A Turnaround Story for Rotating Sushi

(Kura Sushi USA, Q3 FY21 Earnings Review)

If you would like to reach this as a webpage, and not an email, click here

On Tuesday the 13th of July, Kura Sushi USA reported their Q3 earnings for FY21.

As this is one of the companies within my portfolio, I shared my thoughts on that today.

This was originally part of the paid newsletter (sent out this morning) but seeing as there won’t be another guest interview for a week or so, I thought I’d share it with everyone today.

I won’t spend a HUGE amount of time on Kura Sushi today, as I am sure I have already overloaded your senses with sushi discussion with the deep dive on Kura Sushi I sent out at the beginning of July.

In general, and based on subscriber feedback, I am aiming to make these personal equity quarterly updates more concise.

For those of you who missed the fourth edition of the deep dive series, you can find that below:

Key Takeaways from Q3 Earnings

After two sequential quarters of $9M in revenues, Q3 showed more than 100% sequential sales growth with $18.5M, thrashing expectations of ~$15M.

Operating margin and net earnings are back to positive.

Indoor capacity is now at 100% for all 32 stores as of June.

Despite 100% indoor capacity, due to the social distancing requirements, the average seating capacity was still only 60% in Q3 (which ended in May), but this is a huge improvement versus 25% in Q2.

Impressive performance still captures a time whereby all California stores (52% of the store count) were not fully open (Q3 ends in May). Thus, Q4 (where CA stores opened in June) is expected to be even more impressive.

Off-Premise sales mix holds strong at 10% for Q3. Pre-covid this represented just 1% of total sales.

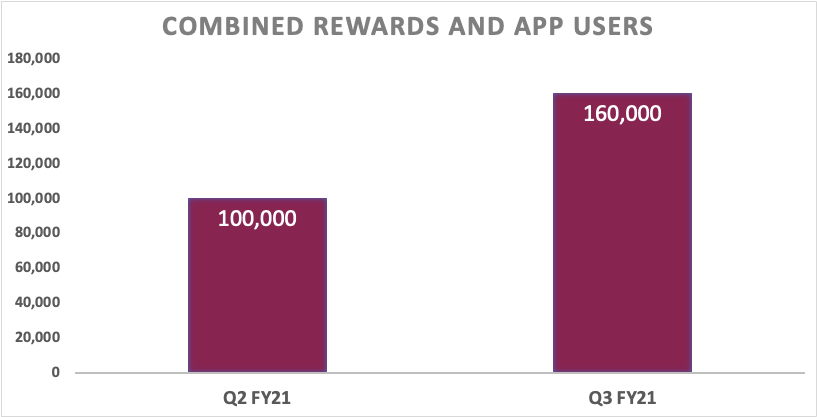

Kura Sushi App Rewards members grew 60% sequentially to 160,000 members.

Appointed a new COO to fill the empty role, Sean Allameh, who has a wealth of experience growing small franchises across the US.

There are 8 new leases signed, providing the store count growth runway for FY22. Historically, stores are opened within one year after signing the lease.

Operating cash flows improved substantially QoQ, and positive operating cash flow is anticipated for Q4.

The balance sheet looks considerably stronger than last quarter.

Kura tapped an additional $5M of their revolving credit facility, now standing at $17M borrowed, and $28M left to tap.

The Recovery was Aggressive

When discussing the Q3 outlook, back in the Kura Sushi deep dive, a few weeks ago, I had stated that the upper range of sales expectations for me was ~$15M. I would be happy if sales reached that mark.

Kura had other plans and reported $18.5M in sales for the quarter (+103% QoQ), taking the sales base firmly back to pre-covid levels. The recovery was underway in Q1/Q2 but is now fully established in this third quarter.

The interesting thing, however, is that Kura’s fiscal quarter ended in May. The California stores (where the majority of their stores are based) only opened to full capacity in mid-June. Only as of July 1st where all of the 32 stores opened to 100% capacity, with no restrictions in place.

During the third quarter, Kura managed to achieve this impressive sales performance, despite average seating capacity being at levels of just 60%, compared to 25% in the prior quarter.

Thus, it appears that despite the impressive sales for Q3, we are yet to even fully realise the full extent of the sales until we get Q4 results.

Assuming Kura generate a record quarter of ~$21M in Q4 (which is very achievable) this would bring them to a full-year sales figure that is only 10% below their pre-covid base of $64M. This bodes very well for FY22.

The expansive nature of the revenue base also aided the overall composition of cost which saw:

Food and beverage decline to 31.7% of sales (down from 38% in Q3 FY20)

Labour costs declined to 8.9% of sales (down from 126% in Q3 FY20)

Occupancy costs declined to 10.2% of sales (down from 56.5% in Q3 FY20)

Other costs declined to 14.7% of sales (down from 34.3% in Q3 FY20)

G&A costs declined to 23.2% of sales (down from 102.6% in Q3 FY20)

The larger decline across labour, G&A, and occupancy costs are simply related to the fact that these costs are less variable in nature in comparison to food, which can be curtailed rapidly during periods of decreased demand.

The result is a notable improvement in the 9-month trailing gross margin, which currently stands at 4.75% after being negative last year.

On the topic of inflationary pressure on food and beverage costs (brought up in the earnings call), Uba cited that they would not be a “big factor” in the cost of goods sold, as their top 5 commodities only represent about one-quarter of their food and beverage purchasing mix.

For labour, there was also the recognition of a $5.8M employee retention credit applied under the CARES Act extension which benefited that.

Excluding the credit and retention and hiring bonuses, labour and related costs would have been 36.6% of sales. The LT target for management is to have labour cost account for the low 30s in terms of a percentage of sales.

With the surplus in sales, Kura is now back to being operationally profitable for the first quarter since Q4 FY19, pulling in $900,000 in operating profit.

The contrast to their FY20 third quarter (where they reported $8M in operational losses) is stark. After accounting for taxes and interest, Kura generated $800,000 in earnings for the quarter. This similarly marked their first profitable quarter since Q4 FY19, where the compared generated $916,000 in earnings.

In terms of restaurant-level margins, which is when Kura basically add back all of the expenses that are notdirectly related to individual restaurants, the third quarter showed $1.1 million in restaurant-level operating profit for a margin of 5.8%.

For the three quarters of the year thus far, that amounts to $9.2 million in operating losses and $1.4 million in restaurant-level operating losses.

However, during the year thus far, despite adding back $10.6M in G&A and $6M in other add-backs to that operating income (to calculate the restaurant-level margin), Kura has facilitated $8.9M in retention credits during the period, which is conducive to the restaurant-level of the operations.

These retention credits are refundable to Kura, and should not be recurring in nature going forward. Thus, I would not be overly concerned here. This is the first quarter that Kura have showed positive restaurant-level operating income since the beginning of the pandemic, which is the key takeaway here.

StoreCount

The current store count remains at 32 after the opening of the Bellevue store during Q3, but in an effort to bolster their expansion efforts Kura announced the acquisition of Sean Allameh (below), who will act as the Chief Operating Officer, a previously empty role.

Allameh has extensive experience in the restaurant industry, most recently serving as the COO at Luna Grill where he helped grow the California-based brand from 16 to 49 locations. Prior to that, he served as Director of Operations at Unami Burger, where he revamped the company’s procedures and guidelines including a reorganisation of the new unit opening team within the training department, and also successfully opened 13 locations within two years in new markets.

It seems like the perfect fit for a company that is looking to expand from 32 stores to at least 57 stores over the next three fiscal years.

It would appear (based on Uba’s comments) there are no plans to open new stores in the fourth quarter, as the goal of 7 new stores has been satisfied for the current fiscal year.

Management did acknowledge that 8 new leases have been signed as of Q3, which lays the groundwork for store expansion in FY22. This includes three new markets in Arizona, Massachusetts and Pennsylvania.

The typical lead time from lease signing to store opening is under one year, so it may be the case that we see eight additional store openings in FY22, but whether that turns out to be 7 or 9 doesn’t matter all too much. Management was tight-lipped on the actual store count guidance for FY22.

At present, there is one store under construction, the Stonestown Galleria location, based in San Francisco.

Without giving too much away, Uba noted that the pipeline of RE deals is the most exciting it has ever been, and they look to continue to momentum of FY21 in FY22.

“We are benefiting from new real estate opportunities created by the pandemic as well as a more rigorous site selection process through our new data platform, Forum Analytics, resulting in the most exciting pipeline we've had since entering the states.

Fiscal '21 was a record development year for Kura and we expect to maintain this growth momentum by opening even more units in fiscal '22.”

- Hajime Uba, CEO

In terms of the growth for FY21, the job is done. An additional store opening (Stonestown Galleria) in Q4 would be a bonus, but it’s more than likely to open sometime between then and Q1 FY21, which would be the October to December period of 2021.

Comps and Consumer Engagement

Comparable restaurant sales performance is reflective of stores that have been opened for longer than 18 months.

If we are accounting for the 9 months of FY21, the comparables unit base is 21 stores (as shown in the below chart). Here, the nine-month YoY comparable sales performance is down 20.5%.

For the third quarter alone, on a consolidated basis, the Kura comparable store base (which is 23 stores if we account for just Q3) recorded comps of 455% YoY.

But again, there are a few things to consider here.

Firstly, we have to bear in mind that the Q3 period (which ended in May) was still running at 60% average seating capacity as well as having the CA stores not fully operational for in-store seating.

Secondly, the distribution of comparable sales is skewed across the US. In Texas, during the third quarter where full seating capacity was in place, the region produced 5% positive comps as compared to a pre-pandemic FY19 baseline.

Using the same baseline, the comps for California was down 36% across Q3.

Management noted that after the re-opening in June of the California stores, system-wide comps began to exceed those of the FY19 year across their CA stores.

It is highly likely we see a considerable improvement into full-year comparable sales metric after we account for another strong fourth quarter. I think it’s more prudent to wait for that data to come through. This should set a nice bar for FY22.

Off-Premise & Rewards

Back in early July, I opined on the nature of the off-premise sales mix for Kura Sushi, citing that it could be (management’s words) a high single-digit to a low double-digit component of sales in the future after reaching heights of 31% of sales in late 2020.

The third quarter gave us another glimpse of how that reality may play out, showing that as of Q3, off-premise sales were 10% of the revenue base. It’s worth remembering that pre-pandemic, this was closer to 1%.

In the month of June, the off-premise sales mix would fall to 6% after the opening of the CA stores for in-store dining.

“So within that mid-single digit to high single digit expectation that we have for post-pandemic off-premises sales. We're seeing similar results across markets, and we think this is a great demonstration for the long-term stickiness of off-premises for Kura.”

- Hajime Uba, CEO

A great deal of this off-premise demand comes at a low cost through the company’s expanding social media presence (one of their primary forms of marketing) as well as their rewards programme.

At the time of writing, Kura currently has ~110K followers across Tik Tok (1.8K), Facebook (74.7K), Instagram (32.2K), and Twitter (1.8K).

The most conducive form of marketing for the visual experience of their store format is best suited to Instagram, where they have shown impressive growth over the last year, essentially doubling their follower count.

Perhaps most importantly, the Kura Sushi rewards programme, which acts as another non-paid form of advertising and user retention tool, has grown by 60% sequentially, now standing at 160,000 members in Q3.

The Kura app facilitates the needs of both in-store and off-premise customers, all whilst increasing retention, engagement, and the experience of the Kura brand for consumers.

This part of our business is still nascent and remains a very exciting prospect. I have talked at length about how wonderful the Starbucks rewards base is for their company. Ideally, Kura would look to emulate that.

Liquidity and Cash Flows

There have been some notable improvements in the balance sheet this quarter, with the current ratio standing at 1.2 (0.85 in Q2), and the quick and cash ratios standing at 0.47 and 0.28 after being 0.33 and 0.13 in the previous quarter.

There is an additional $3M in cash in the business after Kura extended its borrowing under the revolving credit facility by a further $5M in Q3, taking the total borrowing up to $17M.

Recall that during Q2, Benrubi suggested the total borrowing for FY21 could reach between $20M to $22M by year-end. As such, I would anticipate the company to tap into the facility once more in Q4.

On the positive side, there is some leverage in terms of working capital, which is back to positive ($3.4M) as of May.

I would like to remind readers that the excessive working capital post-IPO ($33M in Q4 FY19) was a result of the proceeds from that offering. Most of which was burned through during the pandemic.

Now that Kura is back to a positive operating margin, sales are expecting to be record-setting next quarter, and they have some liquidity on the balance sheet, as well as an additional $28M in their revolver, things are looking much better.

With respect to the cash flows, operating cash flow for Q3 showed marked improvement at (-$529,000), supported by a positive bottom line of $770,000.

Kura allocated $1.62M towards investing outflows, all of which was allocated to CapEx during Q3. Financing inflows amounted to $4.81M after the tapping of their revolving credit facility.

Whilst not pretty, the improvement is clear, and I fully expect to see positive operational cash flows (or close to it) during Q4.

Pre-pandemic, Kura would typically kick out $6M in operational cash flow each year, and this was with a considerably smaller store count base. Thus, I am looking to FY22 for a cleaner bill of health on reported cash flows.

Guidance for Q4 and FY21

There was no official guidance given for the remaining quarter of the year, with management citing the uncertainty in the environment as a factor.

The only partial guidance provided was the following information on CapEx spend and G&A expenditure.

Weekly CapEx spending for Q4 will be approximately $260,000.

Weekly G&A spend to be approximately $320,000 as Kura scale the organisation in preparation for new units and growing system size.

Concluding Remarks

The market clearly enjoyed the spectacle of Kura’s Q3 earnings. On Wednesday 14th, the stock opened at ~13% greater than the prior day’s close and finished the day at close to +23% in one sitting.

The remainder of the week would take Kura from a $320M business to one that is valued closer to $428M.

I would speculate that the $18.5M in sales took the consensus estimate of ~$15M by surprise. This, and the fact that this performance was created during a quarter where the majority of the store count was still partially open.

Q4 looks set to be tantalising, and management appears to be brimming with confidence. This was quickly priced into the stock.

“I'd like to reiterate my comments from our last earnings call where I had mentioned that we were moving from a relatively defensive strategy to a more aggressive one on the strength of our sales recovery and new unit performance.

Our performance in the third quarter has only made us more confident, and the investments that we're currently making in preparation for the next fiscal year are a demonstration of this confidence.”

- Steven Benrubi, CFO

Back in early July, when writing the deep dive, I suggested that Kura Sushi was a potentially great business trading at a less than ideal price. I still believe that to be the case.

At the time, when concluding that piece and opining about the FY21, I stated:

“2021 will likely be another lacklustre year before the light begins to shine whereby Kura can operate through a ‘full strength’ year in FY22.

Thus, in my mind, it’s more so about monitoring that recovery and trying to find an attractive entry point. Because, right now, the valuation rests upon the recovery, which is effectively priced-in to the fullest extent.”

I followed up by noting that “in these circumstances, quarterly earnings are typically there to confirm some underlying thesis.”

For me, this remains the case. The Q3 was better than expected, I have ticked the box to suggest the recovery is going well, and remain excited to see what they can show in Q4 and then in the following year of FY22.

Both FY20 and FY21 contain considerable warp from the pandemic, but the latter half of FY21 is now showing us what is to come in FY22.

When you observe the pre-covid gross margins of this business (themid-10s) and observe the parent entities gross margins (50%+), it appears that there is a great deal of scope for margin expansion as Kura USA continue to scale.

I have no intention of buying at current market valuations, as you are underwriting a lot of baked-in valuation right now, in my opinion.

Should the market offer up an opportunity, I will be waiting to acquire another small tranche should it be appropriate.

One thing that is really important to note, is that over 50% of Kura’s store count are concentrated within the state of California, with a further 22% based in the state of Texas.

Together, these two states account for 75% of the total store base. As such, any reintroduction of covid restrictions in these two areas will have an outsized impact on the recovery.

New to the newsletter? Sign up here.

Want to learn more? Browse the about page.

If you have any ideas related to the information you’d like to see each week, or perhaps where you feel it could improve, please reply to this email, or drop me a DM on Twitter @investmenttalkk.

Conor,

Lead Analyst at Occasio Capital Ltd

You can also reach out to us here:

Twitter: @Investmenttalkk/@TheITNewsletter

Commonstock: Investment Talk

Facebook: @TheInvestmentTalkNewsletter

Pinterest: @InvestmentTalkkk

Email: Investmenttalkk@gmail.com