Good morning,

Today i am happy to bring to you another classic slice of educational market theory.

Sir John Templeton, a well known fund manager, once said;

“Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria”

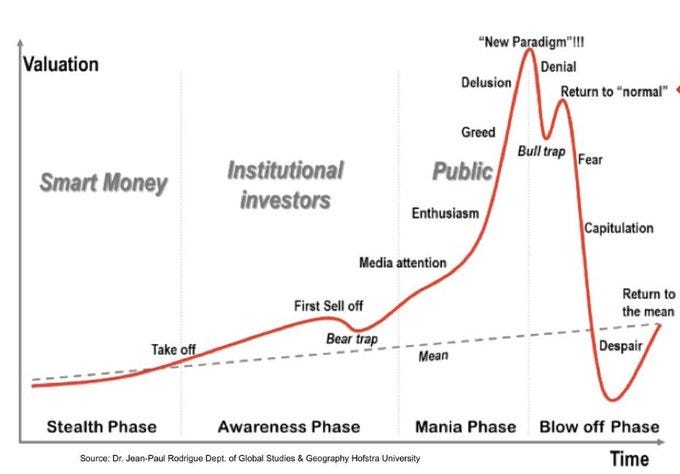

The idea that John coined here relates to the relationship between market sentiment and market cycles. See below for the illustration of the Templeton Curve.

The above diagram was created to highlight the usual evolution of investor sentiment during a bull market cycle.

Pessimism

At the early stages of the bull market, stocks are climbing their way out of the shallows of the last bear market. This stage is mostly catalyzed by an improvement in underlying economic fundamentals. Bull markets usually start at the depths of a bear market. When all hopelessness has been priced in to the market. Thus, bull markets tend to start when the broad scope of investor sentiment is pessimistic.

Skepticism

As the aggregate economy/market recovers, pessimism will be replaced by skepticism. Whilst the recovery and retracement may be underway, a vast majority of the market find it difficult to forget the recent bear market, and the potentially large losses that came with it. It can take time for the wounds to heal, and a great deal of investors will be hesitant to jump back into the market at this stage. Fears of a second drop will loom and media headlines will likely be filled with pieces on whether this bear market is over yet, anticipating a potential reversal.

I do recall that Benjamin Graham once said:

“Buy when most people, including experts, are pessimistic, and sell when they are actively optimistic.”

Optimism

Over time, as the previously skeptical investors see that the market has slowly been building, they will then become optimistic about the market and the future. At this point, they will cautiously get back in to the market. During this phase, we can expect economic and business fundamentals to be fairly strong. News outlets and investors will still find things to be concerned about however.

These may include slowing GDP growth, interest rates, commodity prices, and a host of other economic factors. At the same time, the market will continue to move forward.

Euphoria

As the bull market strengthens and lengthens, those investors who suffered in the previous bear market will start to get investor amnesia. During this phase, expect to see wide-spread adoption of investing. Your neighbor, her mother, your postman, all telling you to buy XYZ because it’s the hot stock of the month.

Media headlines will now typically be majorly optimistic about the future. They may discuss a new paradigm or a new hot industry, that will lead the charge forward.

You may see an increase in the frequency of overpriced IPOs at this stage. Back in this newsletter i covered that idea.

Notably, the quality diminished, the frequency increased, and the overvaluation also increased in the run up before the 2000 dot com crash.

In euphoric market cycles, investors will be highly convinced that the market will still continue to climb forward, often because ‘it’s different this time’.

Euphoria in itself does not cause a bear market. More so, when the euphoric market valuations become so detached from reality that the demand for the stocks catches the upper limit, and there is no more demand to drive prices higher.

The greater fool theory dictates that you must find a greater fool to buy the item from you at a higher price, and that is the incentive to buy. Once that cycle stops, things can crash. Equally, when that becomes the rational for investing, beware.

Investor sentiment, alone, usually does not have the power to end a bull market run, or conversely jump-start a recovery from a bear market. Investor sentiment can, however, be a useful indicator as to what stage the market cycle is currently in.

The bear market that begins at the end of a euphoric stage in the cycle typically includes a great deal of fear, worsening economic conditions, and the disbelief that the market will recover.

Understanding which phase of the cycle we are in, is a valuable insight to have as an investor. During the peak of euphoria, the implied financial risk is at it’s peak. We have a great deal of overvaluation and despite the market’s ability to stay irrational for a long period of time, we have limited upside, and potentially endless downside.

Conversely, during the depths of a bear market when asset prices are extremely depressed, even more so than their actual worth, this poses limited downside and the greatest level of upside.

If you had bought shares of Cisco Systems back at the peak of the dot com euphoria period in 2000, you would still, 20 years later, have negative returns. The stock took 2 years to bottom out, and then slowly ascended (with bumps) for 20 years to a point that is not even 70% of the highs of 2000.

The valuation at which you buy into a position matters.

Here is another interesting chart about the phases of market cycles.

Take a look, and gauge where you think we are right now.

Personally, i feel we are somewhere either in the ‘take off’ phase or the ‘return to the mean’ phase. However, there is strong evidence to suggest we are in the ‘return to normal’ phase and are on the heels of a large and unprecedented decline into capitulation.

However, i personally think we had extreme capitulation back in March where markets fell over 30% in the space of three weeks.

By June, we had retraced over 75% of the previous lows, later retracing all of it. Never before has a retracement that covered even 60% of the prior low, went on to retest the prior low. If we should, it would be a first-ever. Despite that not being impossible, it is highly unlikely in my opinion.

Drop a comment and let me know which phase you think we are in, and why.

Take a look at the below chart, highlighting the S&) 500 of this year versus the average S&P 500 bear market. The stretch of time from the peak, to trough, and recovery is incredibly short. The wavers, in comparison to the typical bear market cycle, which slowly unwinds, has a great deal of decline around 300 days in, and then slowly recovers, all over a number of years.

In this way, the March crash behaved more like a correction, as opposed to a bear market. The correction would therefore indicate that we are still following on from the previous bull market that was taking place prior to corona virus. Note here, that this is simply rhetorical, i am not making any judgement here, just stating what i see.

For newer readers who may not be aware, a corrections typically a period, within a bull market, that ‘corrects’ and reversed the price trend in the region of 10/20%. From which, the bull market will continue. A bear market, on the other hand, is said to be present when the market declines more than 20%. Following on from which, the market will typically take a number of years to recover to previous highs.

We can clearly see that the S&P 500 entered bear market territory in March, declining 31%.

However, the market as a whole has behave more in line with a correction. The level of volatility, implied via the VIX, has been outstanding in 2020. but is now slowly winding down.

Who would have guessed, if i had told you in January that the broad indices would witness a 30% or greater decline in value, and then be back to all time highs before the year is over?

Not me that is for sure.

This is partly the reason why market timing aught to be a sin, but that is a topic for another day.

I hope that brought a little value to your morning

IT