Why International May Finally be a Focus at Chipotle

Assessing the change in narrative for Chipotle's international expansion

A few months ago I wrote an article titled “What is the next burrito?”. Like Starbucks and espresso, Chipotle popularised a nascent food trend and built a scalable brand around it; growing like a weed in the interim. Investors want to discover these brands before they become mainstream. I offered a few suggestions, but as far as Chipotle is concerned, I concluded that the next Chipotle might be… Chipotle. While Starbucks went on to become a global enterprise, Chipotle is still, for the most part, confined to its domestic market.

After reporting third-quarter earnings a few weeks ago, the business looks to be in good shape as it approaches a $10 billion revenue run rate and is on track to open a record number of stores in 2023. With ~3,300 stores in their portfolio, investors were pleased to hear that next year’s guidance for new store openings (285 to 315) indicates an acceleration compared to the current year. Chipotle is a resilient business. After the catastrophic impact of the 2015 E. coli scandal, the business evolved and bounced back. During the pandemic, the business embraced digital, doubled down on drive-thru Chipotlanes and permanently shifted the volume composition of its stores.

Today, roughly 60% of a store’s volume is generated via the front-line service team, compared to ~80% pre-pandemic. This shift plays in Chipotle’s favour because its margin-accretive and helps bolster throughput; a variable the management team are fixated on. To me, there’s a lot to like. It’s a tried and tested scalable formula with great unit economics that is decades away from saturation. This is evidenced by the company’s solid restaurant-level margins; which stand close to 27% in 2023, as well as the healthy trends in average restaurant sales. Most importantly, while Chipotle has increased pricing on occasion to offset inflation, growth is still being powered by transaction volume; implying customers are absorbing higher menu pricing relatively well.

Under the hood, gross, EBIT, and net margins are improving annually, the company has no outstanding debt, a healthy balance sheet with ample cash, operating efficiencies with negative cash conversion cycles, and is expected to deliver double-digit growth for the foreseeable future. While the company is hardly a share cannibal, the company has knocked out ~11% of the sharecount over the last decade. While the vast majority of that came between 2016 and 2018, the board approved an additional $300 million authorisation in Q3, following their $226 million repurchase during the same quarter.

Before the pandemic, the company was targeting ~5,500 stores across North America. Recently, they upped their target to at least 7,000 on the back of their efforts to lean into digital (which accounted for 37% of sales in Q3) and drive-thru. Both of these factors play into Chipotle’s strengths. Domestic focus is an obvious strategy for Chipotle. It is where their brand is strongest, where their supply chain is optimised, where their playbook is established, where the affluent customers are, and where the known demand is. But to become a global brand they have to… well… become global and venture overseas.

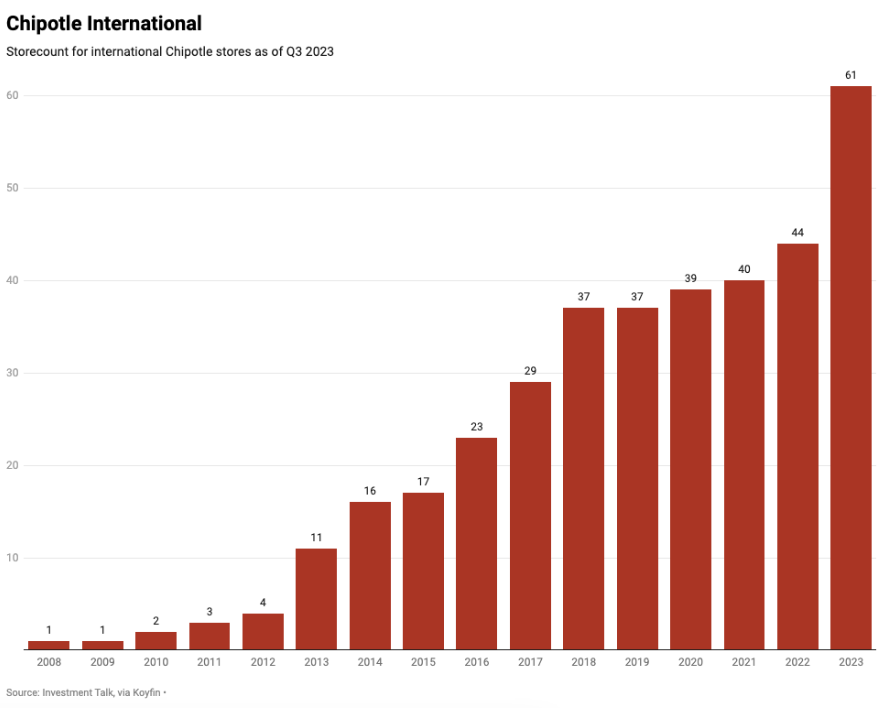

After launching their first couple of ex-US locations back in the early 2010s, most investors would be shocked to hear the company had only opened 61 international stores thirteen years later. It doesn’t surprise me its never been a focus. Chipotle’s outlay for marketing is typically in the low single-digit range as a percentage of revenue. To conquer continents like Europe or Asia, the company would likely have to endure decades of suboptimal cost structure as it builds out a supply chain network and awareness. Brian Niccol claims the top line component (demand, in other words) looks great in Europe today, but remarks they are still “working hard on how we get that to flow to the bottom line”. When comparing US and international expansion, for years the US has been the safest bet. Even today, management is claiming domestic store count can double before they even come close to their 7,000 target.

While domestic saturation is still a long way away, I have reason to believe that Chipotle are now in a strong position to expand internationally and that management may be telling investors this is the case.

International

Once every few years there is a wave of headlines that read something along the lines of “Chipotle is ready for global expansion”. Until now, when international activity finally looks like it’s about to be prioritised, those headlines have been misguided. It’s been an aspiration of the company as far back as 2008; when they opened their first non-US store in Toronto, Canada. Shortly after, they opened a few more stores, including some in London; their first venture into Europe. A lot of excitement was drummed up around the 2013 to 2018 era before Brian Niccol was appointed as CEO; when the expansion took a breather.

Read between the lines (the lines of the earnings call transcripts that is) and you’ll recognise that international development has long been a passing fancy. Not something management took too seriously and, to their credit, not something they got investors’ hopes up about.

After opening their first non-US store in 2008, John Hartung (CFO) would state “It won't be the typical venturing into international, where you're bleeding money for a long time because you've got this infrastructure, and you've got to grow rapidly to cover that infrastructure”.

When asked about Chipotle’s international expansion strategy back in Q4 of 2010 John Hartung would retort; “I guess the best way to answer that is that it's not a growth strategy still. And so what that means is we don't have a timeline for a kind of meaningful store opening plan. We don't have a timeline for when it will be meaningful to the business”.

In 2013 when John Hartung was asked about international once more he said “We don't really have a projection or a forecast to tell you that, okay, next year or the year after or so is going to contribute meaningfully to our unit growth or to our growth overall”.

Several years went by with no mention of international in earnings calls until 2017 when someone asked if there was any international growth to speak of. To which management replied; “nothing planned in international right now”.

During the 2018 ICR conference, management would continue to remark that “it's an opportunity for the future - but today it’s not a focus area”.

In 2019, new CEO, Brian Niccol suggested “down the road, we'll figure out how we pivot outside the U.S”.

Then the pandemic came and put a dent in any international expansion plans, as Niccol outlined during a Bernstein conference in 2020. A few months later, Niccol would say “over the next 3 to 5 years, I don't see any reason why we can't start having success outside the U.S”.

In the fourth quarter call of 2020, however, Niccol remarked there was still no plan for international; “We've not made decisions on how we want to enter those other markets. And frankly, we haven't laid out exactly the order of how we're going to do it”.

Commentary from Niccol between 2021 and 2022 became more positive, where he mentioned the optimism for the eventual international focus, and how he viewed it as a medium to long-term opportunity; beginning to put a timeframe on it. Yet, still, Niccol leaned on existing international markets as their area of focus.

In Q2 of 2023, things appeared to be taking a new turn. Chipotle made a change to its organisational structure that resulted in more capital being allocated to international expansion. Listed as one of Chipotle’s five key strategies was “expanding access and convenience” by accelerating new openings. Part of this strategy included “laying the foundation for an international expansion”. Chipotle have already begun shifting resources, both human and capital, to their European business, and recently reached a franchising agreement with the Alshaya Group, to open restaurants in the Middle East. Despite opting for the franchise model in the Middle East, Niccol claims they “still believe company ownership in Western Europe makes a lot of sense”.

In the most recent quarter, there was less direct discussion about international, but Niccol updated investors that a plan has been put in place to deliver economics and brand awareness that would support accelerated growth in Europe. I’ve read enough Chipotle earnings calls to be cautious of reading too much into this, but the language has changed. In days past management would quash international questions. Today, there is explicit communication as well as the movement of resources.

Why might now be the time?

The most obvious factor is size. Chipotle is now a business valued at more than $55 billion. Compared to the inception of their international exploits, the revenue pool is ~10x larger, the store count is ~4x larger, the free cash flow is ~9x larger, and the margins are much fatter. Put simply, they have a well-stocked pool of resources to take on some execution risk. The brand presence has also come a long way. Despite not operating heavily outside of the US, the Chipotle brand is already global without a physical presence. Quick-serve Mexican food was, at one point, an industry that included a consumer education learning curve. The concept was novel and most consumers were not familiar with burritos or Mexican food. In markets like the UK, brands like Tortilla Mexican Grill have reduced those barriers. Now, when Chipotle enters a new market that education barrier is considerably smaller, and it’s likely the market already has a faint awareness of the Chipotle brand. The broad improvement in digital adoption amongst the consuming public will also play into Chipotle’s strengths outside of the US.

Most importantly, the closer Chipotle gets to domestic maturation, the more incentivised it will be to hunt for new pockets of growth. North America presents an attractive reinvestment runway today but as the years pass store growth will have to be generated elsewhere. If you observe Starbucks, who are decades ahead of Chipotle in the business cycle, the vast majority of their store growth today comes from China.

There are structural factors to consider here, however. Increased marketing spend, lower pricing power, weaker margins, and operational inefficiencies, to name a few. As a shareholder, I believe that domestic focus continues to be the best bet for Chipotle at this stage, but the prospect for this business to finally allocate more resources to international expansion is one that excites me for the years ahead.

Thanks for reading,

Conor

I think another challenging aspect of Chipotle’s international expansion is the supply chain, and whether the quality of ingredients demanded by Chipotle can be maintained efficiently. It’s already difficult in N America, my guess is that it would be a tad more difficult at a large scale in other geographies.

CMG should have considered expansion into China looooong time ago. if a tea drinking population can accept coffee, then the same rice-mixed with vegis and meat-eating population can certainly accept, wait for it, well a bowl of rice mixed with vegis and meat!