Pandemic Darlings That Never Bounced Back

20 of the most severe drawdowns from pandemic favourites that have yet to recover

If the 2020-21 era will be remembered for anything (and I am positive it will be remembered for A LOT of things), it is the creation of a bunch of charts that look like this. There are hundreds of stocks from this brief period of exuberance in the market that share a resemblance to the below chart of Zoom Video. As investors flocked to digital-forward companies, years of demand were pulled forward. Most of these companies failed to retain these new customers once the world re-stabilised. Yet, even for those who did, the overzealous inflation of share prices ultimately led to some severe drawdowns.

This weekend I was researching a basket of pandemic darlings. While the spectrum of business quality varied widely, they each shared a few commonalities. Their market valuations were bid up far too high. Most of them peaked in 2020 or 2021. When the air left the room, they collapsed. I figured it would be fun, maybe traumatic for some, and perhaps even nostalgic, to take a trip down memory lane and look at twenty of the most severe drawdowns from pandemic favourites that have yet to recover.

There is no science behind the selection. I was primarily interested in businesses which explicitly benefited from the initial period of the pandemic and then collapsed. Some of these companies have no business being public entities. Others have continued to improve under the hood but are dealing with the realities of a narrowing gap between valuation and fundamentals; one which got stretched too far in preceeding years. Perspective is important here. While a 90% drawdown sounds crazy (ceteris paribus, it is) the all-time highs these businesses traded at in 2021 were not based upon rationality. For many, the ensuing drawdown was a return to normality. For most, they are unlikely to ever see those heights again.

And lastly, this isn’t dunking. I owned a few of these at one point in time. I managed to escape a couple with some nice profit and avoid a drawdown. For a few others, I wasn’t so lucky.

1) Stich Fix (SFIX:NASDAQ)

What it does: An online personal styling service that uses data science and human stylists to send customers personalized clothing and accessories. The company generates revenue by selling these curated fashion items directly to consumers through a subscription model or individual purchases.

Drawdown: 97%

Peak valuation: $11.2 billion (2021)

Current valuation: $433 million

2) Lemondade Inc (SFIX:NYSE)

What it does: An insurance company that uses artificial intelligence and behavioural economics to offer homeowners, renters, pet, and life insurance policies directly to consumers. The company makes money by charging premiums for these insurance policies and retaining a portion of those premiums while the rest is used to pay claims and cover operational costs.

Drawdown: 91%

Peak valuation: $10.4 billion (2021)

Current valuation: $1.2 billion

3) Fiverr International (FVRR:NYSE)

What it does: An online marketplace that connects freelancers with clients seeking various digital services, such as graphic design, writing, programming, and more. The company makes money by taking a commission from each transaction on its platform, typically around 20% of the service fee charged by freelancers.

Drawdown: 92%

Peak valuation: $11.4 billion (2021)

Current valuation: $870 million

4) Redfin Corp (RDFN:NASDAQ)

What it does: A real estate brokerage that operates online and through traditional agents, offering services like home buying, selling, and mortgage lending. The company makes money by charging lower-than-average commissions on real estate transactions and by providing additional services such as title and mortgage services.

Drawdown: 92%

Peak valuation: $9.9 billion (2021)

Current valuation: $908 million

5) Zoom Video (ZM:NASDAQ)

What it does: Provides video conferencing, online meeting, and collaboration tools for businesses and individuals. The company generates revenue primarily through subscription fees for its various service tiers, which include free and paid plans offering different levels of features and participant capacities.

Drawdown: 90%

Peak valuation: $162 billion (2020)

Current valuation: $18 billion

6) Upstart Holdings (UPST:NASDAQ)

What it does: A fintech company that uses artificial intelligence and machine learning to assess credit risk and provide personal loans. The company makes money by partnering with banks and lending institutions to originate loans, for which Upstart earns fees, and by selling these loans on the secondary market.

Drawdown: 91%

Peak valuation: $30 billion (2021)

Current valuation: $3.3 billion

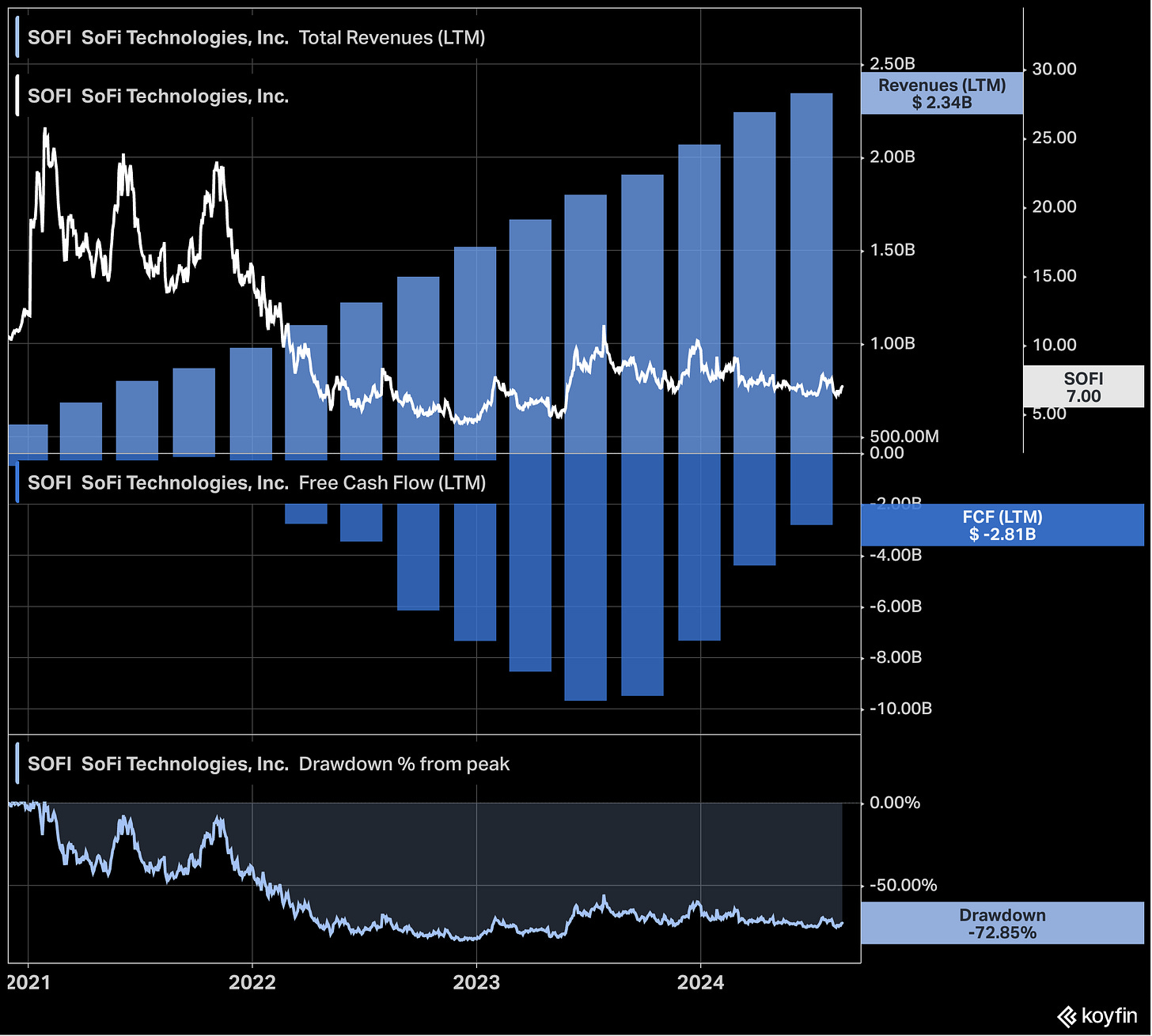

7) SoFi Technologies (SOFI:NASDAQ)

What it does: A fintech company that offers a range of financial products, including student and personal loans, mortgages, investment services, and banking solutions. The company generates revenue through interest on loans, fees from financial products and services, and membership benefits for its users.

Drawdown: 73%

Peak valuation: $19 billion (2021)

Current valuation: $7.5 billion

8) Roku Inc (ROKU:NASDAQ)

What it does: Manufactures streaming devices and provides a platform for streaming content from various channels and services directly to televisions. The company makes money through a combination of hardware sales, advertising revenue from its free ad-supported streaming channel, and revenue-sharing agreements with content providers who distribute their apps on the Roku platform.

Drawdown: 88%

Peak valuation: $63 billion (2021)

Current valuation: $8.5 billion

9) Virgin Galactic (SPCE:NYSE)

What it does: A space tourism company that aims to provide commercial suborbital spaceflights for private individuals and researchers. The company generates revenue by selling tickets for these spaceflights and through related services, including research missions and future space-based experiences. Basically a publicly run go-fund me page.

Drawdown: 99%

Peak valuation: $14 billion (2021)

Current valuation: $187 million

10) Opendoor Technologies (OPEN:NASDAQ)

What it does: A real estate technology company that simplifies the home buying and selling process by allowing homeowners to sell their homes directly to Opendoor for a cash offer. The company makes money by reselling these homes on the market, typically after making some improvements, and by charging service fees to sellers.

Drawdown: 95%

Peak valuation: $20.7 billion (2021)

Current valuation: $1.2 billion

11) PLBY Group (PLBY:NASDAQ)

What it does: A lifestyle company known for its flagship brand, Playboy, which spans various business segments, including sexual wellness products, apparel, and digital content. The company generates revenue through the licensing of its iconic brand, direct-to-consumer sales of products, and its digital and media platforms.

Drawdown: 99%

Peak valuation: $2 billion (2021)

Current valuation: $49 million

12) Etsy Inc (ETSY:NASDAQ)

What it does: An online marketplace that specializes in handmade, vintage items, and craft supplies, connecting small independent sellers with buyers around the world. The company generates revenue by charging listing fees, transaction fees on sales, and additional fees for optional seller services like advertising and payment processing.

Drawdown: 82%

Peak valuation: $38 billion (2021)

Current valuation: $6.2 billion

13) NIO Inc (NIO:NYSE)

What it does: A Chinese electric vehicle (EV) manufacturer that designs, develops, and sells smart, high-performance electric vehicles, primarily in the premium segment. The company makes money through the sale of its electric vehicles, battery swapping services, and offering a range of complementary products and services, including software and autonomous driving features.

Drawdown: 92%

Peak valuation: $11.4 billion (2021)

Current valuation: $870 million

14) Peloton Interactive (PTON:NASDAQ)

What it does: A fitness company that offers exercise equipment, such as stationary bikes and treadmills, integrated with a subscription-based platform for live and on-demand fitness classes. The company makes money through the sale of its high-end fitness equipment and recurring revenue from monthly subscriptions to its digital fitness content.

Drawdown: 98%

Peak valuation: $49 billion (2021)

Current valuation: $1.2 billion

15) ContextLogic Inc (LOGC:NASDAQ)

What it does: Operating under the brand name Wish, ContextLogic is an e-commerce platform that connects consumers with a wide range of affordable products, primarily from sellers in China. The company generates revenue through sales commissions on each transaction, advertising fees from merchants looking to promote their products on the platform, and logistics services provided to sellers.

Drawdown: 99%

Peak valuation: $18.3 billion (2021)

Current valuation: $143 million

16) Teladoc Health (TDOC:NYSE)

What it does: A telemedicine company that provides virtual healthcare services, including medical consultations, mental health support, and chronic condition management, through a digital platform. The company generates revenue primarily through subscription fees from employers, insurers, and individuals, as well as per-visit fees for consultations.

Drawdown: 98%

Peak valuation: $42 billion (2021)

Current valuation: $1.2 billion

17) Rivian Automotive (RIVN:NASDAQ)

What it does: An electric vehicle manufacturer focused on producing adventure-oriented electric trucks, SUVs, and commercial delivery vans. The company generates revenue through the sale of these vehicles and plans to offer additional revenue streams through software services, including over-the-air updates and a future charging network.

Drawdown: 92%

Peak valuation: $153 billion (2021)

Current valuation: $13.3 billion

18) Bumble Inc (BMBL:NASDAQ)

What it does: An online dating platform where women originally make the first move in heterosexual matches, promoting more equitable interactions. This feature was recently removed. The company makes money through subscription services, in-app purchases for premium features, and advertising.

Drawdown: 92%

Peak valuation: $14.6 billion (2021)

Current valuation: $1 billion

19) MatchGroup (MTCH:NASDAQ)

What it does: Owns and operates several popular online dating platforms, including Tinder, Hinge, Match.com, OkCupid, and Plenty of Fish. The company generates revenue primarily through subscription fees, in-app purchases, and advertising on its various dating platforms.

Drawdown: 80%

Peak valuation: $50 billion (2021)

Current valuation: $9.1 billion

20) Cardlytics Inc (CDLX:NASDAQ)

What it does: A digital advertising platform that partners with financial institutions to deliver targeted cashback offers to consumers based on their purchase history. The company makes money by charging advertisers for these targeted campaigns and sharing a portion of the revenue with its banking partners.

Drawdown: 98%

Peak valuation: $4.5 billion (2021)

Current valuation: $183 million

Thanks for reading,

Conor

Oh man—I owned so many of these via investing groups and lost money on all of them. PTON, UPST, TDOC, BMBL, MTCH, ETSY, ROKU, ZOOM, FVRR was probably half my portfolio in 2020/21. 2022 was a brutal year! Lol. The lessons were painful but I learned a ton. Great post.

I love this selection. I had somehow managed to completely miss the Playboy IPO at the time, and didn’t know it was listed!