“I couldn’t be more excited to begin delivering the best of the US to all UK customers,” remarked Vlad Tenev, CEO of Robinhood, in a tweet posted yesterday. The retail brokerage app that took US investors by storm has been voyaging towards the UK for years. Three years ago, the company attempted to dock on British soil but aborted last minute. Their third attempt looks set to be official. The app that shoots confetti at users for buying out-the-money call option contracts has landed on British soil. On Thursday, the company opened a waitlist for UK customers as Tenev looks to benefit from the UK’s “sophisticated” customer base. Early access will roll out across the following weeks, reaching full availability in early 2024.

Tenev views the government’s decision to lower business taxes as a “clear [sign] that there’s a desire and a plan to make the UK the best place for business”. Despite the UK’s long-standing status as a financial hub for global finance, the population’s appetite has long been muted. Compared to our American cousins, where more than 50% of adults invest in stocks, the UK’s participation rate sits in the low 10s and has been declining for years. There has been progress in encouraging individuals to invest made by newer entrants to the market in recent years; most notably Freetrade and Trading 212. Between them, the retail-friendly brokerages have mustered 1.4 million and 1.5 million users, respectively.

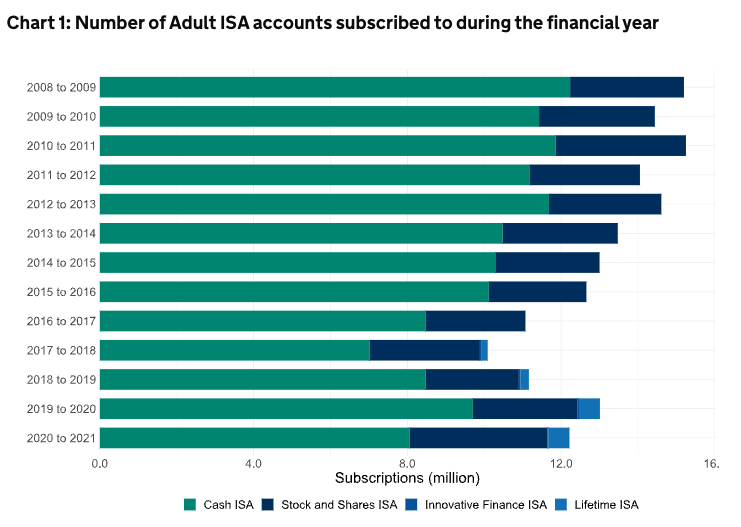

While Tenev cited that Hargreaves Landsdown still charges exorbitant commission fees as a nod to the market share Robinhood hopes to capture, it is Freetrade and Trading 212 who should be his largest concern. While the trio of retail-friendly brokerages will be attacking incumbents like Hargreaves together, both Freetrade and Trading 212 have already carved out market share based on the value proposition that Robinhood is offering. Both brokerages already charge 0% commissions, they have clean, simple UI/UX, and they provide education for their investors. Furthermore, the duo offer the all-important stocks and shares ISA, and Self Invested Pension Plan (SIPP) accounts. The former allows investors to invest up to £20,000 per year within a tax-exempt wrapper. A customer with a UK ISA has no reason to utilise a general investment account (taxable) until they fulfil their ISA allowance in a given year. The majority of UK residents can’t even afford to do so. We don’t exist in a perfectly rational world, however. The education barrier in the UK is still high. As great as the stocks and shares ISA product is, it remains underutilized by UK residents.

Robinhood is not launching with any of these UK-specific savings accounts, but has plans to and is in talks with regulators. So what are they offering?

They are coming in aggressively, offering users access to more than 6,000 US stocks and ADRs, no commission or FX fees, a 5% cash interest rate, and 24-hour weekday trading; the latter is unique to Robinhood. This, of course, all comes wrapped in Robinhood’s simple and intuitive platform interface. The company has also pledged a commitment to financial education offering in-app tools comprised of “easy-to-understand financial education resources developed with the modern investor in mind”.

Objectively, none of this is all that new for UK investors. What worked well for Robinhood in the early years of its US expansion, may not work as well in the UK, which has long adopted zero-commission trading for retail investors. Another factor of Robinhood’s success overseas was its reliance on payment for order flow. A practice that is banned in the UK; payment for order flow is a method of compensation where a brokerage receives payment based upon the volume of trades it routes to market makers.

In an interview with Bloomberg, Tenev suggests that the efforts Robinhood have taken to diversify its business means that the absence of payment for order flow will not be a problem in the UK; products like Robinhood Gold subscriptions and stock lending were cited as examples. While it is true that payment for order flow is a smaller slice of the revenue pie than in years past, Robinhood already has the technology and services to ensure that the incremental cost of serving UK customers is lower than what it would have been in the early days of US expansion. That said, it wouldn’t be unreasonable to assume that the US business will subsidise the UK businesses initially, at least on the bottom line.