Charts Charts Charts

Monday 3rd April, 2023

Hey, you are reading Investment Talk. If you’d like to join the 20,100 other readers learning about life, the stock market, and the companies within it, subscribe below. Charts Charts Charts is your weekly curated snippets from the stock market.

If you enjoy today’s article, feel free to share it or like it, as it greatly helps. Now let’s begin.

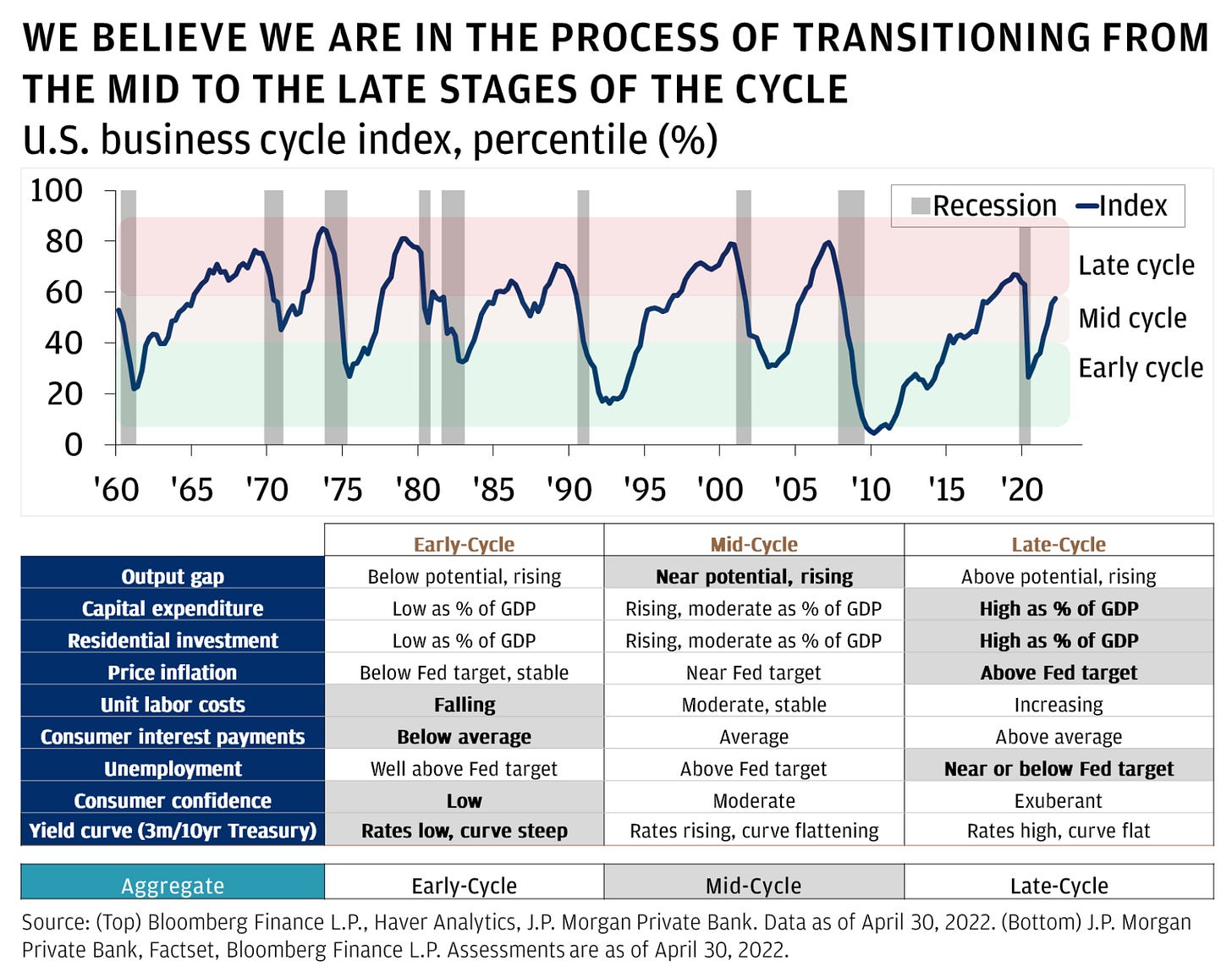

1. JP believe we are mid-cycle, avoiding a recession

“JP Morgan’s view is that the US economy is currently in the mid-cycle phase and they predict that it will move into late-cycle by the end of the year. If you look at the recession bars in the chart [below], most of them cover the index when it is mid-cycle. However, the chart also shows us that most of the recessions occur when the index is moving from late- to mid-cycle to early cycle. Given where the index is currently, it seems to suggest we are going the opposite direction and therefore, a recession isn’t likely

But, this time may just be different. We have an interesting set of factors playing out. The Fed hiking cycle doesn’t seem to be ending with a drastic cut, the unemployment level still remains remarkably low, we’re experiencing quantitative tightening and inflation is a major factor that hasn’t played a huge part in the economy since the early 80s”.

2. What stocks really want

“Stocks have generally rallied following the end of past Fed tightening cycles. The exceptions were when the economy entered recession near the end of tightening. Our baseline year-end SPX forecast of 4000 would be a break with the historical pattern”.

3. US Payroll growth cools

“The pace of US hiring in March likely continued to show firm yet moderating labor demand, just as an anticipated slowdown in wage growth may offer some comfort to Federal Reserve officials in their inflation battle. Non-farm payrolls are seen climbing by nearly a quarter million after employers added 311,000 jobs in February, according to the median projection in a Bloomberg survey of economists”.

4. A big week for employment indicators

“Tt is a big week for employment indicators, which are likely to confirm that the labor market remains relatively strong. February's JOLTS report (Tue) should show that job openings remain plentiful (chart). Jobless claims remain low too. March data for payrolls from ADP (Wed) and BLS (Fri) should show gains of around 200,000 with solid increases in food services and health care, again”.

5. Soft landing is water cooler talk

“Increasing discussions on S&P 500 earnings calls focus on a potential 'Soft Landing,' while chatter about an impending 'Recession' declines. However, in absolute terms, 'Recession' still dominates the conversation”.

6. S&P earnings to contract 6.6% in Q1

“SPX is expected to report a Y/Y earnings decline of -6.6% for Q1 2023, which would be the largest decline since Q2 2020 (-31.8%)”.

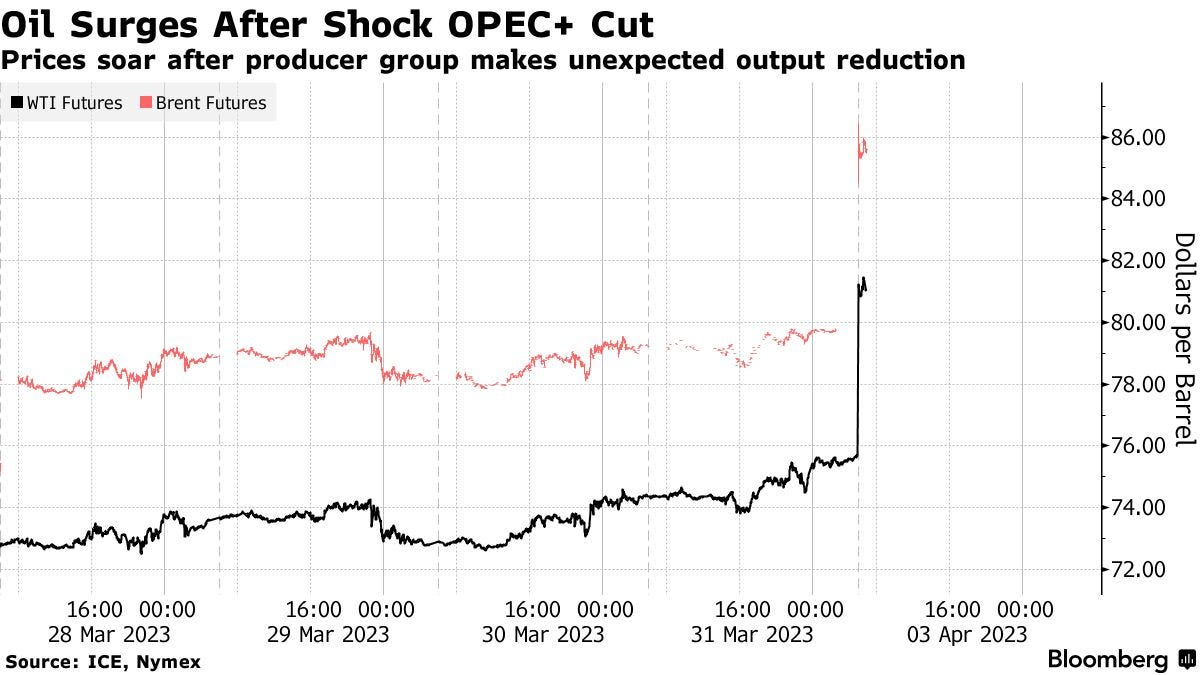

7. Oil surges on OPEC cuts

“Oil surged after OPEC+ unexpectedly announced crude output cuts that threaten to tighten the market, delivering a fresh inflationary jolt to the world economy and irking the White House. West Texas Intermediate soared as much as 8%, the biggest intraday move in more than a year, and traded near $80 a barrel early in New York. In wider markets, the dollar advanced along with Treasury yields”.

8. Insiders are buying

The ratio of insider selling to buying dipping into bullish territory in March.

9. Market breadth weak, but improving

Not much more that needs to be said.

10. Money on the sidelines

“Money market funds assets above $5 trillion now. Safe to say there's a ton of capital that can and will eventually be deployed into equities. The last times we saw this type of surge were in 2009 and 2020”.