Is it Really Just the Mag 7?

A short comment on the Mag 7 dominance

2023 has been the year of the “Magnificent 7”; a cute name used to group Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla. They are labelled magnificent because they have performed incredibly well this year; leading market commentators to remark the performance of these seven companies has carried the market in 2023. But is that really the case?

Here are three examples of charts you have likely seen used to express this point of view:

S&P 500 vs the Equal Weight

The S&P 500 is “top-heavy”; the Mag 7 equates to ~28.8% of the index. This year, each of those seven stocks has performed incredibly well; ranging from total returns of 47% for Apple to 230% for Nvidia. Because they are such large fixtures in the index, the leverage their returns have on the overall contribution to performance is substantial.

Observing the YTD total returns for the S&P 50 (XLG), S&P 100 (OEF), S&P 500 (SPY), and S&P 500 Equal Weighted (RSP) paints a perfect picture. As the level of concentration dwindles, so too have the returns this year. This is not an uncommon trend. If you pull this chart out 10 years further, the order of performance looks much the same. When you pull it out 20 years, accounting for the GFC in 2008, it looks different. Here, the S&P 500 leads (+527%), followed by the equal-weighted cousin (+519%), the S&P 100 (+500%), and the S&P 50 (+471%). Nonetheless, these securities paint a good illustration of the trends in 2023.

S&P 500 vs the Mag 7

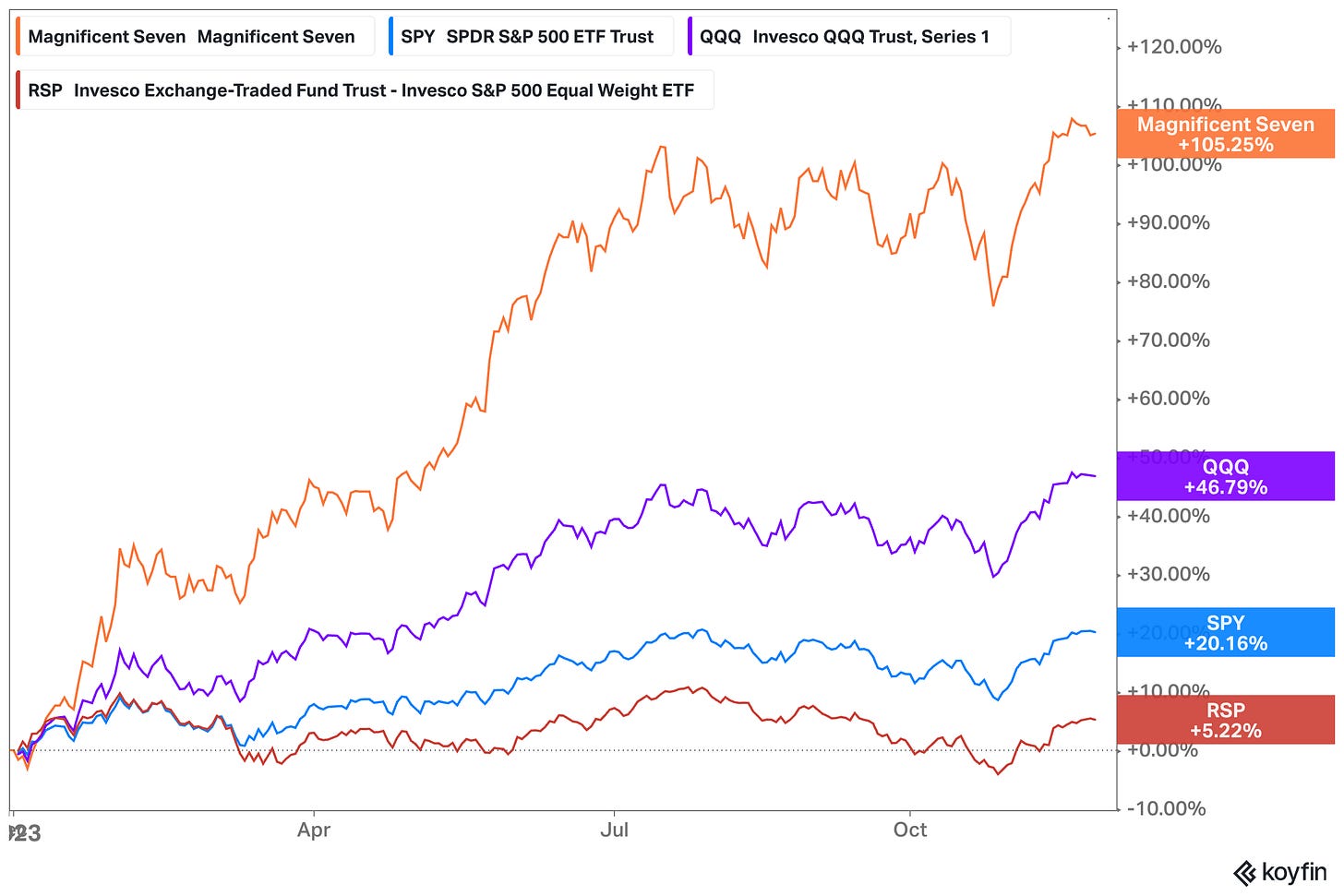

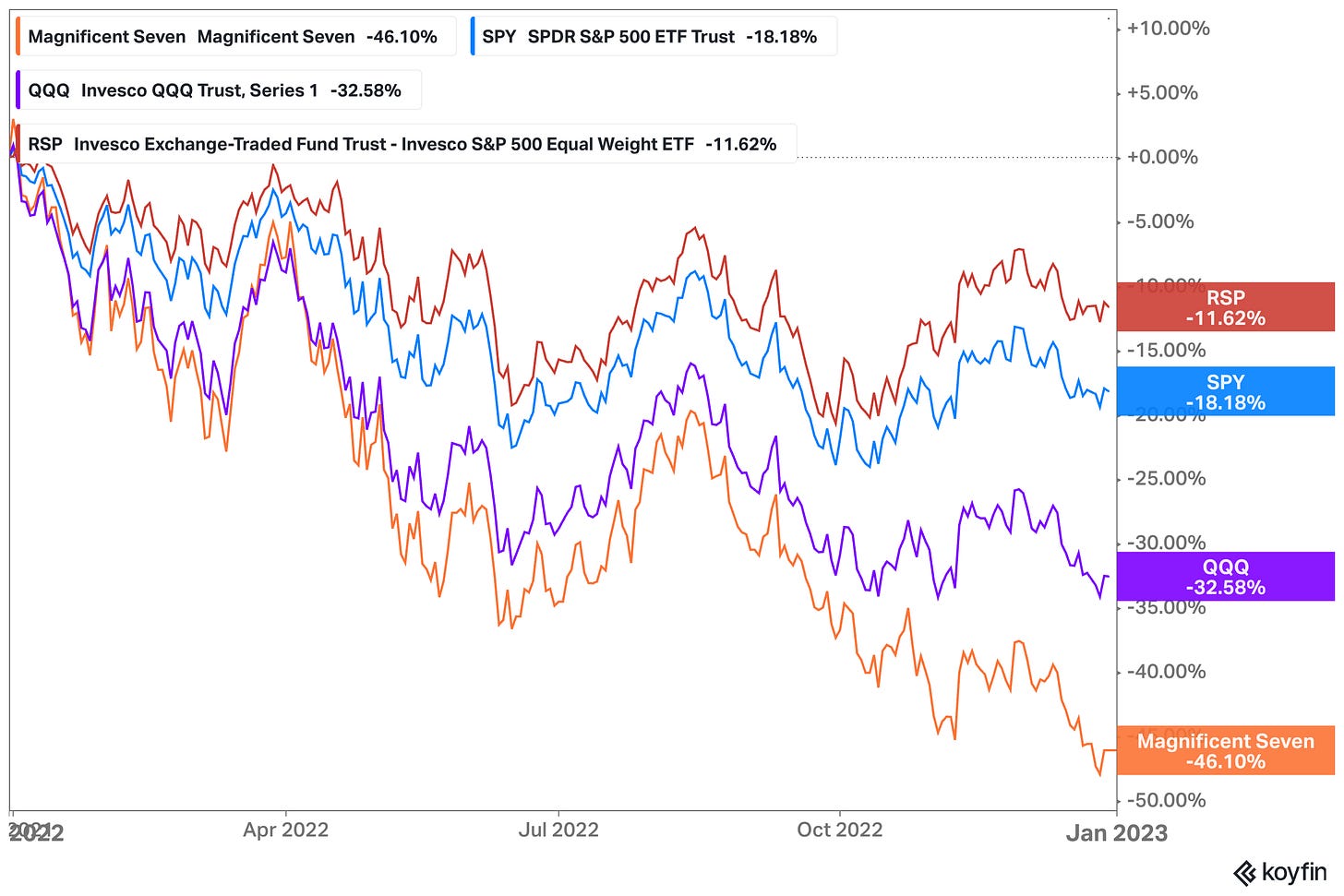

Below is a chart showing the indexed1 performance of the Mag 7 vs the S&P 500 (SPY), the Nasdaq 100 (QQQ), and the S&P 500 Equal Weight (RSP). I think this one speaks for itself.

Something that often goes unsaid in these discussions (and I hope people are cognizant of) is that the Mag 7 had their arses handed to them in 2022. Using the same indexed2 Mag 7 chart, you can see that Mag 7 was down 46% in 2022; faring considerably worse than QQQ’s hefty 33% drawdown and the SPY’s 18%.

The Equal Weight S&P 500, while down 12%, was the best security for downside protection that year; largely due to its lack of concentration. It’s a double-edged sword; concentration. While a comeback for the Mag 7 was not a guarantee3 for the year 2023, whatever these seven stocks do will have an outsized impact on the index. It just so happens that this year, after bottoming out in 2022, all seven constituents decided to engage in a synchronised barnstormer.

S&P 493 vs the Mag 7

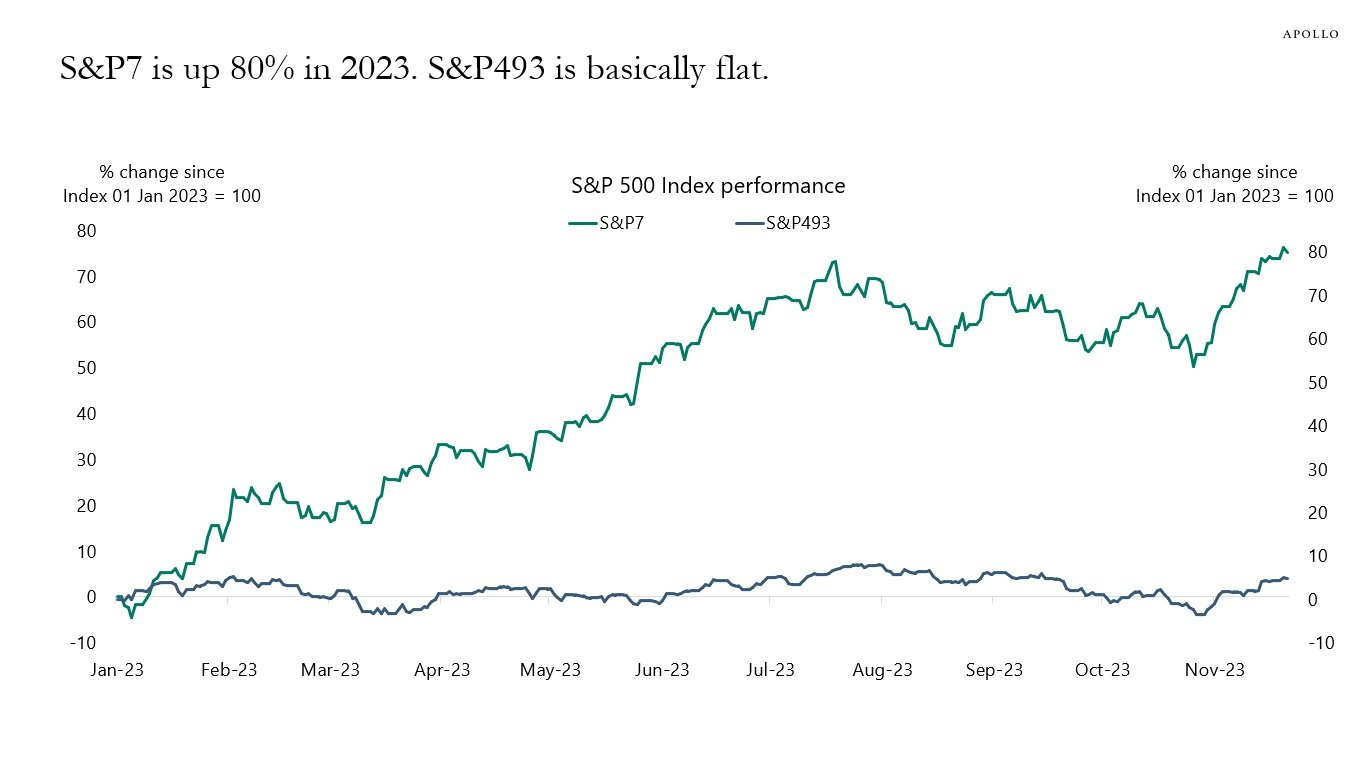

Tosten Slok, Apollo Chief Economist, believes the performance of the Mag 7 in 2023 is down to AI being the “shiny new toy”; a subject matter that each of the seven constituents is actively involved in. He uses a chart to display the returns of the Mag 7 vs the other 493 consistent in the S&P. He draws a comparison between the Mag 7 and the historic equivalents during the tech bubble (~2000) and Nifty Fifty (~1972).

Another suitable example of how to portray the same idea.

Is it Really Just the Mag 7?

It’s certainly true that the Mag 7 is doing most of the legwork as far as the S&P 500’s total returns are concerned. Together, the Mag 7 account for 28.8% of the index weighting, and have contributed ~14.7% of the 20.2% returns for the S&P 500 this year4. But collectively, there are ~301 stocks in the index that have positively contributed to the S&P 500’s total return this year.