Released in May, Burberry’s FY24 results put an end to what has been a disappointing year for the British heritage brand. Successive profit warnings in Q2 and Q3 in combination with repeated communication of a slowdown in demand ensured that expectations were dampened. On Friday, shares fell below £10 per share (closing at £9.80) for the first time since 2016, marking an almost eight-year low. The 4.3% decline on Friday followed the company’s announcement that it would raise a further £300 million in debt.

It places Burberry in the lowest percentile in more than 10 years across several valuation1 measurements. A discounted valuation might just be all that Burberry has going for it right now, however.

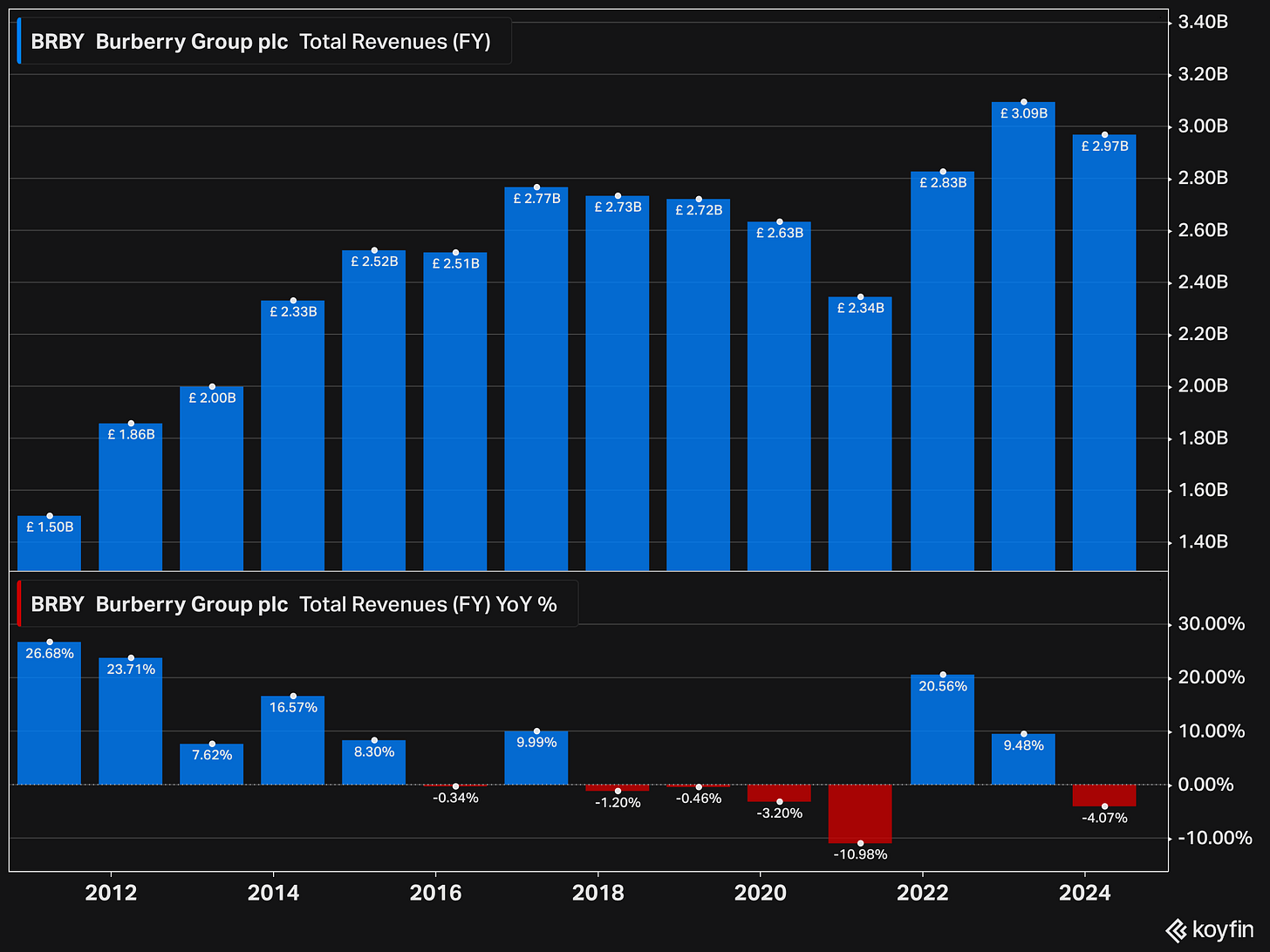

Revenues in FY24 (£2.97 billion) came in flat at constant currency but declined 4% YoY after foreign exchange. This marks Burberry’s fifth annual revenue decline in the last seven years. The downturn was widespread with both the retail (£2.4 billion revenue, down 4%) and wholesale businesses (£506 million revenue, down 7%) down on the year. Across product categories, growth was absent. The company’s largest division, accessories, accounts for 36% of revenue and saw revenue decline 6% to £1.06 billion.

Geographically, small deviations in the Asia Pacific (down 1%) and EMEIA (+1.3%) offset one another, with a net £2 million gain YoY. The Americas saw revenue decline 19% for an incremental loss of £140 million in revenue. Persistent pressure in the region continues to weigh on results. The table below highlights the messy nature of Burberry’s year, represented by a mixed bag of comparable store sales across regions. The Americas stands out as the worst performer, failing to report a single positive comp in any quarter.

To combat this, Akeroyd suggests that the United States and China will be a priority in the coming fiscal year. The majority of this will focus on lifting brand presence via marketing investment. The reopening of the number one flagship store in the US, located on 57th Street in New York, is expected to be complete this year too.

Outlook fails to inspire

Revenue is 13% higher than in 2019, before the pandemic. To Akeroyd and Lee’s credit, they inherited a turnaround business in a complicated time. That said, the fundamental picture at Burberry is bleak. Revenue has stalled and margins2 are declining. In FY24, gross margin (67.7%) declined by 280bps while operating margins (14.1%) declined by 640bps to levels not seen since the height of the pandemic in 2020. Far below the 20% operating margin that management aspires to. The business remains profitable but progressively to a lesser extent. Net income amounted to £270 million in FY24, down 45%.

The company have repurchased ~£800 million in shares over the last two years, reducing the outstanding share count by ~10%. This decision, in addition to the £435 million in dividends paid out during that time, has left the balance sheet looking somewhat sensitive. Cash & equivalents of £441 million is the lowest the company have held on the balance sheet in over a decade and has stretched net debt to adjusted EBITDA to 1.4x; well ahead of the 0.5x to 1.0x target range. Despite this, Akeroyd claims they are “comfortable with this leverage position” in light of the fact Burberry “continue to be a cash-generative business”. Evidently, because on June 13th the company announced the issuance of a £300 million bond at a 5.75% coupon due June 2030 (rated Baa2 by Moody’s).