Have We Reached a Cyclical Low in Unemployment?

The Federal Reserve raised rates 25bps in March and suggest that rate hikes are no longer appropriate to quell inflation

Hey, you are reading Investment Talk. If you’d like to join the 19,800 other readers learning about life, the stock market, and the companies within it, subscribe below. You can check out my other articles and follow me on Twitter too. If you enjoy today’s article, then feel free to share it, it helps a lot. Now let’s begin.

Anotha’ one

Stocks declined sharply yesterday following the beginning of Chairman Powell’s speech1. So far in 2023, just 47% of the companies within the S&P 500 are showing positive returns YTD and only 38% are beating the market’s ~2.95%. Of the losers, 19% of the stocks in the S&P 500 are down more than 10% in 2023. Unsurprisingly, many of the laggards are mid-sized domestic banks.; the worst-performing stock in the S&P to date is First Republic, down 89%. The first item that Powell addressed in his prepared remarks was the suggestion that central bank intervention was necessary to quell contagion and reassure depositors. He admits that it is “too soon to determine” the full extent that these banking woes will have, but attempted to reassure observers by stating the US banking system is “sound and resilient”.

“History has shown that isolated banking problems, if left unaddressed, can undermine confidence in healthy banks and threaten the ability of the banking system as a whole to play its vital role in supporting the savings and credit needs of households and businesses. That is why, in response to these events, the Federal Reserve, working with the Treasury Department and the FDIC, took decisive actions to protect the U.S. economy and to strengthen public confidence in our banking system. These actions demonstrate that all depositors' savings and the banking system are safe”.

He would go so far as to suggest the problems at Silicon Valley, while pertinent, were an isolated case.

“Silicon Valley Bank failed with taking too much risk and not hedging that risk appropriately. These weaknesses are not at all broad throughout the banking system. This is an outlier”.

Just one month ago the market had expected the Federal Reserve to raise rates by 50bps. That was until troubles in the US banking sector began to emerge. Within hours, markets began to contest whether the Fed would raise by just 25bps or pause rate hikes for the month of March. In the end, Powell opted to go with the former, acknowledging that while pausing rates were considered, there was a “strong consensus” for 25bps. In fact, it was voted for unanimously.

Rates are no longer appropriate to quell inflation

This is what Powell expressed on Wednesday afternoon; alluding to tighter lending practices. Recent developments are likely to result in “tighter credit conditions” for households and businesses which will weigh on economic activity, hiring, and inflation. Despite this, the Fed is adamant that they have no plans to cut rates in 2023.

“Financial conditions seem to have tightened probably by more than the traditional indexes say. Because traditional indexes are focused a lot on rates and equities, and they don't necessarily capture lending conditions”.

Here is some context from BofA.

"We agree that some amount of unexpected tightening in bank lending standards may be forthcoming. In other words, the US economy may see tighter lending standards than what could be explained by macroeconomic fundamentals. If so, our view is that it could indeed substitute for further rate hikes. Hence, we no longer expect a 25bp rate hike in June and now foresee a terminal target funds rate of 5.0-5.25% reached in May”.

While the Fed suggests it has no plans to cut rates any time soon, the market disagrees as significant rate cuts are being priced in by year-end.

For months now, the Fed’s statements have included verbiage around its policy pertaining to the expected “ongoing increases” in rates. That language has now been dropped as the Fed is “no longer stating that ongoing rate increases are appropriate to quell inflation”. While not an indication that rates will be cut anytime soon, it does mark a big shift in policy during this current tightening cycle. As things stand, the median rate projection sees rates hitting 5.1% by the end of 2023, 4.3% by the end of 2024, and 3.1% by 2025. I suppose it makes people feel more secure trying to project rates. Not wishing to admit that the reality is nobody knows. The Fed’s original stance on rates, while a tad delayed, began as a proactive measure. Today, they are looking to be more reactive in nature.

Yellen didn’t get the memo

Yellen2 and Powell didn’t appear to be singing from the same hymn sheet in their public addresses yesterday. While Powell remarked that “depositors should assume their deposits are safe”, Yellen would remark “we are not considering insuring all uninsured bank deposits”. This comes after a day after her saying "the government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe". This is what spooked investors. Even Bill Ackman had his say.

“Yesterday, Yellen made reassuring comments that led the market and depositors to believe that all deposits were now implicitly guaranteed. This afternoon, Yellen walked back yesterday’s implicit support for small banks and depositors, while making it explicit that systemwide deposit guarantees were not being considered. We have gone from implicit support for depositors to Yellen’s explicit statement today that no guarantee is being considered with rates now being raised to 5%. 5% is a threshold that makes bank deposits that much less attractive. I would be surprised if deposit outflows don’t accelerate effective immediately. A temporary systemwide deposit guarantee is needed to stop the bleeding”.

There is some nuance here, however. I believe that in this case, Powell is talking about the Fed’s lending programs that allow banks to cover increased withdrawal volumes, and Yellen is speaking about deposit insurance more broadly. They both want to give the impression that depositors have nothing to fear because the Fed is willing to give banks the liquidity they need. Short of saying he would do anything it takes, Powell has been forthcoming on this front. However, banking tends to be a game of confidence; customers need to feel reassured that should they want to withdraw their deposits, they can. Naturally, if every depositor decided to withdraw their funds in unison, there would be severe trouble; which is why contagion is so feared. Each individual, in a sense, is acting rationally. They want to protect themself, but when a large enough group of rational individuals follow the same logic, the collective becomes irrational. If history is anything to go by, the Fed’s insistence on saying the system is “sound and resilient” leads many to believe that it is, in fact, not.

Something broke

According to FDIC data, there are $7.4 trillion in deposits that are insured up to $250,000, while $10.5 trillion are uninsured.

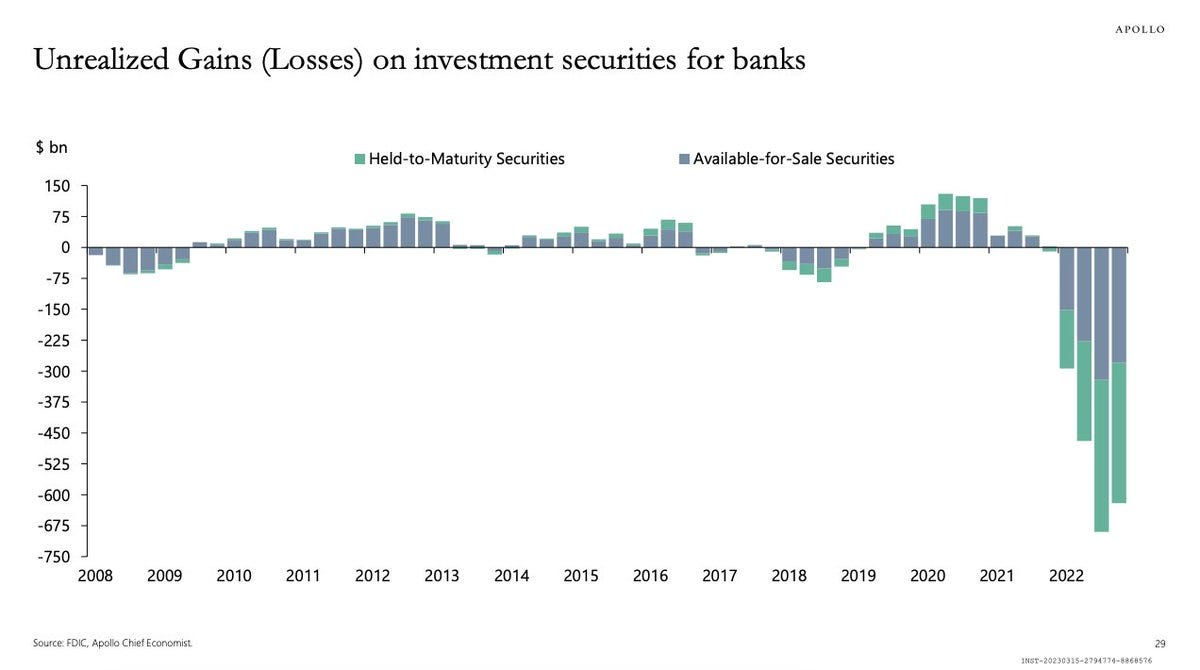

The FDIC also suggests that banks have unrealised losses in excess of $600 billion across their portfolios. Most of these assets (primarily US Treasuries) have been acquired since the post-GFC era when rates sat at near zero. Few expected the resurgance of inflation in 2022 and the steepest, sharpest, incline of rates in modern history which would follow.

Dr Yardeni3 concludes that, in hindsight, “interest rate risk has turned out to be a much bigger problem than credit risk for the banks during the current monetary policy tightening cycle”.

“Then again, as long as the securities are held to maturity, unrealized losses don't have to be realized unless the banks have to sell them if they are faced with bank runs. In any case, they are forced to raise their deposit rates to be competitive with money market rates to halt disintermediation. Doing so hits their profitability since they can't raise interest rates on all their current loans”.

So far as leading indicators are concerned, he points to the fact that the inverted yield curve has been signalling that something will break since last summer following the abrupt end of the free money post-low rate regime.

In his opinion, Silicon Valley Bank was that “thing” that which broke.

“With the benefit of hindsight, the era of free money under Fed Chairs Ben Bernanke, Janet Yellen, and Jerome Powell created a big bubble in the banks' bond portfolios. The Treasury contributed to the bubble by issuing lots of bonds that the banks purchased at much higher prices.

Silicon Valley Bank is that broken something that has raised concern about small community and regional banks”.