Charts Charts Charts

Wednesday 5th April, 2023

Hey, you are reading Investment Talk. If you’d like to join the 20,200 other readers learning about life, the stock market, and the companies within it, subscribe below. Charts Charts Charts is your weekly curated snippets from the stock market.

If you enjoy today’s article, feel free to share it or like it, as it greatly helps. Now let’s begin.

1. OPEC gets high on its own supply

“OPEC is cutting oil production to defend much higher prices than ever before. The chart below, from Goldman Sachs, shows the (nominal) price of Brent crude the Friday before any output cut announcement (collective or voluntary)”.

2. OPEC gets high on its own supply (2)

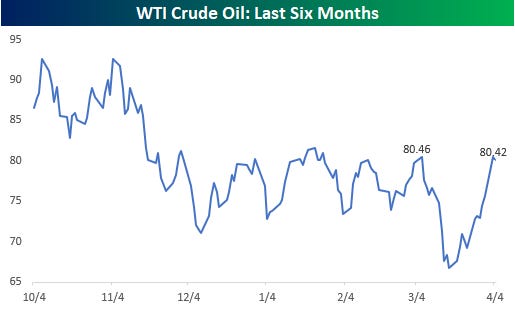

“Crude oil almost traded to a one-month high after OPEC+ announced yesterday's production cuts of up to 1.6 million barrels a day”.

//

“Brent crude jumped by 6.6% yesterday, which was largest one-day spike since last year’s Russian invasion of Ukraine … before that, more common to see that kind of move in early 2020”.

3. Russian crude accounts for 71% on water

“Checking in on what's on water. Russian-loaded crude on water surpassed 128 million barrels on March 31. Russian grades account for 71% of crude on water”.

4. Supply chains are back

“The supply chain woes of the past two years now look to have completely unwound while the resulting pricing pressures also look to have faded are now back to levels seen in 2018”.

5. Insider trading

“Overall Insider Trading - Last 60 Days Thank you Carl Icahn and Warren Buffett for giving us some green!”.

6. ISM slides to 51.2 in March from 55.1

“ISM Services (purple) dropped to 51.2 in March from 55.1 in February. Most major components dropped from their February levels, with New Orders (blue) plunging the most and Prices Paid (gold) at the lowest level since 2020. That bodes well for inflation.”.

7. ISM sees the largest decline in five years

“Prices paid in the services sector cooled the most in five years last month Significant change given the Fed is trying hard to get services inflation under control”.

8. US manufactured goods fell by 0.7%

“US manufactured goods new orders fell -0.7% MoM in Feb. Ex-transport, orders fell only -0.3% MoM with machinery orders down -0.6% MoM. Ex-transport unfilled orders fell -0.1% MoM and were only up 1.1% YoY as backlogs ease”.

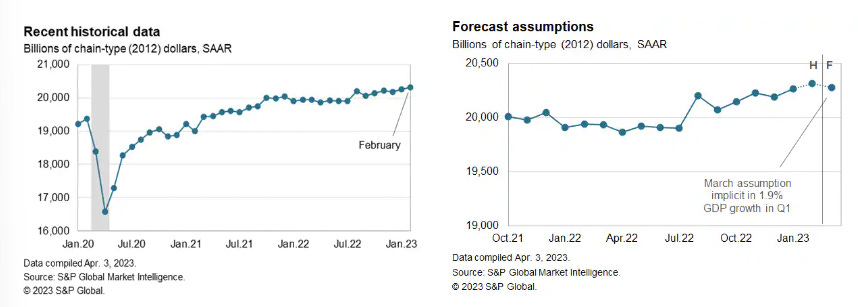

9. Monthly US GDP grows 0.2% in Feb

“Monthly US GDP rose 0.2% in February. The level of monthly GDP averaged over January and February was 2.0% above the fourth-quarter average at an annual rate”.

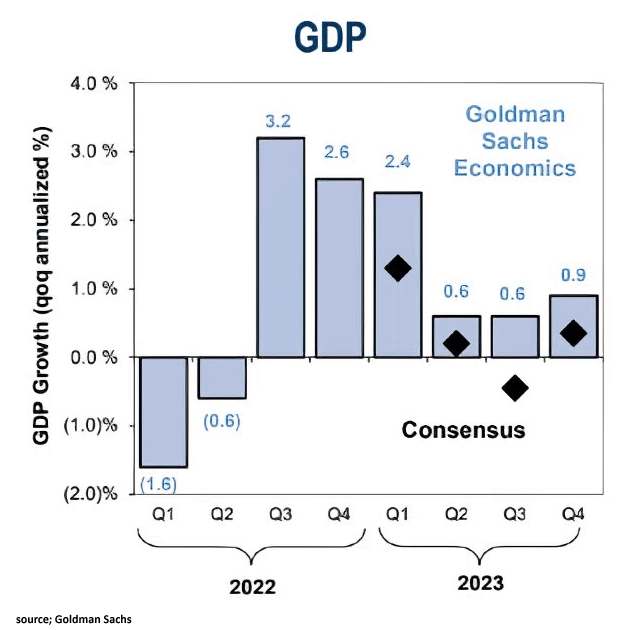

10. Goldman Sachs upgrade GDP outlook

“Goldman Sachs remains more optimistic than consensus on US GDP growth in 2023”.