transactions with +4% in average ticket.

International same-store sales (-6%) driven by 3% decline in transactions with a 3% decline in average ticket.

China same-store sales (-11%) driven by 8% decline in transactions with a 4% decline in average ticket.

Margins are down across the board.

Significant downgrade in FY24 guidance across the board for revenue, store expansion, EPS, and the Q2 to Q4 China recovery.

A rare sequential decline (1.5 million / 4.3%) in US Rewards membership as occasional customers rotate out of the 90D cycle.

Rewards membership in China (21 million) has been flat since Q4 FY23.

Starbucks plans to introduce tapioca balls (boba) and a new energy drink line; open the Rewards app to non-Rewards members to reach the occasional consumer; and consider a deeper exploration of the relatively unserved evening to night daypart.

Trouble at home

For Starbucks, the trouble starts at home. North America saw a 3% decline in compare store sales with a 7% decline in transaction volume; partially offset by a 4% increase in average ticket. Revenues were flat year-over-year but came with a 6% decline in operating income ($1.48 billion) and a 110bps decrease in margin (18% in the quarter). Continued concerns over the loss of appeal to the occasional customer were illustrated by a 4% sequential decline in US Rewards membership; a rare occurrence for Starbucks. While up 6% on a year-over-year basis, the trend of customers falling out of the 90-day activity catchment is a concern. It indicates that, for whatever reason, people are visiting Starbucks less frequently. Remarking that their most loyal customers are showing no signs of fatigue, the root of the problem seems to lie with the casual customer.

In a best-case scenario, this is the result of a temporary shift in consumer behaviour; a degration of their propensity to consume smaller luxuries like Starbucks in light of the current economic environment. You can argue that Starbucks perpetuated this by increasing prices too aggressively during inflationary times.

Consumer’s disposable income and appetite for small luxuries will always fluctuate. The great financial crisis, for example, stifled the consumer’s appetite for life’s little luxuries (Starbucks revenue declined 6% between 2008 and 2009) but didn’t cause permanent damage to Starbucks. The worst-case outcome is that Starbucks has gone too far or, more importantly, lost appeal amongst a subset of the American consumer. I believe the former is closer to reality. Arguments about increasing competition and the “mid” quality of Starbucks coffee are moot points; both factors have been present for decades. But time will tell.

The troubles may start at home, but they don’t stop there. International as a whole saw a decline of 6% in same-store sales with a 3% decline in both transactions and average ticket. One caveat here is that China, which saw an 11% drop in same-store sales, is pulling down the average. Excluding China, international would have seen positive revenue and same-store sales comps in the quarter with strength across Latin America and Japan. Things have been so bad that founder and multiple-time CEO, Howard Schultz, took to LinkedIn to share his perspective on their lack of focus; “It’s clearly not business as usual” he said.

“It’s not the miss that matters. It’s what comes next. What’s the diagnosis of the problem? What’s the impact on morale? And what’s the strategy to fix it? At any company that misses badly, there must be contrition and renewed focus and discipline on the core. Own the shortcoming without the slightest semblance of an excuse. There is a natural tendency to try to do too much too soon. Don’t try to do everything at once. Leaders must model both humility and confidence as they work to restore trust and increase performance across the organization.

Starbucks will recover, of that, I am certain. Starbucks created an industry that did not exist. The brand is one of the most recognized and respected in the world. I am confident the China business will return to health and become the company's largest market. The brand is incredibly resilient, but it’s clearly not business as usual”.

- Howard Schultz

Schultz concludes that “the company’s fix needs to begin at home” citing the US operations as “the primary reason for the company’s fall from grace”.

Guidance faux-pas

Starbucks could have gotten ahead of this wave of negative sentiment by ripping the band-aid off last quarter. In Q1 it was expected that Q2 would be “meaningfully below” the full-year growth guidance. Coincidingly, amidst a downward revenue revision, Ruggeri repeatedly played down questions asking why the year’s EPS forecast remained at 15% to 20% despite the evidently deteriorating consumer trends. Adamant they’d be able to maintain the growth rate, she told investors “Despite these headwinds, we remain committed to our full-year fiscal 2024 EPS growth in the range of 15% to 20%”.