Not Another Article About Banks

There have been 563 US bank failures since 2001 and we just witnessed two of the largest in one weekend.

Hey, you are reading Investment Talk. If you’d like to join the 19,500 other readers learning about the stock market, the companies within them, and life, subscribe below. You can check out my other articles and follow me on Twitter too. If you enjoy today’s article, then feel free to share it, it helps a lot. Now let’s begin.

How many?

Let me be the first to tell you that I am far too stupid to comment on the intricacies of banks, banking regulations, and all that jazz. This isn’t an in-depth article about the failure of Silicon Valley Bank or a forensic account of the world’s banking health. Like you, I am piecing that together myself; learning, absorbing. The news cycle has attracted many banking tourists. While they are now forensic accountants, they didn’t appear to be concerned about the banking sector when Q4 results came out…. almost 2 months ago. I will share a few pieces I think cover the matter coherently and objectively in this weekend’s edition of Market Talk.

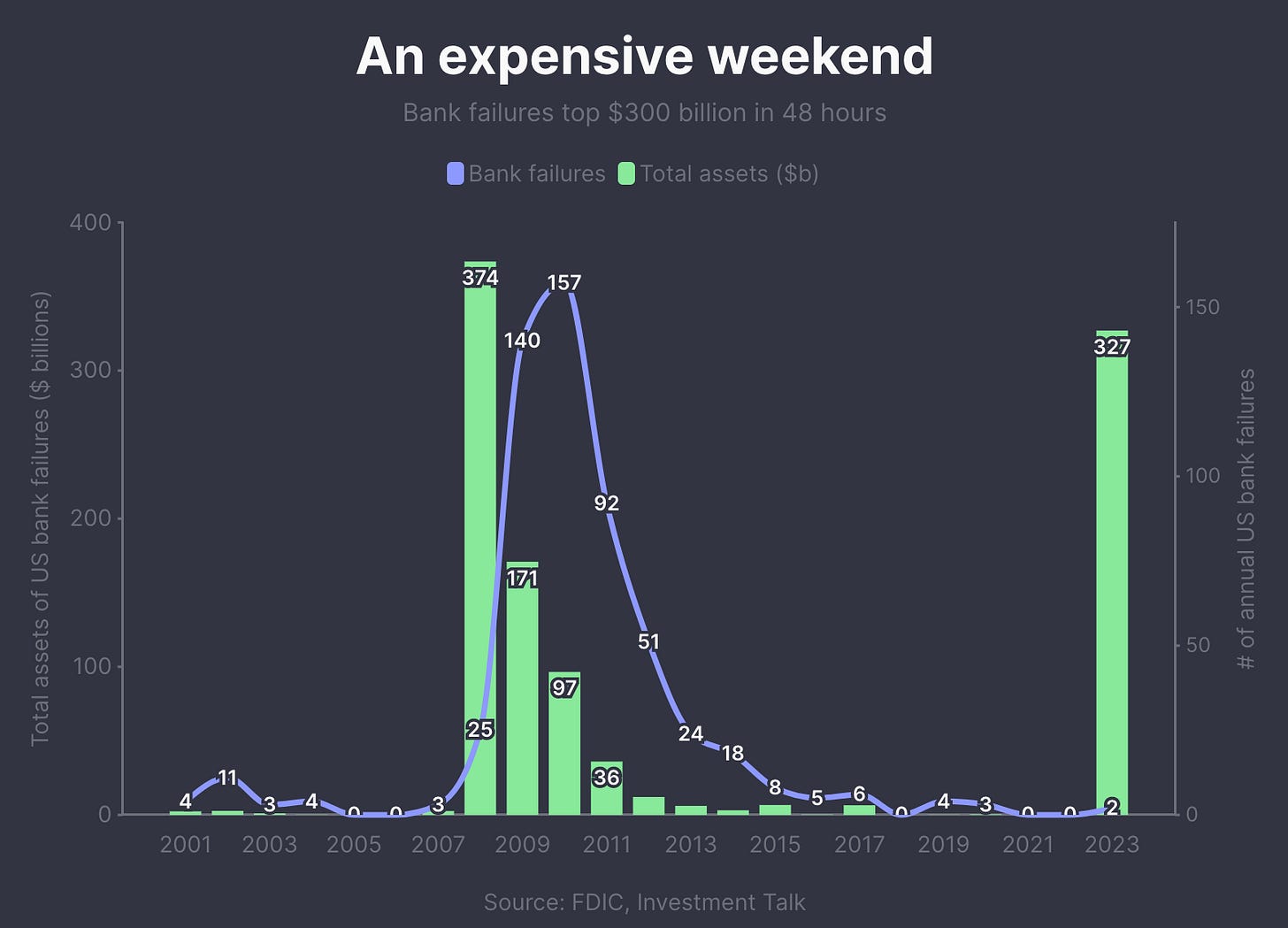

What this article will be, is a simple breakdown of what has gone on through the medium of five visuals. Starting with the fact there have been 563 US bank failures since 2001 and we just witnessed two of the largest in one weekend.

While the failures of Silicon Valley and Signature Bank are huge, 322 (57%) of the bank failures in the last two decades happened between 2008 and 2010. Adjusted for inflation, the failure of Washington Bank ($307 billion in assets in 2008) would be ~$418 billion in today’s money, roughly twice the size of Silicon Valley Bank. IndyMac, another smaller circle in the visual, would be ~$43 billion today.

An Expensive Weekend

Zooming out, you can appreciate why folks might be spooked. This year we have witnessed (just) two bank failures, amounting to $327 billion in asset value. During the bursting of the real estate bubble in 2008, there were 25 bank failures which amounted to $374 billion in asset value, of which Washington Mutual accounted for 82% of the total. Another 464 banks failed over the next 5 years but none as large as Washington1. What we have witnessed this year is relatively large value with minimal quantity.

But when adjusted for inflation, 2008 would be closer to $508 billion and 2009 would be ~$233 billion in today’s money. Naturally, human’s are programmed to wonder “who is next?”. Will there be a spate of forced consolidation in the banking space? This has caused paranoia of further bank runs and failures to spread across markets.

Nerves are contagious

It began last week when the six largest banks in the United States shed ~$110 billion in market value in the space of five days.

And it followed through to this week, this time hammering smaller domestic US banks on Monday. Consumers are now thinking, “what if I have deposits in one of these banks?”. Investors are now thinking, “what if consumers are now thinking what if I have deposits in one of these banks?”. The likes of Fifth Third (-14%), Comerica (-28%), Zions Bancorp (-26%), Western Alliance (47-%), PacWest (-21%) and First Republic (-62%) were all down significantly on Monday but appear to be getting some reprieve in the early pre-market hours of Tuesday morning.