This is my little book nook, tucked away in the corner of my living room with barely any room for much else (the bottom shelf is stuffed with cookbooks). I’ve tried to get better at giving my books away once I am done with them, to friends or family. In some cases, like my original copy of Peter Lynch’s One Up On Wall St, they get left behind on long-haul flights by my partner….

Tsundoku, The Art of Unread Literature

In Japan, they have a term (“Tsundoku”) for a person who collects unread literature; i.e. buying more books than they ever plan to read. I promise you that this isn’t some superficial “look at all my books” exercise. I have read most of the books on this shelf. I can admit that I unironically purchased The Art of War on a recommendation, and never got that into it. Back in March 2023, Frederik Gieschen wrote1 a great piece on how platforms like Twitter and LinkedIn condition us to become insight junkies. They serve “quick bites that make us feel smarter but turn out to be empty calories” and they encourage public figures to engage in faux intelligence for clicks and reputation. A prime example is how people often take great pride in their bookshelves in the hope that houseguests marvel at their fine collections. Little thought is ever given to whether or not these books have been consumed.

“Life is not a quest to read the most books and investing is not a race to out-read your competitor. Value is created by applying what you’ve learned through better judgment. This requires reading, repeated engagement to process and integrate, and even periods of disengagement to filter and surface what is important”.

In my late teens, I went through a stage of reading 25-30 books a year. Then I became a student and was mandated to read books, so reading for pleasure took a backseat. My first job after university involved a daily commute, 45 minutes each way, so I had the time to pick up my reading again. I still read a lot in the current day, but most of this is resigned to financial filings, transcripts, and the like. Nowadays, I’d say I read between 5-10 books a year if I’m lucky, so I like to make them count. This is all to say that this list is a subjective collection of books I have read and the ones that had the greatest impact on me; whether it be in terms of enjoyment, education, or their ability to alter my perspective.

This list is largely related to finance. Although I do read outside of the genre, I am being mindful of my audience here. If an 18-year-old version of myself came to me and asked which books I would enjoy most throughout the next decade of my life, this is the list I’d share with them; in no particular order.

1) The Most Important Thing

A library of lessons from OakTree Capital’s Howard Marks

Howard Marks, 2011

Pages: 180

I spend a few months every year in India, where I have a father-in-law with an insatiable reading habit. Besides the interesting coffee table chats this fosters each morning, he frequently gifts me books he thinks I will enjoy. During my most recent trip, in March this year, he gave me Howard Marks’ The Most Important Thing. Like most good books, the chapters are concise and centred around a specific theme. If you are a fan of Howard’s memos, this book is essentially a collection of those memos, with a few updates and expansions here and there.

The chapters include timeless commentary on topics like the relationship between price and value, opportunism, second-level thinking, market cycles, three chapters on risk, luck, knowing what you don’t know, and some great work on the realities of effective contrarianism. Due to its length, this is a book you can burn through in a couple of sittings with a few hours spare. This one doesn’t get as much recognition as some other popular books; I believe it deserves to.

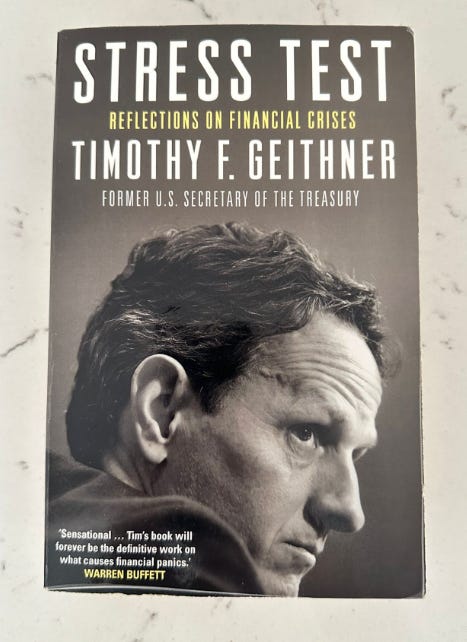

2) Stress Test

A behind the scenes account of the GFC from former Secretary of the Treasury

Timothy Geithner, 2014

Pages: 484

I must have been in my early 20s when I read this. I remember shuttling back and forth from work on a train and being so deeply engrossed in the story. Although this book is a work of non-fiction, recounting the lead-up and aftermath of the great financial crisis of 2008 from the US Treasury’s perspective, it’s as compelling as a fiction novel.

In this book, Timothy Geithner takes the reader inside the room, detailing the events as they unfolded, intensified, and eventually derailed out of control. He was the man in charge of putting out fires and part of the team tasked with preventing the nation’s economy from collapsing. The book is littered with observations about handling crises, panic, and how bubbles and speculative behaviours creep into society. It’s as frightening as it is gripping, and many soundbites have stuck with me over the years. In particular, his use of fire as an illustrative tool. I am paraphrasing, but there is a point in the book when the country is on its knees, and he compares the crisis to a fire ravaging the economy. He explains the paradox of their job being to put out the fire when at the same time allowing the fire to burn in some instances would help clear out the toxic elements of the economy. Similar to forest fires, which are destructive by nature, they are also an important catalyst for regeneration and encouraging new growth.

3) The Psychology of Money

Timeless lessons on money, risk, life, and happiness

Morgan Housel, 2020

Pages: 238

What Morgan Housel does incredibly well, throughout his blog at Collaborative Fund or in his books, is to write about complex topics in a way that is understandable to anyone. You will often find that the more straightforward the writing appears, the more effort the author has expensed in acquiring the knowledge to articulate it in such a simple fashion. It’s one thing to be intelligent enough to understand something complex, and another to be able to translate it to the layman. In keeping with the theme of simplicity, the book’s subheading, timeless lessons of wealth, greed, and happiness, is enough to convey what the book is about.

For whatever reason, I was mistakenly sold a pre-sale copy of Housel’s newest book, Same As Ever, before it was due to be launched in November. What a spot of luck. I won’t give too much away in this case, but I will say that it’s on par with his first book.

4) Capital Returns

A masterclass in investing through the capital cycle

Marathon Asset Management & Edward Chancellor, 2016

Pages: 204

I’d heard a lot of good things about this book, so eventually, I decided to read it last month. While it comes with a slightly elevated price tag for a book of its size, it’s worth every penny. Capital Returns is an edited rendition of the evolution of Marathon Asset Management’s investment philosophy, told through a curation of their manager’s reports over the years.

A large focus of MAM’s investment philosophy centres around investing through the capital cycle, a concept they feel is often neglected amongst investors, despite the empirical evidence which suggests it ought to be studied more closely. In a way, it reminds me of some of the basic introductory classes any economics student would take during their curriculum. An industry demonstrates attractive returns on capital, which gets investors giddy and causes new entrants to join the market. Rising competition causes the returns to fall back to equilibrium (below the cost of capital) and the stocks of said companies underperform. The industry then consolidates and investors become pessimistic. With low expectations and less competition, improving supply-side conditions cause returns to increase back above the cost of capital, and the cycle continues.

It too, can be read in a couple of sittings and is populated with a number of real-world examples to demonstrate their findings. Fantastic book, and one I imagine I will be revisiting from time to time.

5) Wanting

Understand how desire controls us

Luke Burgis, 2021

Pages: 304

Another book that was gifted indirectly by my father-in-law, who gave it to his daughter, who then gave it to me. Regular readers know how much I adore this book. So much so, that I reached out to the author to conduct an interview earlier this year. Luke’s dissection of mimetic desire, the hidden imitative force that controls how and what we want, allowed me to see in a colour I never knew existed.

I can count on one hand the number of books that have had a profound impact on the way I view the world; Wanting is one of them. While useful for everyday life, there are obvious parallels to investing in this book that will help you understand yourself, your biases, human behaviour, the consumer, and why the market will forever be conducive to speculation.

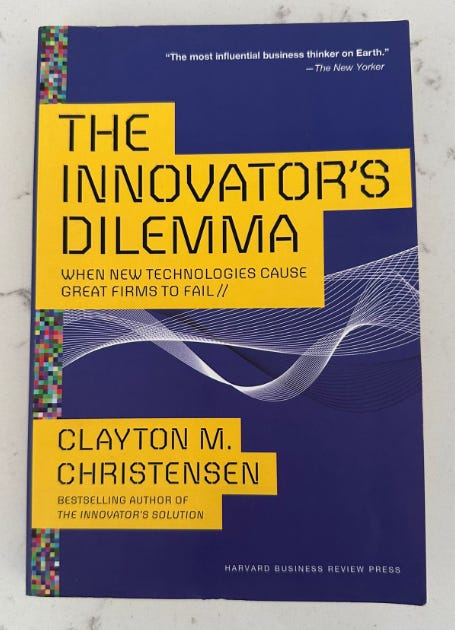

6) The Innovator’s Dilemma

The story of the disruptor and the incumbent

Clayton Christensen, 2016 edition

Pages: 237

Biding my time in the chasm between education and entering the real world, I undertook a master's degree which had a lot of modules related to innovation and entrepreneurship. I figured it would be a moderately relaxed way to kill a year while I figured out what I wanted to do. In one of those modules, I discovered Clayton Christensen. I refer to this book as the story of the disruptor and the incumbent. The book focuses on the business life cycle and competitive forces through the lens of technology. But the lessons expand outwith that relative niche.

When a legacy incumbent has built an empire upon a particular technology, moat, or whatever you want to call it, it becomes increasingly more difficult to “pivot” into the direction where consumer tastes are trending. This is why, so often, newly minted companies, unconstrained by a wide array of stakeholders and customers, are able to break through and steal market share. Another way of framing this book is a study of why great companies can fail. It’s a fantastic introduction to Christensen’s work and a must-read for anyone invested in industries prone to frequent disruption.

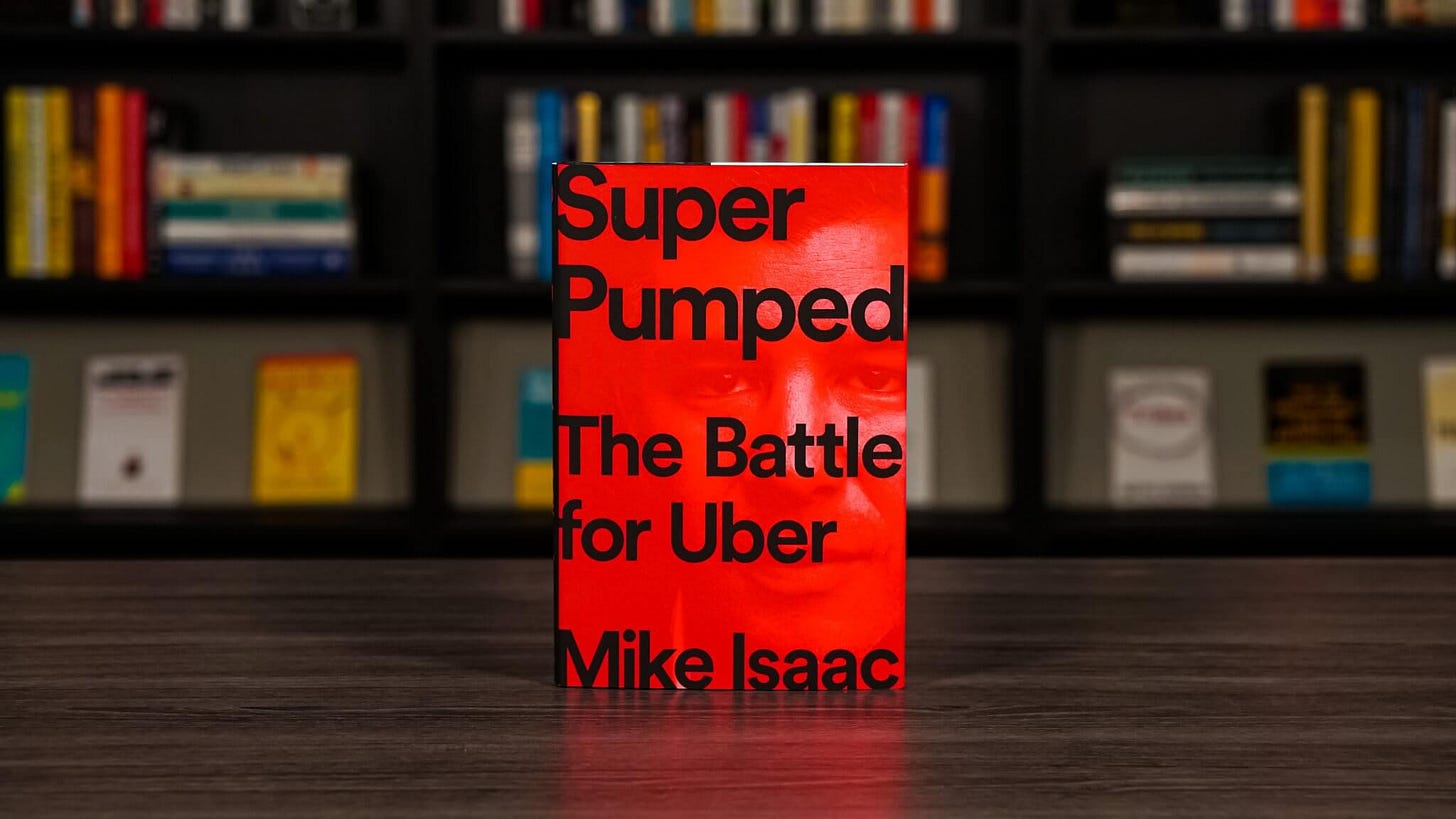

7) Super Pumped

Wild stories from the peak Silicon Valley days

Mike Isaac, 2019

Pages: 320

I remember reading this book during a period when my partner was out of town for a few weeks visiting family. Naturally, I had a lot of free time and burned through Super Pumped, the story of Uber’s founding and IPO, in a matter of days; mostly in the bathtub. More broadly, this is a genre of book I enjoy greatly; the founding stories of the world’s most successful companies. Super Pumped happens to be the one that I found most exciting and fun. I suppose it’s because of the elevated level of drama from their founding story, as well as the insights into what Silicon Valley was like post-dotcom bust, just as it was beginning to pick itself up again and explode into its next phase of growth.

Other books I have enjoyed in this category include, but are not limited to; Grinding It Out (McDonald’s), Pour Your Heart Into It (Starbucks), Shoe Dog (Nike), Losing My Virginity (Virgin), The Everything Store (Amazon), No Filter (Instagram), and An Ugly Truth (Facebook).

8) The Innovation Stack

Solving problems nobody has solved

Jim Mckelvey, 2020

Pages: 260

In the same period I read Super Pumped, I also happened to read Zero to One, An Ugly Truth, No Filter, and Jim Mckelvey’s The Innovation Stack. What begins as the founding story of a little company called Square, transcends into a discussion of what Mckelvey describes as the “innovation stack”; the intertwined tools, actions, and resources a company uses to innovate within their organisation.

The most profound portions of the book are the segments where Jim discusses the idea of building solutions for problems that nobody else has solved before. Something which, believe it not, Square did once upon a time. Part of their rise early on was related to their success in banking the unbanked; a novel concept at the time.

9) The Intelligent Investor

The supposed invested bible

Benjamin Graham, 1949

Pages: 640

This one is such a cliche, which gets a lot of eyerolls, but it belongs on my list. It happens to be one of the very first books I ever read on investing, at what must have been the age of 16/17. Naturally, I barely understood 80% of the book, but the parts that stuck with me related to the mental component of investing. I can remember the tremendous excitement this book instilled in me at a young age, and I am glad to say the passion has not withered away. While I never ended up following the value investor styling of Benjamin Graham, I believe there is more value to be derived from this book than that reductive assessment of its worth. Perhaps I have a sentimenal attachment to this book too.

It’s one of the few books I have come back to several times as I have matured. Mostly every review of this book will tell you to read chapters 8 and 20; the ones that discuss Mr Market and why he should be ignored, as well as the principle of margin of safety. It’s true, they are the most useful chapters of the book, and it doesn’t hurt to remind yourself now and then.

10) Expectations Investing

Finding stocks poised to beat expectations

Michael Mauboussin and Alfred Rappaport, 2021

Pages: 222

There is a chapter in Housel’s latest book called “Expectations and Reality” where he shares a quote from Montesquieu about happiness that goes like this.

“If you only wished to be happy, this could easily be accomplished; but we wish to be happier than other people, and this is always difficult, for we believe others to be happier than they are”. The chapter continues to explain why, despite living conditions being materially better today than they were decades ago, people still yearn for the past. The short answer is that people are only “happier” when the gap between what they have and what others have is narrow. Back in the 1950s, the gap was smaller, and so people felt better off. We base our happiness on the perceived happiness of others. Charlie Munger says the secret to a happy life is to have low expectations. These nuances between expectations and reality are present throughout every facet of life; including the stock market.

There is a sweet spot between what the market expects and reality. Howard Marks details this phenomenon in his book, The Most Important Thing, when discussing contrarianism. There is only value in being a contrarian when you have a contrary opinion to consensus, and that opinion happens to be right. When an investor is confident the market is wrong and the reality is that the market is wrong, there is an opportunity for an attractive return. This is a concept Mauboussin has spent his life writing about and does so incredibly well in Expectations Investing; a book which is littered with practical examples of how you can read price and fundamental data to capture those rare pockets of alpha. A more recent example of expectations investing in action is Nvidia. It has a pretty solid start to the year, people thought it was expensive, and then seemingly out of nowhere they aggressively revised guidance upwards, and the stock surged.

Mauboussin believes the key lies in finding stocks that are positioned to beat the expectations that have been set for them by the market. Once analysts have to readjust their estimates, the stock price soon follows. He suggests that a lot of insight can be learned from studying the company’s share price, using a range of discounted cash flow techniques. It’s a great book that will both make you a sharper analyst and alter the lens through which you observe the stock market.

11) The Little Book of …. Series

A collection of insights from established investors

A mixture of authors and published dates

Pages: Varies

Anytime a new investor asks me for a book recommendation, I direct them to the little book series. Some of these are iconic enough to warrant their own recommendation, and a few of my personal favourites include the little book of stock market cycles, the little book of behavioural investing, and the little book that beats the market.

These are perfect for high-level introductions to various investing concepts, asset classes, and styles. They are also written by relative experts in the field; including books authors by John Bogle, James Montier, Joel Greenblatt, Pat Dorsey, and Aswath Damodaran.

12) Common Stocks and Uncommon Profits

Philip Fisher’s simple approach to investing

Philip Fisher, 1958

Pages: 285

Phil Fisher’s Common Stocks and Uncommon Profits is a classic for good reason. This is the man who, alongside Benjamin Graham, was a model for Buffett’s own investment style. The book is packed with practical advice on the mental aspects of investing, advice on investment checklists, when to buy, when to sell, how to develop an investment process, and documents how investors can benefit from the art of scuttlebutt; one of Fisher’s lasting marks on the investment world.

While many investors kickstart their journey with The Intelligent Investor, I believe that Fisher’s classic is a more suitable introduction to the world of stock picking. It’s also one that can be revisited on a recurring basis.

13) The Magic of Thinking Big

Training the mind to think positively

David Schwartz, 1995

Pages: 320

I’ll start by saying the language in this book has not stood the test of time; it’s a little dated, contains some sexism, and so on. If you can look past that, there are some genuinely great teachings about how to train your brain to see the best in every situation. Personally, this book helped me with handling pressure, and setbacks, appreciating abundance over scarcity, and how optimism can help prevent pessimism from derailing progress.

One of the simpler ideas in this book, but one that stuck with me, is as follows. In every situation that you are faced with, you are in control of how you perceive and react to it. There is an eternal battle between two voices in your head; the one who puts a negative spin on things, and the one who looks for the positives. It’s a conscious decision to decide which of these voices to lean on, and there is seldom any benefit to you, or others, in subscribing to the view of the pessimistic voice.

14) Warren Buffett and the Interpretation of Financial Statements

How Warren Buffett finds durable competitive advantages

Mary Buffett & David Clark, 2008

Pages: 190

I picked up a copy of this book in my late teens when I discovered that I had better develop an understanding of accounting if I wanted to stop losing money in the stock market. In high school, I got a D in accounting but by the time I got to university, my grades turned around. Buffett describes accounting as the “language of business”. Therefore, understanding accounting and its nuances ought to be a prerequisite to picking individual stocks. I have also added a slightly more dated book, with a similar theme, from Benjamin Graham; Buffett’s mentor.

These books are suitable for newer investors because they break down the translation of accounting into high-level concepts without getting too deep in the weeds. They are also great for experienced investors to revisit because as much as we all think we soak up information and it remains in our minds forever, the brain has a tendency to eject things from our memory when we don’t revisit it often enough.

15) The Dark Side of Valuation

A masterclass in valuation and the business life cycle

Aswath Damodaran, 2009 (later editions available)

Pages: ~800

If the previous books are good for dipping your toes into the language of accounting, then Aswath Damodaran’s The Dark Side of Valuation is like an undergraduate degree crammed into a textbook. Make no mistake, this is literally a textbook; one which I stumbled across during my university days, and one which introduced me to Damodaran as an educator. Ideal for anyone looking to take their understanding of accounting and valuation to the next level.

This book covers a lot of ground; intrinsic valuation, DCFs, reverse DCFs, market cycles, capital cycles, business life cycles, valuing debt and equity, accounting, multiples, interest rates, macroeconomic data, evaluating companies in different stages of the lifecycle, sum of the parts interpretation, and a whole lot more. It’s a mouthful, but not something you need to read in chronological order like a regular book. It can stand as a solid reference point for particular practical use cases. It’s probably not a book for the average DIY investor, but if you are serious about valuation, I recommend it highly.

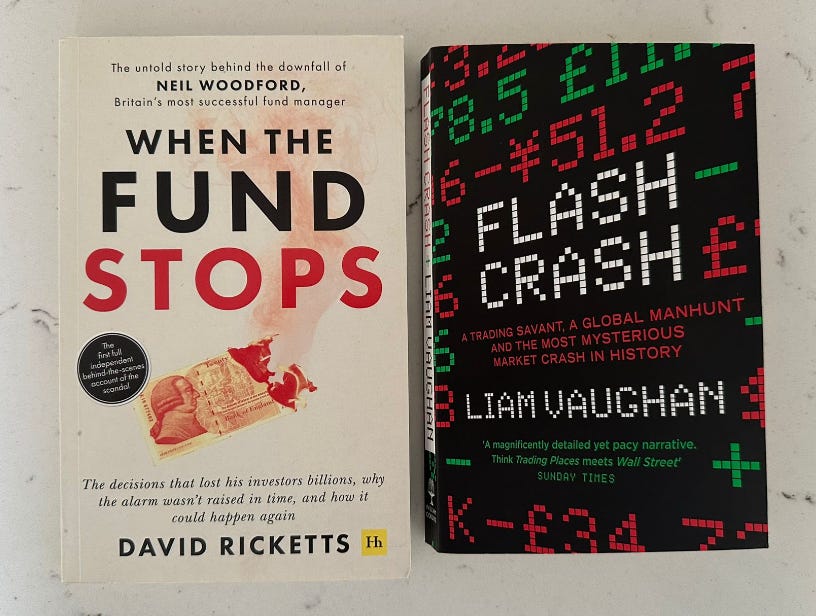

Bonus: When The Fund Stops and Flash Crash

A couple of fun narrative driven books

Neil Woodford (2021), Liam Vaughan (2020)

Pages: ~187 and ~226

To round it off, here are a couple of fun, short, books that detail a fascinating drama-infused story about investors in the stock market. Great for those looking to burn through a book in a few days, with excellent narrative building.

When the Fund Stops is a tale about how one of the UK’s most successful fund managers got himself into a spot of liquidity issues by investing in illiquid garbage and eventually blowing up his own fund.

Flash Crash is a bonkers story about how one London-based investor became one of the largest 5 traders of S&P 500 futures contracts by volume and played a part in the flash crash of 2010, all from the comfort of his bedroom using high-frequency trading software.

Well, that’s the list. I am always looking for more books of similar quality, so please recommend your favourites in the comments section if you have the time.

Honourable Mentions

Here is some other great stuff worthy of your time.

A concise memo on the nature of drawdowns from Chris Mayer, and how they are a necessary facet of owning winners.

Aswath Damodaran teaches how to value what you can’t see; intangibles, with commentary on the Birkenstock IPO.

The latest essay from Paul Graham discusses superlinear returns.

A great chapter from The Story of Warren Buffett that discusses the sons of Stanfard: the men of value investing.

Hey Conor. I've been hesitating on buffett interpretation of financial statements for a while. Did you learn anything new from the book or see it more of a refresher of concepts and for beginners? Thanks!

Great list Conor. Found few books to read from the list for next few months. thank you for sharing.