What Inning Are We In?

Demystifying a common baseball analogy to make you sound smarter at dinner parties

Investors love using sports metaphors. The other day I heard someone say they think we are in the 3rd inning of this market. This baseball analogy is one I have heard numerous times, and it used to fly over my head because the sport is not popular in the UK. Eventually, it resurfaced enough times that I ventured to understand its meaning. If you are unfamiliar with cricket or baseball, I suspect the metaphor might also be lost on you.

In baseball, a game is divided into nine innings. Each inning has two halves; the top and the bottom. In the top half of the inning, the visiting team bats while the home team fields. In the bottom half, the roles are reversed. The batting team want to score runs (when they complete a run around all the bases) and the fielding team want to score outs (rendering a batter or runner unable to play). There are numerous ways a player can be put out, but it’s not important for this conversation. If a team gets three outs during an inning, the inning ends and it’s time for the other team to bat. The game continues until the nine innings are over, or until one team accumulates 10 runs. If the score is tied at the end of the nine innings, it goes into extra innings, where a team must lead by two runs to claim victory.

All you need to take away from this is that as the number of innings played increases, the end of the game edges closer. Investors, therefore, draw comparisons between the maturation of a baseball game and identifying what stage of the market cycle we are in. An important distinction is that there can be no innings without a game in play. Therefore, the concept of innings and the market cycle refers to which stage of a bull market we are in. There are no innings for the stage when everyone is crying into their shirt pocket. At this point, the game is temporarily over, everyone must go home. There are many versions of the market cycle, so we’ll keep it simple and stick with John Templeton’s; bull markets are birthed in pessimism and cremated in euphoria. It’s during these later stages of the cycle that investors become concerned about having to pack up and start all over again.

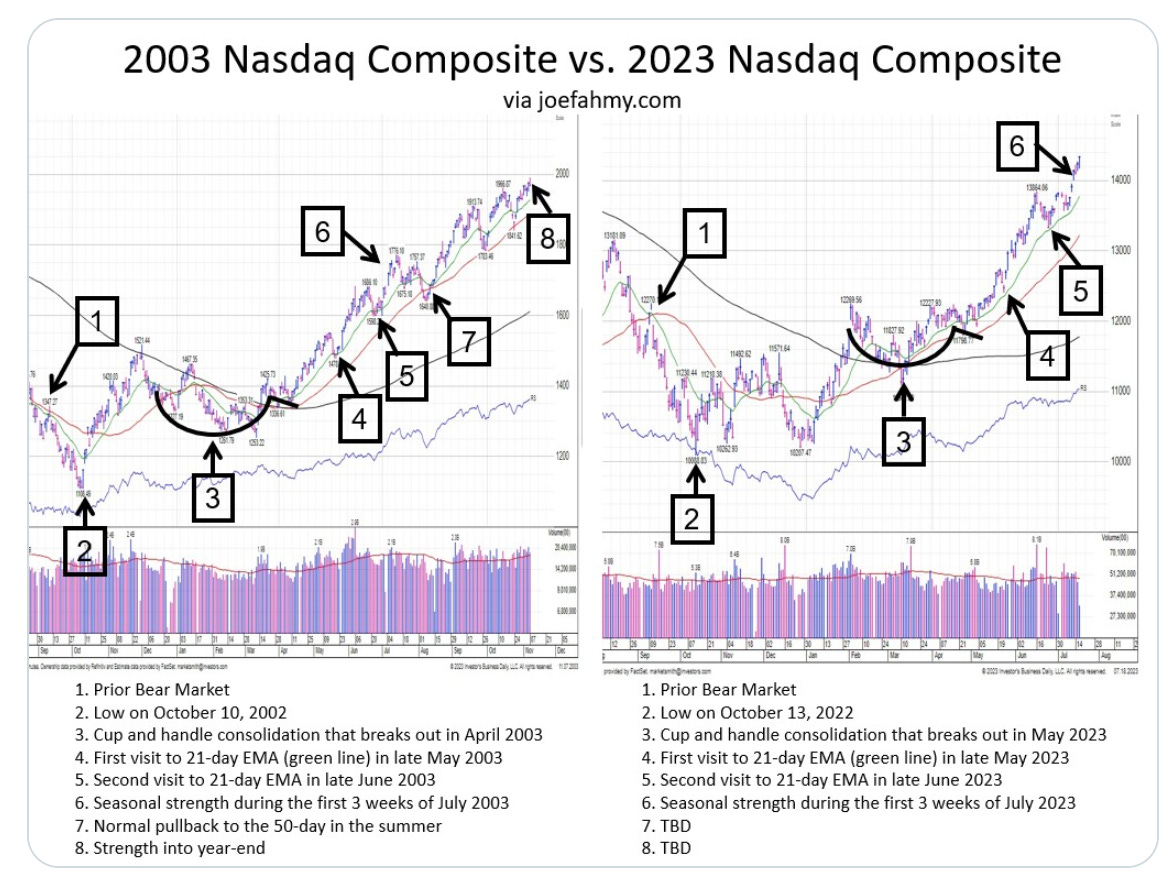

The batter and the investor are quite alike. Both have to make decisions about when to swing and when to exercise patience. Both are exposed to outcomes which dance with the variables of skill and luck. They both want to hit home runs… But unlike baseball players, who go home and live to play another day, the end of a market cycle can be incredibly wealth-destructive to an investor. These outcomes may have a significant influence on our net worth; naturally, it’s within our nature to want to know when the next bull market is about to collapse or when a new one is set to begin. And as Joseph Fahmy, Advisor at Zor Capital, recently reminded us; “history doesn't always repeat itself, but it tends to rhyme”.

The fact that history has a tendency to rhyme tricks investors into assuming they can predict what happens next when those repetitive patterns emerge. The idea is that a bull market is supposed to pass through various innings before it abruptly ends and starts over. There is no need to overcomplicate things; having a definition of each inning. You could illustrate the innings as quarters (now we are moving on to NFL analogies).

• First Quarter: Young bull market, the hype-cycle starts spinning, multiples begin to re-rate and optimism returns. There are still bears talking about projected earnings looking weak. An earnings reccession is still present on a trailing basis. Leading macroeconomic indicators look positive.

• Second Quarter: Earnings and fundamental estimates are revised upwarwards in light of more optimistic outlook. The market begins to react positivley.

• Third Quarter: Somewhat of a lock-out rally. The market continues to march on. Those who were previously sceptical and sitting on the sidelines give up and join in. This is called "the chase".

• Fourth Quarter: Excuberence follows complacency. Markets can stay irrational for a long time. The much-anticipated blow-off top seems to take forever to come. So long in fact, people forget they were anticipting one. They settle into the new normal, they get greedy. Then BAM, it all comes crashing down. It doesn’t really matter what exact inning we are in, because this is hardly an exact science. It might be better to focus on the early and late innings. In other words, ask if the party is just getting started, or if someone has just turned the lights on at the afterparty and you suddenly start questioning your life decisions.