Resources, Resources, Resources

A compilation of financial data & research tools, newsletters, publications, and alternate data sources that I utilise

Last Updated June 27th 2023

Good morning,

After surpassing 22,000 total readers for this newsletter, I decided to update this curative article, which was immensely popular upon its initial release. In this article, I have highlighted a vast collection of resources that I use recurringly which cover financial data & research tools, newsletters, and alternate data.

There are going to be omissions of some great services/products, but I wanted to only highlight those which I personally use often. If you feel any have been missed or would like to recommend some to me (as it’s likely I am simply not aware of them) then please leave a comment at the bottom of this memo. Links to the discussed sites should appear as purple text on web or email, and as bold underscored text on the Substack app. In some cases, I will leave a button.

Financial Data Tools

There are many financial data tools out there for gathering macro and fundamental data and earnings transcripts. I will be sharing only the ones I use personally.

Koyfin - Multipurpose Financial Data Tool

Use Case: Koyfin is my go-to, daily, data tool. For what is basically a Bloomberg Lite, I use Koyfin as my daily hub for all things fundamental and macro-related. I utilise the dashboards to monitor my own holdings where I can aggregate both of my portfolios into one place, the filings & earnings transcripts features to stay abreast of developments, the news feed (tailored to my own holdings) for similar purposes, and the financial analysis tools to quickly pull fundamental data, as well as chart it. There is not a tool that I use more often, nor one that is more integral to my process, than Koyfin.

The price ranges from free, to basic ($15p/m), to Plus ($35p/m) to Pro ($70p/m). I happen to think that Plus is the ideal tier for my use case as this includes unlimited watchlists/dashboards/chart templates, as well as full access to filings/transcripts, earnings estimates, fund exposure, and the snapshot feature.

SEC Filings and IR Pages - Good Old Primary Data

Use Case: I think it goes without saying that every investor should utilise SEC filings (whether located on the investor relations page or the edgar site). Primary information, right from the source. Again, this is likely my own personal taste seeping through, as you can view a feed of filings on something like Koyfin, but I still find myself using Investor Relations pages like a neanderthal. So that I am not completely wasting your time with this one, here is a hack to set up your own automated system to allow relevant filings to be delivered straight to your email inbox for the companies that interest you.

Step 1: Create a new customised email for the purpose of alerts.

Step 2: Every company has an “email alerts” resource on its IR page. Find the companies you want to receive alerts from, and click it.

Step 3: You will then be asked what alerts you’d like to subscribe to. Typically this covers news, SEC filings, annual and quarterly reports, events & presentations, and maybe daily or weekly stock quotes. I tend to tick everything apart from the stock quotes as they can fill up your inbox, and are somewhat irrelevant.

Step 4: Simply plug in your customised email address, and repeat the process for every company you wish to track.

Step 5: Sit back and receive automated email alerts every time your basket of companies issues a filing.

Honourable Mentions

A few honourable mentions to services I have used in the past, or only use sporadically.

Quartr: Quartr began life as an audio-centric transcript app, allowing users to listen to earnings calls on the go. Today, they appear to be evolving, allowing for searchable terms in transcripts, providing supplementary filings, and so forth. I do enjoy using it when I am commuting or running, but as more of a transcript reader than a listener, it’s not one I use more than a handful of times each quarter.

Alternate Data

Below is a list of services I use that offer insights outside of the realm of those I shared in the above segment.

Standard & Poors & Moody’s - Credit Ratings and Research

Use Case: I believe that both services are underutilized by retail investors. Standard & Poor’s and Moody’s provide credit ratings on the debts issued by public entities. In addition, they also publish concise reports outlining why those ratings have been ascribed that dive into the view of the company’s financials from the perspective of a lender (liquidity, solvency, cash flows, et al). These reports are superb ancillary sources of research to attain a more rounded perspective of companies you own or are studying.

Whatsmore, each platform published heaps of industry-level reports on a frequent basis, and much of the content can be accessed simply by creating a free account. Once you’ve done that, search for the tickers of interest, and knock yourself out.

Yardeni Research - High Quality Global Market Data

Use Case: Yardeni Research is a sell-side consulting firm that churns out an ungodly amount of highly informative, and free, information and charts on everything you could imagine that relates to global markets, indices, macro & micro, multiples, fundamental and technical indicators, consumer data, and more. If you have ever seen a chart shared on Twitter that looks like the one below, it’s from Yardeni. I visit the portal weekly to recalibrate myself to what’s going on across global markets.

The data is updated frequently, and there are too many valuable reports in the Yardeni library for me to really do it justice. I’d suggest you just hop on, have a browse through the categories and explore for yourself.

JP Morgan Guide to the Markets - Quarterly Global Market Data

Use Case: Similar to that of Yardeni. Each quarter, JPM will issue a new report (which can be downloaded as a PDF) covering equities, the economy, fixed income, international, alternative investments, factors, industries, and so forth. It stands as a snapshot of the prior three months (and further back), and recalibrates my understanding of where the market currently stands.

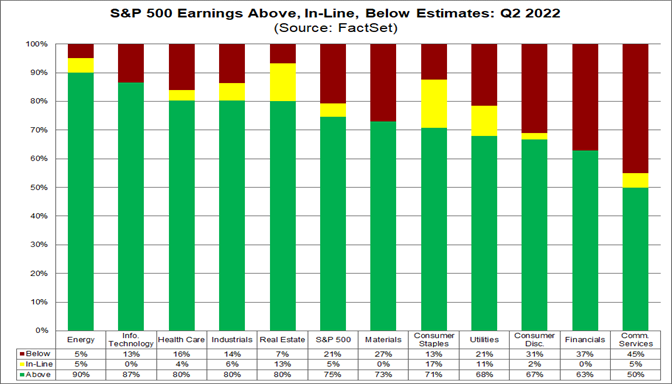

FactSet Insights - Market & Earnings Insights

Use Case: Factset is a financial data service business, that offers a service similar to a Bloomberg Terminal for a slightly lower price. But I am here to talk about Factset Insights, a subcategory on their website that shares articles and reports on a number of topics. Of particular interest to me are the ‘Companies and Markets’, ‘Earnings’, and ‘Economics’ reports they send out. If you have seen me sharing charts like the one below over on Twitter, they are from Factset reports.

These reports are free to access (I recommend subscribing to get them in your inbox) and contain excellent commentary on global markets using their data, as well as more granular insights into earnings periods (relative to expectations, historic averages, et al).

A List of Additional Alternative Resources

• Fred: Economic Data from the Federal Reserve

• FreddieMac: Mortgage Rate Data and Real Estate Research

• US Bureau of Labour Statistics: Macro & Micro Economics Data

• Lloyds Bank: Economic and Market Insights

Newsletters & Publications

Several times a week (typically Monday, Wednesday, and Friday) I open up my publications folder and select “open all”. I will then proceed to pick out a handful of articles that I wish to read that morning. There are reams of newsletters that I subscribe to, and so I have opted to create a top 12 (in no particular order of importance) to simplify things and highlight those which I read most often.

I will leave a shorter description of the other publications I subscribe to afterwards. It is quite likely that I have missed some out by mistake.

(1) TSOH Investment Research Service

Content Focus: Equity Research

Cost: Free Previews or $29 p/m

Synopsis: Alex is a fantastic analyst and one that has spent more than 10 years in the industry on the buyside. A few years ago he left that stable career to pursue TSOH. Today, he is a one-man team, churning out a consistent swath of succinct, informative, and to-the-point research on companies that he both owns and studies and shares his own holdings transparently. There is a sense of continuity that is hard to place my finger on. Somehow he manages to smoothly follow up on companies he writes about in a way that allows long-term readers to follow along the journey of his own research into companies on his radar.

The reports are brief enough to be consumed within one cup of coffee, but informative enough to understand the KPIs of any business discussed. The greatest value I attain from Alex’s work is that his writing improves my own research process, observing how he picks apart certain companies, what he feels to be important vs less important, and the reinforcement of the importance of process & mentality that is sewn between the lines of his prose. Whatsmore, I find it to be an excellent form of idea generation.

Content Focus: Curation

Cost: Free or $15 p/m

Synopsis: Liberty’s highlights are the epitome of curation across finance, tech, science, history, and outright randomness. Issuing 3x newsletters each week, I rarely know what to expect, nor do I really care. Each issue never fails to provide me with something interesting and I find the commentary sprinkled throughout to be deeply intellectual, reflective, and humorous. It’s a newsletter that often leaves me pondering, great for the brain receptors. Amongst the large volumes of stock market-related content that I consume, Liberty offers me a refreshing splash of colour. At the very least, reading Liberty’s Highlights will make you a much more interesting dinner guest.

Content Focus: Investment Process, Fundamental Analysis

Cost: Free

Synopsis: Authored by the Dean of Valuation, Aswath Damodaran. Speaks for itself. As an acting professor at NYU Stern, each article posted by Damodaran is like going back to university, but in a good way. Whether it’s breaking down macro, educating on the nuances of fundamental analysis, or analysing the instinct value of particular stocks, I am consistently in awe at the quality of the content that the professor shares. Follow his writings, and you’ll bag yourself a free education in valuation.

(4) Counterpoint’s Consilient Observer

Content Focus: Valuation & Decision Making

Cost: Free

Synopsis: Authored by Michael Mauboussin and Dan Callahan, the memos circulated from the Consilient Observer is of the highest quality. At times bordering on the academic, the issues are concise enough not to lose the attention of the reader and tend to focus on one core theme. These memos dig deep into the practical understanding of financial statement analysis, from SBC dilution to the expense treatment of intangible vs tangible assets, base rates, and DCF models. They also venture into broader topics such as observations in the creation and maturation of new markets and the unit economics of particular sectors. If I had to describe it in one sentence, I would opt to suggest that Dan and Michael’s publication translates the language of accounting to strengthen the reader’s understanding with both practical demonstration, and thought-provoking inquisitiveness. Each issue is a masterclass in analysis.

(5) The Transcript

Content Focus: Companies, Markets, & Earnings

Cost: Free or $20 p/m

Synopsis: Essentially the outsourcing of a team of analysts to pour through all the transcripts you don’t have time to, boil them down into key points and themes, and send them directly into your inbox. The team does an incredible job of composing narratives and keeping them concise, and one of their founders, Erick Mokaya is a deeply impressive individual who deserves every success.

(6) Neckar's Minds and Markets

Content Focus: Dissecting the mind of operators

Cost: Free or $12 p/m

Synopsis: Neckar is another incredible curation and thinker. Often focussing on what the greatest investors are saying, or have said, he eloquently curates his themes with a healthy measure of his own commentary sprinkled throughout. You will always learn something new in each edition.

(7) Intrinsic Investing, by Ensemble Capital

Content Focus: Investment Process

Cost: Free

Synopsis: The Ensemble Capital blog, authored by Sean Stannard-Stockton et al, is one that I enjoy because of the consistency in their mantra of true long-term investing. These are folks that really do block out noise from their decision-making. The majority of memos are centred around investment processes, with the occasional splattering of commentary on names within the Ensemble portfolio.

(8) SemiAnalysis

Content Focus: Semiconductors

Cost: Free or $17 p/m

Synopsis: Semiconductors are well outside of my circle of competence, but they are such an important component in the modern world. Dylan Patel is my go-to semis guy as he is highly informed about the space, but manages to write about the space in layman’s terms for us dum-dums. The content matter will vary between research into the technology of the industry, individual companies, the industry as a whole, geographic competition, legislation, and more. I am a subscriber of the free version of SemiAnalysis (the paid version is outwith my needs currently) but still find that I get an incredible amount of information all the same. I don’t own any pure-play semi-companies currently, but given that 99% of the companies I own rely on them, I find it prudent to increase my understanding.

(9) TKer by Sam Ro

Content Focus: Financial Journalism, Curation

Cost: Free or $8.25 p/m

Synopsis: A review of Sam Ro’s Tker remarked the following: “Sometimes a financial journalist is so good at what he does that he becomes his own brand”. Upon reading that, it felt like the best way to describe what Tker is. As a tenured financial journalist, Ro’s newsletter covers a lot of ground and oscillates between macro, the stock market, headlines, and the great corporate shuffleboard. I will repeat that I am not someone who is a headline watcher. That’s because I have folks like Sam who will do that for me, compile it (those headlines which actually matter) alongside the data, and present it to me in a curated, bite-size, fashion. A great newsletter for people who are lazy with respect to keeping up with the news and macro.

(10) Asian Century Stocks

Content Focus: Asian Markets

Cost: Free or $29p/m

Synopsis: I have sung Michael’s praises before throughout Investment Talk, but he operates the greatest newsletter that covers the Asian markets, in my opinion. With so many authors fixated on the US, Asian Century Stocks provides deep dives on Asian companies, thematic reports on Asian markets and industries, interviews with investors, and curation of Asian-related news. I am a free subscriber and find that there is still an excellent cadence, quantity, and calibre of work being shared with me. A must-have for anyone who has (or wants) exposure to Asian equities.

(11) Valuabl

Content Focus: Macro & Equity Research

Cost: $800 per anum

Synopsis: I believe that Valuabl may be one of the most underrated newsletters out there. Once every other week, Edmund Simms sends out an issue of Valuabl, and within that one issue there is a humorous cartoon, an update of the cost of capital, the debt cycle monitor, an aggregate look at regional valuations in stock markets across the world, all of which is concluded with 1-2 investment ideas that are sharp, to the point, and come with a robust valuation and sensitivity analyse and rating. The consistency and quality of Edmund’s work are quite something, and I most greatly value the investment ideas segment for reasons already alluded to in other publications. The form of presentation within those ideas is unique, succinctly capturing both the qualitative (narrative) and quantitative elements of a business and really driving home what the KPIs are for the thesis.

(12) Apricitas Economics

Content Focus: Macro

Cost: Free or $15 p/m

Synopsis: Authored by Joey Politano, whom I had the pleasure of interviewing in November 2022. There is a special place in heaven for people who can simplify the understanding of economic policy as well as Joey does. He finds nuance in the detail and is able to separate the wheat from the chaff, as it pertains to economic data.

Other Informative Publications

It’s tough to boil down a top 12, as it leaves out many great publications that I read frequently. Here is a list of other high-quality newsletters are newspapers that I enjoy reading.

Newsletters - Equity Research Focus

• Mostly Borrowed Ideas: One incredible deep dive per month and the granularity with which Abdullah explores the companies he writes about is fantastic.

• Punch Card Investor: Great deep dives.

• The Transcript: The finest curator of earnings calls on this planet.

• StockOpine’s Newsletter: Excellent equity research and earnings profiles.

• Invariant: Some outstanding, differentiated, research pieces.

• Macro Ops Musings: A blend of equity research and market commentary.

• The Crude Chronicles: A focus on energy, macro, and oil companies.

• Musings on Markets: Authored by the Dean of Valuation, Aswath Damodaran. Speaks for itself.

• Rational Reflections: Solid curation, occasional business profiles, and a fetish for Warren Buffett.

• Analyzing Good Businesses: Monthly write-ups of interesting stock picks.

• Margin of Safety Investing: Searching for compounders.

• The Investor's Journal: Candid observations from a tenured investor.

• Vestrule: High-quality individual stock write-ups.

• My Investing Journey "From $100K to $1M" & More.: Great curation and insights from an individual investor seeking to 10x a $100K portfolio.

• Security Analysis: Write-ups about value stocks from Value Stock Geek, who fathomed the ‘weird portfolio’, which is dope.

• Best Anchor Stocks: Solid GARP write-ups from my buddy Leandro

• Invest Karo India: A mixture of Indian and US company & industry write-ups.

• Scuttleblurb: A legend in the space, high-quality investment write-ups.

• Analyzing Good Businesses: One solid company write-up every three weeks.

• Cedar Grove Capital Management: Equity research, curation, commentary, all very good stuff from Paul Cerro over at CG Capital.

• Value Situations: Solid curation of value and special situations

• The Special Situation Report: Curation of Special Situations, M&A and Shareholder Activism.

• Grizzly Research: Good for sporadic short reports

• 310 Value’s Newsletter: Solid equity research from a buyside investor.

• Stock Market Nerd: Deep dive research and earnings profiles.

• Trading Engineered: An excellent newsletter for traders, authored by Richard Moglen.

• Below the Line: Hard to pinpoint exactly, but it’s random, it’s well written, and I am always left happy. Business, trends, business models. IDK, it’s just great.

• Kingswell: Everything Berkshire.

• Emerging Value: A focus on undercovered stocks.

• Overlooked Alpha: Concise research notes on a wide range of companies, with the aim of providing investment ideas.

• Holland Advisors: Occasional company write-ups with a strong backlog.

Newsletters - Macro

• Apricitas Economics: Finds clarity amongst noisy macro data.

• The Morning Hark: Daily briefings of everything macro.

• Concoda : Macro analysis of the highest order, with sharp wit thrown in.

• kyla’s Newsletter: Economic and market commentary from Kyla Scanlon, presented in a vibe-friendly way.

• Doomberg: Economics, markets, green chickens, and policy

• The Last Bear Standing: Weekly dissections of complex themes, written in a way a child could understand.

• Daily Chartbook: Daily scrapes of the most interesting market charts, data, research, and insights pulled from various individuals and institutions. Curation at its finest.

• Snippet Finance: Curated snippets of insights across a huge range of investment relates matters.

• Banking on the Market: Authored by the fantastic Ayesha Tariq, a swath of economic and fundamental-related commentary.

• Latinometrics: Think if Chartr had a baby with a Latin American. Data-viz style content, about the Latin American region.

• CalculatedRisk Newsletter: Everything you’d ever need to know about housing, by Bill McBride.

Newsletters - Everything Else

• Stratechery: Ben Thompson’s legendary blog on everything tech.

• Woodlock House: Chris Mayer, author of 100-baggers, blog.

• Platformer: High-quality commentary on everything big tech. I only read the free articles.

• Miller Value Partners: The blog of the fund run by Bill Miller.

• Glimpse: A monthly report of surfacing trends across a broad range of sectors.

• 01Core: High-level qualitative analysis of industry, businesses, and trends.

• Fundsmith: Quarterly letters from Terry Smith

• Saber Capital Notes: Authored by John Huber, the managing partner at Saber Capital. Great thoughts on process and mentality.

• Lewis Enterprises: Only recently discovered this one, but it’s great. Can’t quite nail down exactly what the theme is, but it’s awesome with a fluid writing style.

• Baillie Gifford: Solid articles across a number of themes from the Baillie Gifford Fund.

• McKinsey Insights: Good for an occasional opinion piece on an industry.

• Farnham Street: Intriguing quarterly letters from Jake Taylor.

• Pew Research Center: Occasionally useful reports on consumer goods

• Bronte Capital: Authored by John Hempton, the zany Australian that was one of the first to blow the whistle on Valeant Pharmaceuticals. Strong archive.

• Collaborative Fund: Bitesize articles from Morgan Housel.

• Above the Crowd: Bill Gurley’s legendary blog. Not super active, but whenever it is, it’s awesome. This thing is older than me.

• The Acquirer’s Multiple: Great curation of value investing news.

• Research Affiliates: Insightful opinion pieces on markets.

• Aikya: Sporadic articles from the folks at Aikya Investment Management. Always great.

• Piper Sandler: Institutional reports on macro and market-related matters, as well as great consumer-related reports

• ESG Hound: Great snappy (sometimes snarky, in a good way) commentary on all things ESG.

• The Verge: I mostly read this for the musings on big tech.

• Concentrated Compounding: Half-Year and Annual Reports from an anonymous fund manager.

• Net Interest: Marc Rubinstein's newsletter. Great history lessons.

• Marketplace Pulse: Data and research on all things related to e-commerce.

• Chartr: Bite-sized, data-viz content that spans all things business related.

• More to That: A fascinating blog that explores some of the deeper incentive structures of human nature.

• A Wealth of Common Sense: Authored by Ben Carlson. Frequent, concise, humorous and educational articles about the stock market.

• The Irrelevant Investor: Authored by Ben Carlson’s partner in crime, Michael Batnick. Similar vibe to Carlson’s blog, but with Michael’s own spin.

• OakTree: Where the memos of Howard Marks reside, always an enjoyable bit of reading.

• MicroCapClub: Authored by Ian Cassel, the well-known microcap investor and fund manager, the articles are not overly frequent but are always incredibly thoughtful, and I routinely read the archives.

• Mostly metrics: Weekly newsletter about finance and business models authored by CJ Gustafson, a veteran tech operator. Succinct, and funny.

• Schroders: Insights from the team at Schroders asset management. Always good for a concise splash of insight.

I hope that everyone who reads this came away with at least one new resource that will benefit them in some way. Furthermore, please leave suggestions below if you feel I am missing out on anything that is useful in your own process. I am always hunting for new resources.

Thanks for reading,

Conor

Great list, and I'm not just saying that because I'm on it! Cheers Conor 💚 🥃

This was GREAT, ty Conor!