Hey, remember me?

This is the longest I have gone without sending a newsletter since I started this publication over five years ago— the last entry being in May. During this absence, I have been busy.

In my personal life, I spent a month in Asia, where I visited Thailand for the first time. When in Ko Samui, I decided it was about time I proposed to my partner. I also had the pleasure of visiting Northern Ireland for the first time. I can now say I have visited every country in the United Kingdom.

At Koyfin, the business and the team are growing, and i’ve never been more excited about our trajectory and the opportunity we have ahead of ourselves. It’s been eight months since I last reflected on what we have been up to, so today’s newsletter will centre around that.

Below is a variety of the things we have released at Koyfin in 2025, as well as some commentary on what is coming down the line.

1. Shipped ✅

Features and improvements we have shipped to users.

I never tire of the satisfaction that comes from marking a highly upvoted feature request from our community feature request forum as ‘Complete’. The ones that garner more than 100 upvotes are particularly pleasing. This year, we have knocked a few of those off the list— including desktop alerts (300 upvotes) and adding historic data to our Watchlist & Screener (200 upvotes). We are also weeks away from unveiling another, the Interactive Brokers integration (150 upvotes).

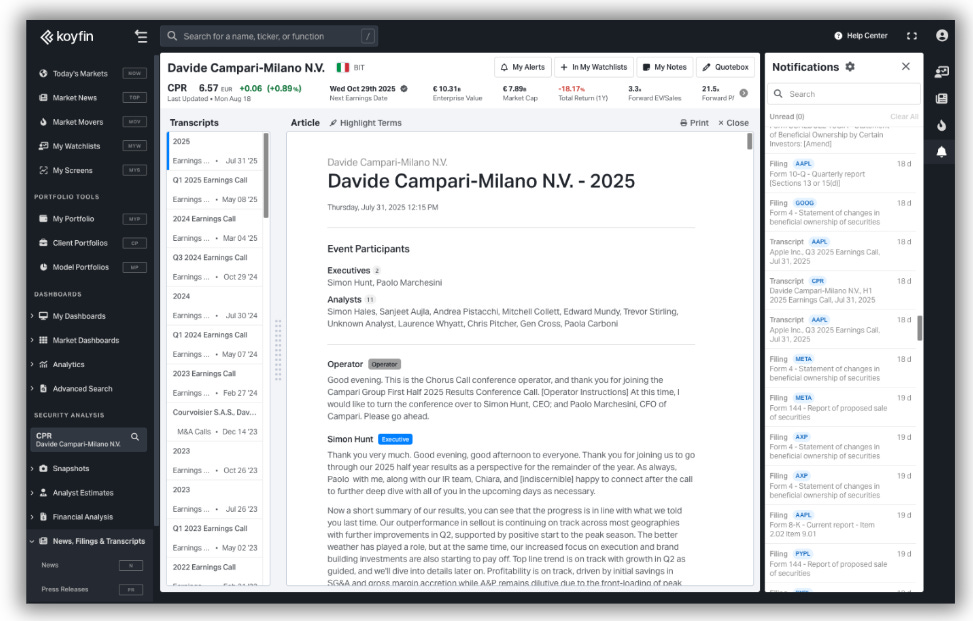

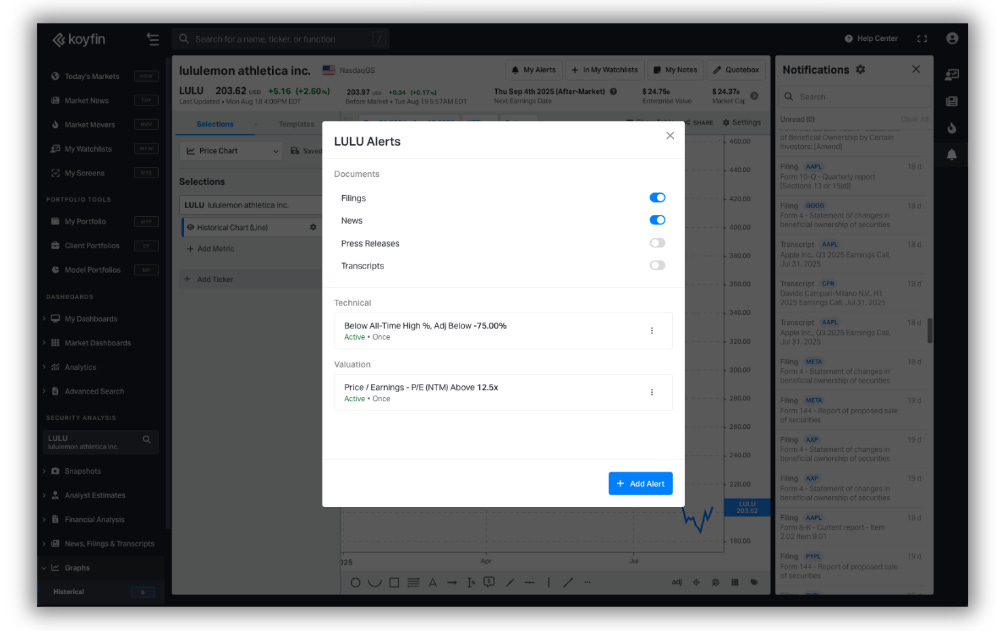

1.1 Desktop Alerts

Desktop Alerts had been highly requested for years. We initially launched alerts on Mobile in 2023, with limited functionality of only price alerts for US stocks and Press Releases. The wait is finally over, and I believe that we went above and beyond to deliver a robust v1 of desktop alerts.

When we decided to work on desktop alerts, we wanted to ensure that this would be a dramatic improvement to what we supported in mobile, and in a way that complemented our desktop platform. In our first release of desktop alerts functionality, we:

Expanded coverage to include global equities, ETFs, and Mutual Funds.

Broadened alert types to include price, technicals, valuation, and documents (press releases, news, filings, transcripts).

Added the ability to set notes on alerts.

Supported setting alerts on Watchlists and Portfolios.

Introduced a notifications side panel to see notifications triggered live throughout the day.

This panel is also interactive and will direct you to the source of the notification, whether that be a transcript notification or a price graph.

Created an alerts management dashboard that will allow users to edit, pause, and delete their alerts, as well as search and sort through their existing alerts, or manage their notification settings.

Alerts can be created or accessed through the ‘My Alerts’ button that will now feature throughout the desktop platform. Notifications delivery is also supported via Email, Mobile, and In-App for Desktop. There is more we can do with alerts, but this has proved to be a great foundation.

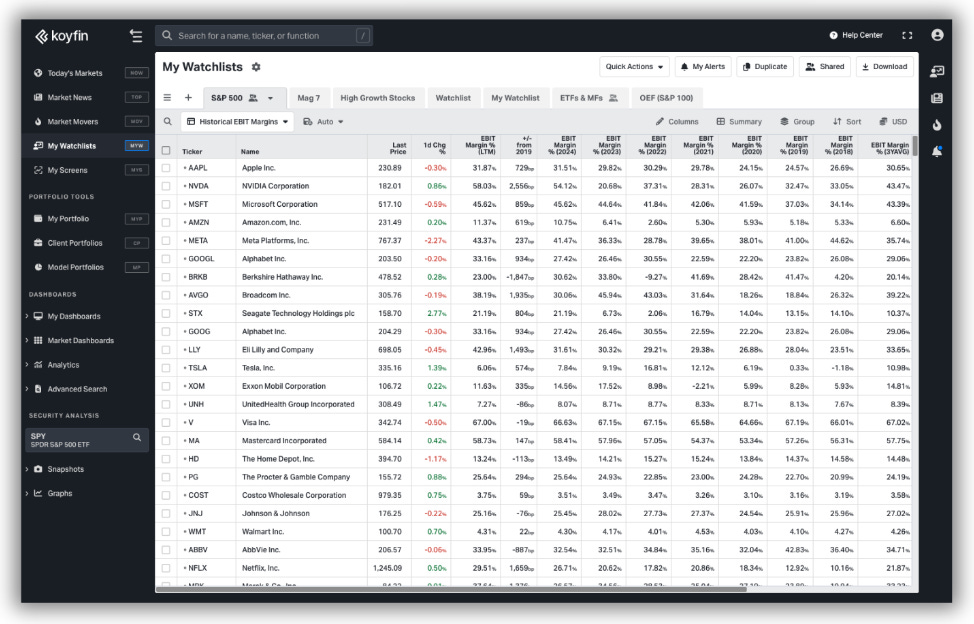

1.2 Historic Data in Watchlist & Screener

The concept is a simple one. Previously, in Koyfin’s watchlists, screeners, market and scatter plot graphs, the biggest limitation was a lack of time series analysis. Despite having thousands of metrics to choose from, you were limited to a point-in-time perspective. As an example, you could add EBIT margin to a watchlist, but the choices you had were the latest Fiscal Year (FY), Fiscal Quarter (FQ) or Last Twelve Months (LTM).

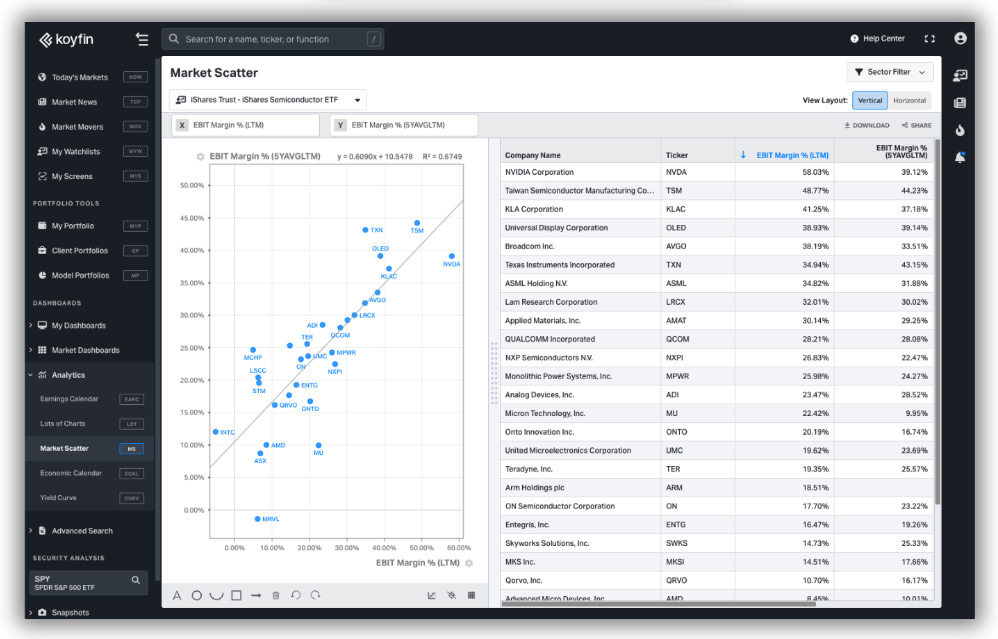

This update changed all of that. We created a new structure for our data in the column selection, meaning that metrics now have subcategories for FQ and FY history, as well as Historic Averages.

In a Watchlist, this made it possible to present the historical years or quarters of EBIT margins, to see how the metric has evolved. These historic metrics are also available for use in custom formulas— as demonstrated below, I created a custom formula to show the difference, in basis points, between today’s margin and the 5Y average.

It doesn’t take much imagination to consider how greatly this improves the screener's usability, either. If I wanted to screen for companies that had reported negative EBIT margins for the last 5 fiscal years but have flipped to profitability in the last twelve months, this is now possible, whereas before it was not.

In areas like Market Scatter, users can now more readily visualise data on a time series basis. In the above example, I have plotted the current vs 5Y average EBIT margins of the Semiconductor industry and overlayed a linear regression line to observe which companies are reporting higher margins relative to history.

One of the joys of being a PM at Koyfin is getting to help build features that I, as a user, am passionate about. This was certainly one of those occasions.

We are not done with historic data yet, however. We are going to follow up by adding more, such as:

Historic Trailing Growth Rates: For example, the growth of revenue over the last 3 years, 5 years, 10 years, etc.

Historic YoY & QoQ Growth Rates: For example, the YoY growth of each quarter going back the last 3 years. This will be great for visualising acceleration and deceleration.

Historic Actuals, Estimates, and Surprises: See how consistently companies beat estimates.

1.3 Portfolios & Integrations

Koyfin is loved by individuals and bottom-up fundamental analysts. But we also specialise in solving problems for Advisors. Back in December 2024, I wrote about how focused we have been on this demographic and how far we had come. At that time, we unveiled a new Advisor tier in our pricing plans. We now have two plans, Advisor Core and Advisor Pro.

The pace has not slowed. Below is a hand-picked selection of evidence that we are shipping features advisors have asked us for.

1.3.1 Integrations

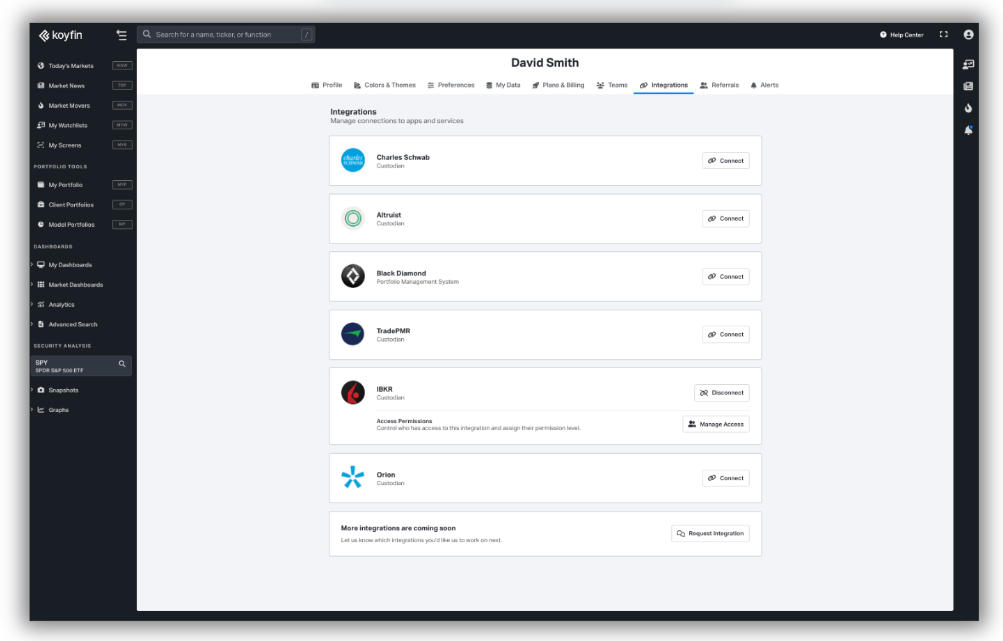

In December last year, we had just launched our maiden integration, Schwab Advisor Centre.

Since then, we’ve added support for Altruist, Black Diamond, TradePMR, Interactive Brokers, and Orion. Our next conquest will be Fidelity, which we hope to make available later this year.

1.3.2 Client Portfolios v2

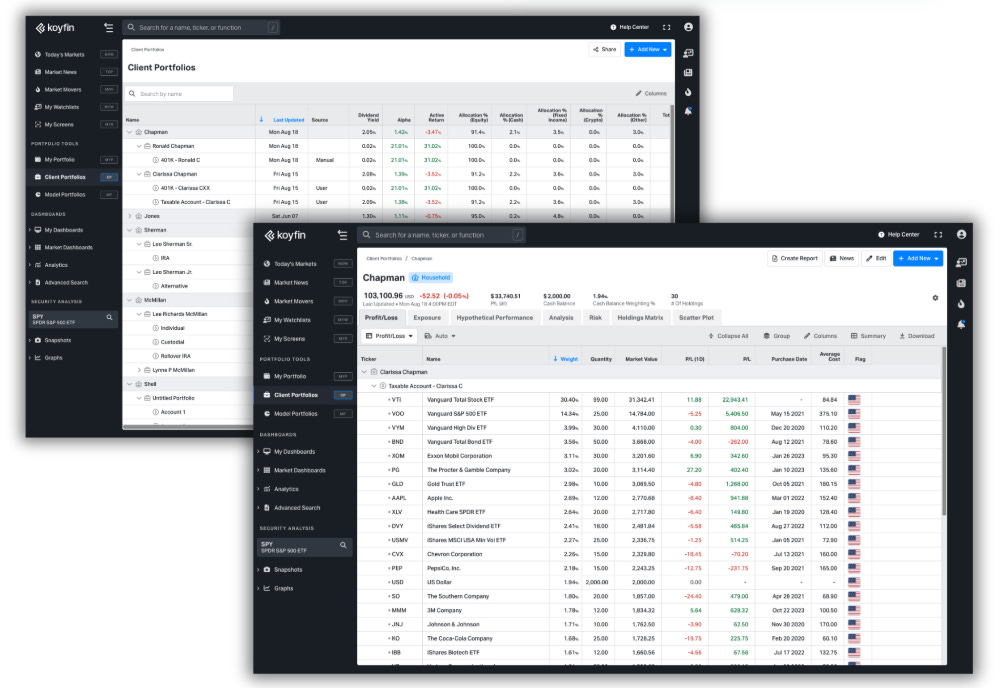

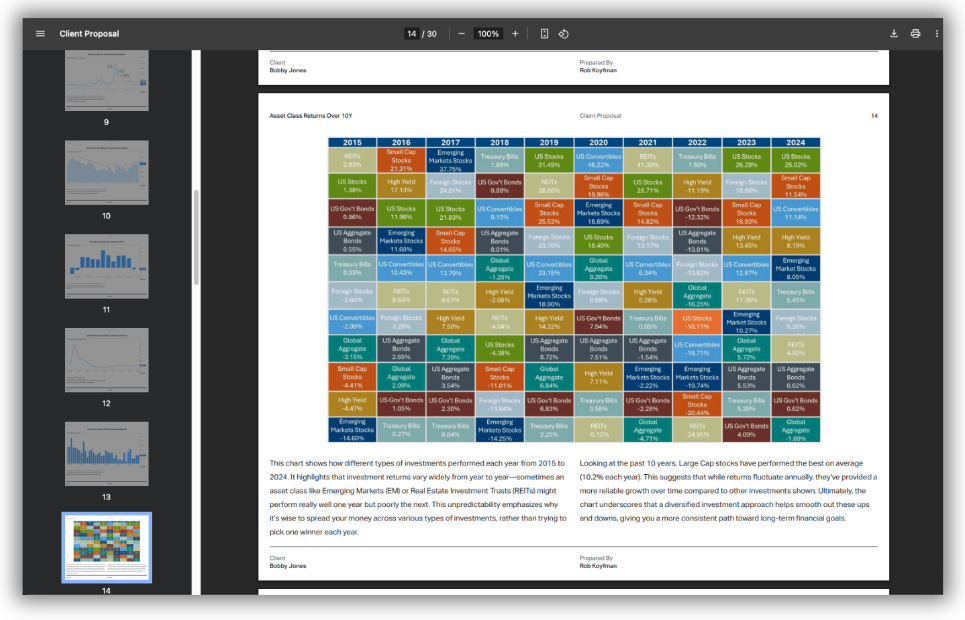

Client Portfolios was a feature we developed to push forward Koyfin’s status as a Portfolio Management System (PMS)— designed to support thousands of portfolios and integrate with an advisor’s custodian or other PMS tools. This gives advisors an efficient and fast way to visualise exposures, the P/L of their client’s assets, and seamlessly generate reports.

In our first version of Client Portfolios, the structure was flat— meaning that all portfolios were on the same level. We’ve since introduced a three-tiered structure:

Households: Highest level, contains Portfolios and Accounts.

Portfolios: Mid-level, contains Accounts.

Account: The atomic level.

The flexibility this provides with respect to household management has been immensely positive. Advisors can now organise client investments logically, move accounts across portfolios and households, generate reports at any level, and view data rolled up into an aggregate or zoom in to a particular account.

We also introduced the concept of views to Client Portfolios, meaning that all tables now feature customizable columns and the ability to create a multitude of unique views.

1.3.3 Custom Report Pages

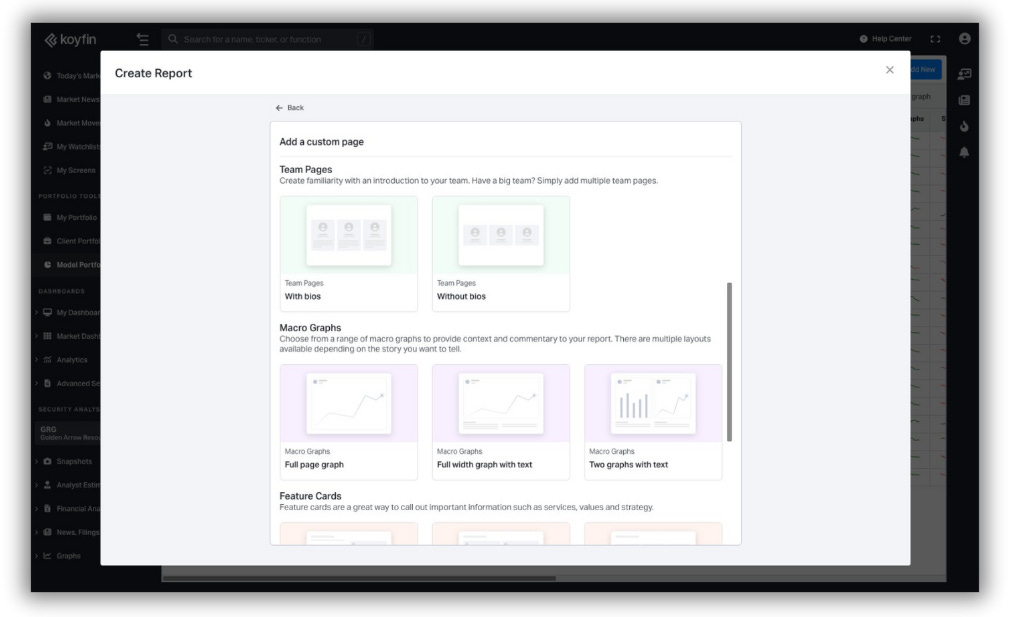

In keeping with the theme of enhancing our core spine of advisor functionality, Reports was another feature we announced late last year that we have continued to improve on. We’ve added a host of new exhibits to reports, in addition to transforming several of the exhibits from static to customizable.

We also took this theme of customisation a step further by developing what we call ‘Custom Report Pages’.

Custom Report Pages allow users to create branded content within their reports and are designed to help tell the firm's story, explain the investment approach, and add context or commentary to proposals.

This includes a new library of customizable pages that includes team bios, the ability to add charts with commentary, feature cards for outlining investment principles or service offerings, and editorial pages to meet every other need you might have when creating a report.

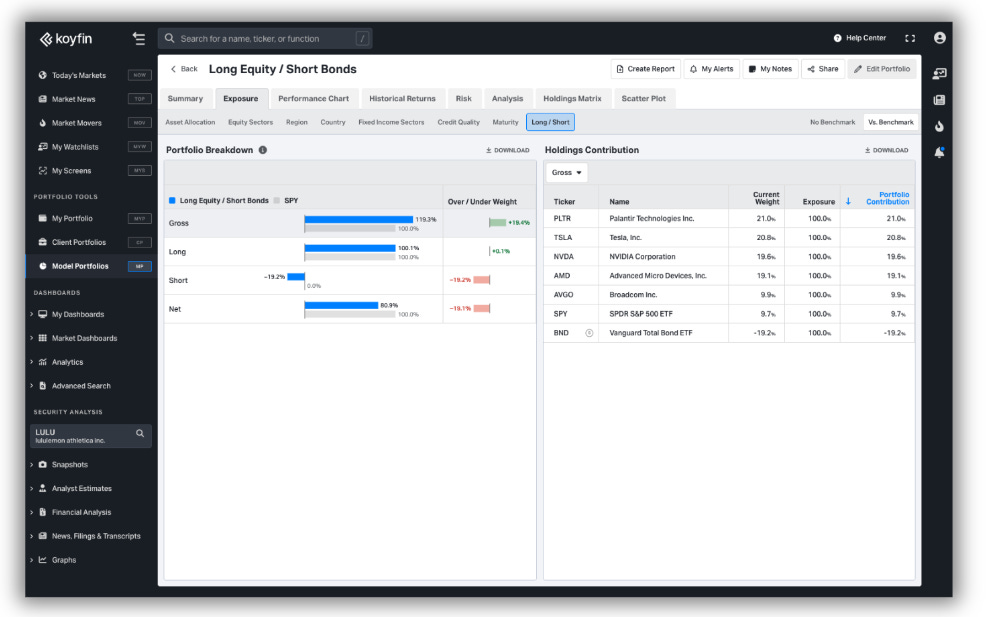

1.3.4 Short/Leverage Model Portfolios

If you are an advisor who employs leverage or short strategies, then model portfolios that support this are a mission-critical need. This was a common request from advisors, and considering established players like Ycharts don’t offer this, we filled that void.

Behind the scenes, this was no small feat. It required altering the fabric of our model portfolio infrastructure and a lot of testing, but on the front end, it works seamlessly. Users can now enter allocation weights as negative values and/or express >100% gross exposure at the portfolio level.

The UI dynamically adjusts depending on whether the model is long-only or contains shorts/leverage. Performance will factor in shorts and leverage, even to the extent that a model can become ‘bankrupt’ if the conditions allow for it. Reports will also dynamically adjust to support the correct analysis of short and leveraged exposures in models.

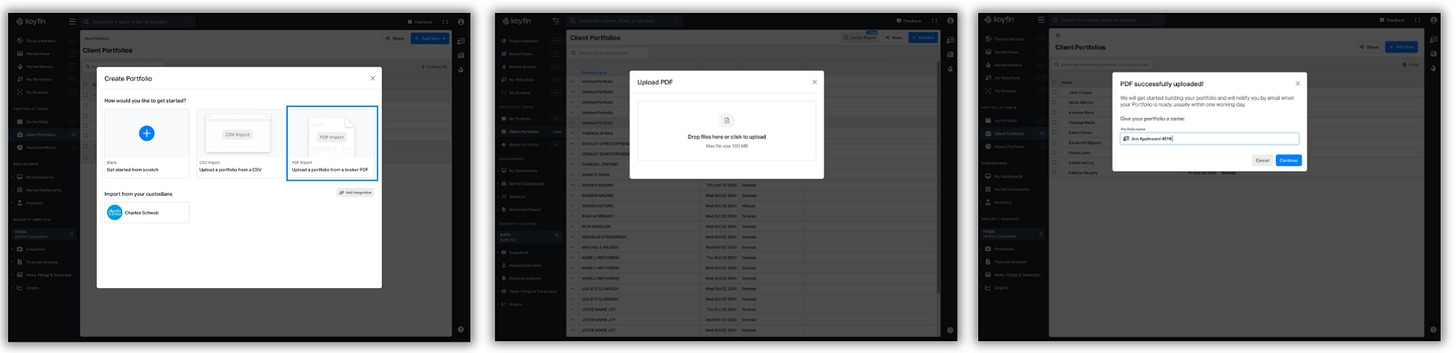

1.3.5 PDF Statement Upload

Imagine you are an advisor and you want to prepare a client proposal report for a prospective client later in the week. This report will compare the proposed model you are offering them vs. their current portfolio. They send you a PDF brokerage statement of their current holdings.

At this point, what are your options? You have to replicate the client’s portfolio in order to create this comparative report. This includes the lots, quantities, and cost basis, and a lot of other tedious manual work. While this manual workflow is available in Koyfin, it’s made a lot easier with PDF Statement Upload.

Simply drop the PDF statement into the reader, give the Portfolio a name, sit back, and wait. The portfolio should be processed and created within 24 hours, and Koyfin will keep you notified of the progress (in-app and via email) every step of the way. When it’s ready, you can spin up a proposal report in seconds.

1.3.6 Portfolio Capacity Upgrades

Quite simply, we bumped the maximum capacity (number of holdings) of our model portfolios to 1,000 holdings and the capacity of My Portfolio and Client Portfolios from 400 to 2,000 holdings.

Naturally, there have been a plethora of smaller enhancements made this year, but these are the ones I am particularly proud of.

Thanks for reading,

Conor

Congratulations Conor! I was going to ask if she said YES, but I scrolled down to see the answer! My best to you,

Mark

Congratulations on the engagement! (I assume the proposal was met with a yes!)